September’s last week promises to be an important one for all sorts of markets due to the ongoing Brexit talks between the UK and EU. Without a deal on the horizon, investor’s trust might experience ups and downs with crucial effects on the Forex market (especially the pound) as well as stock markets across Europe and America. Likewise, the oil has seen a price hit last week with the crude trading up to $72 a barrel.

We, at tradersdna, have brought David Jones, Chief Market Strategist at Capital.com, to share his insights about the turmoil the markets are getting into.

Brexit talks keep the pound in no-man’s-land

“This one is set to be a busy week for all sorts of markets,” he started saying, furthermore as “the currency markets have been making headlines after last Friday’s plunge for the pound – the largest one day slide for more than a year. Talks between the UK and EU regarding Brexit have once again hit an impasse – the speech where Prime Minister Theresa May outlined her frustration to the nation was the catalyst for the sell-off.

Hopefully this week will see a virtual knocking of heads for both sides and they can actually start making some sort of progress in the negotiations. Plus later this week on Wednesday, there is the latest interest rate decision from the US central bank, with a rise of 0.25% widely expected. In early trade on Monday morning, the pound was under some pressure but still holding above Friday’s low versus the US dollar of 1.3050.”

Better Times for Stock Markets

On the other hand, for Mr Jones stock markets had a better time last week with both the US S&P500 and the Dow Jones setting fresh all-time highs. The incredible performance of US stock markets continues – the S&P has now risen four-fold since the financial crisis lows and is up by almost 10% for the year to date. Although there are always plenty of doom-mongers trying to call a top in these admittedly overstretched markets, investors seems more than happy to continue to buy any sell-offs. Despite the ongoing threat of trade wars, stock markets still remain strong and it would not be surprising to see further fresh highs set in the weeks to come.

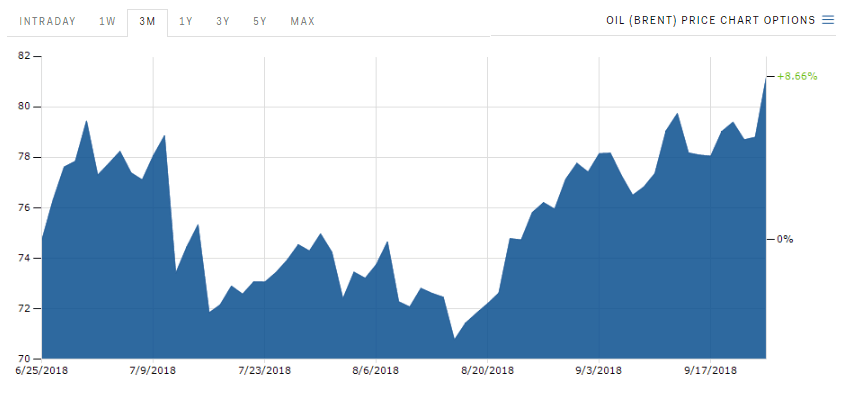

Oil trading up to $72 a barrel

“With plenty going on in the foreign exchange and stock markets it can be easy to miss the action elsewhere. But last week saw the oil price hit a two month high as US Crude Oil traded up to $72 a barrel. This is only a couple of dollars beneath the three year highs set in July. If further significant gains are seen for the price of oil we could see this translate to some pressure for global economic growth,” he ended his insights with.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.