South East Asia is a buoyant region. With a 5.2 per cent growth rate on average for the last 5 years, the region is improving rapidly both its economy and its world status as an emerging player. Among all those countries, Malaysia is the one-to-look the next decade. The country is making impressive progress to become a regional powerhouse in terms of technology development, digitisation of its economy and as a business hub. A clear evidence of that is GlobalData’s latest report, ‘Malaysia Cards & Payments: Opportunities and Risks to 2023’, which reveals that the share of cash in total payments is set to decline from 88.1% in 2019 to 80% in 2023.

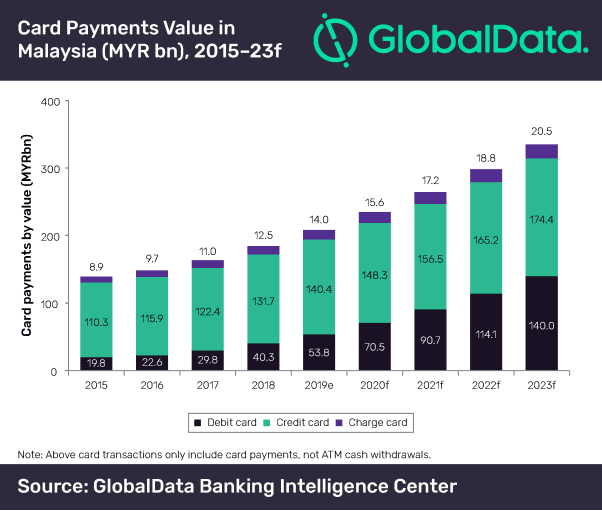

Although Malaysia remains a cash-dominant economy with majority of consumer payments still carried out using cash, the country is making steady progress to reduce cash dependence, as the total card payments value is set to increase from MYR208.2bn (US$50.4bn) in 2019 to MYR334.9bn (US$81bn) in 2023, according to data and analytics company. GlobalData.

Ravi Sharma, Senior Payments Analyst at GlobalData, explains: “While cash continues to dominate overall payments, there has been significant progress in the adoption of card-based payments. The Government initiatives including the introduction of an interchange fee cap, the migration of payment cards to support PIN and contactless payments, and the expansion of point-of-sale (POS) terminals have all contributed to the growth of the payment cards market.”

Bank Negara Malaysia (BNM), the country’s central bank, has been playing a key role in the promotion of electronic payments. In this regard, it has completely waived interchange fees for any payments made via domestic debit cards to the government or its agencies until 31 December 2020.

Scheme providers are gradually reducing interchange fees. Effective from 1 January 2019, the revised interchange fee of Mastercard and Visa credit cards was set at 0.675%, compared to 1.037% in 2017. In addition, effective from January 2019, American Express revised its interchange fee on credit cards to 0.575%. Reduced interchange fees will further boost payment card acceptance among merchants.

Furthermore, the Government set up Market Development Fund for the development of POS infrastructure with plans to have 800,000 POS terminals in the country by 2020-end.

Sharma concludes: “Improving payments infrastructure and lower card acceptance cost will further push the use of payment cards in Malaysia over the next five years.”

Read More:

charles schwab a modern approach to investing & retirement

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading