Since Q4 of 2021 to today we have had wild swings within fixed income markets. As G10 central banks have taken notice of rising inflation and bit by bit have had to drop the “transitory inflation” line. This has led to the front end (2 Year yields) rising dramatically and pricing in a more hawkish Fed as a result fattening the yield curve.

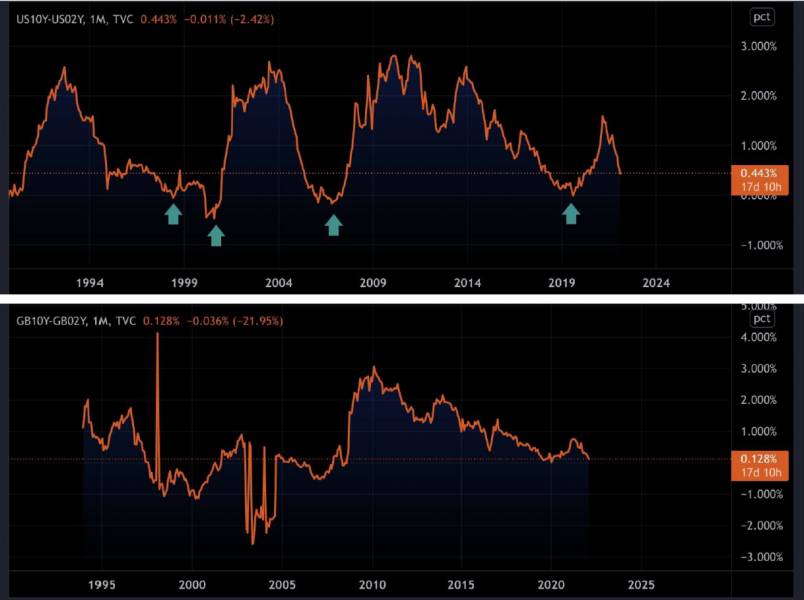

Why does inversion matter?

Put simply when the curve inverts historically speaking it usually precedes a recession. What is different this time is we are at 0-0.25% interest rates and in past cycles the curve has inverted because policy was too tight. The normal procedure would be the curve inverts the Fed cut interest rates and starts QE, which in turn helps stem outflows of risk on assets such as equity’s.

The difficult part now is inflation is far beyond the 2% level and with midterms coming up in November the Whitehouse needs inflation to come down. The policy error here is by tackling inflation and raising interest rates they cause the yield curve to invert.

Bonds

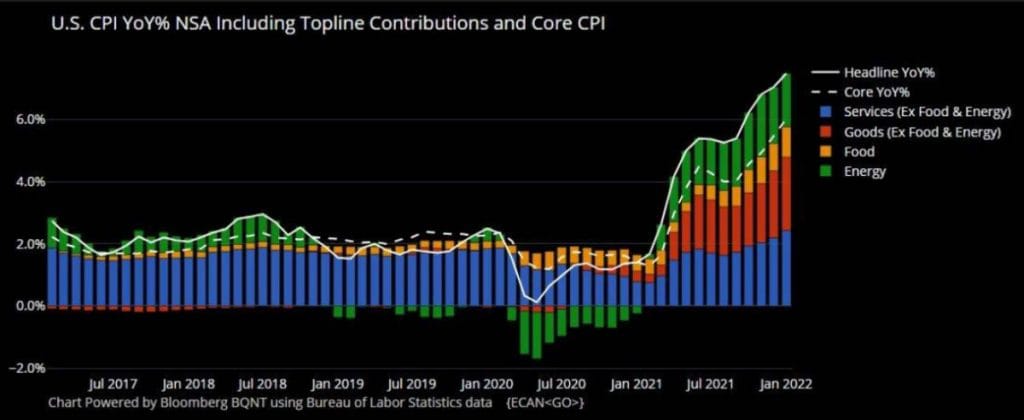

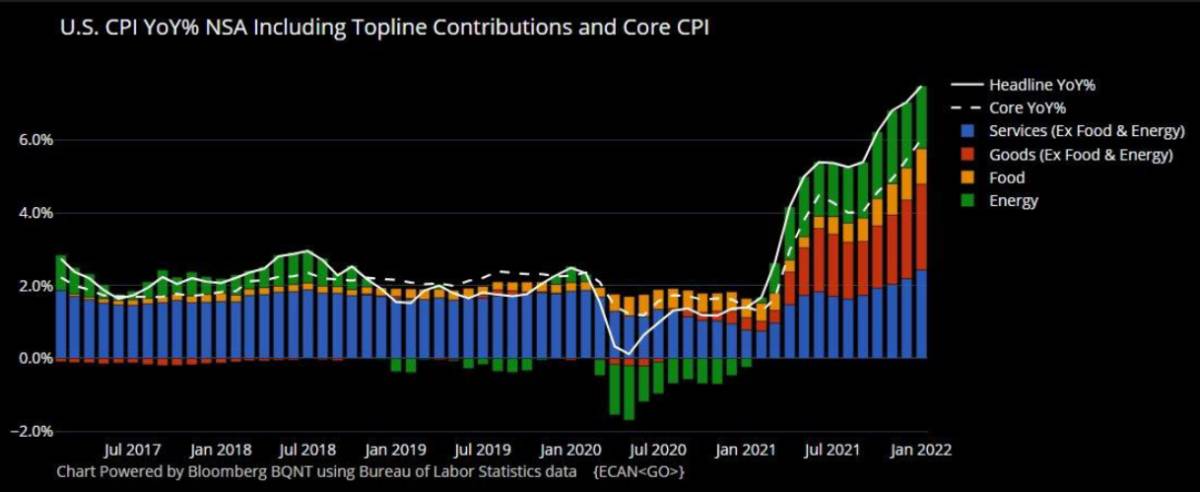

Data in particular inflation numbers are in coming hot at 7.5% not seen since the early 80s.

(Source: Bloomberg, Michael McDonough)

Most of the attention has been around US yields but something to note is this is not just a US phenomenon. German, Japanese and Swiss 5YRs have now all turned positive. This has made negative yielding debt plummet from $14.4T – $4.5T since Dec 2021 as shown in the chart below.

(Source: Bloomberg, Lisa Abramowicz)

What I see is the most important indicator to where we are heading is the 2/10 spread the curve is reaffirming those left tail risks. This has mostly come from the front end (2Y) as rate hikes have been getting priced in. Currently US 2/10 spread is sitting around .40% from inversion and the UK is sitting at .13%.

The biggest question is where will interest rates go? As a general rule the Fed follows the 2Y as displayed this currently indicates around 5 hikes. (Orange line 2Y yellow line Fed Funds).

FX

USD

The Fed first rate hike is scheduled for the March meeting. Although there was whispers of an emergency hike this week I personally think that seems like panicking and it will be proceed as scheduled. We have gone from pricing in 25bps to 50bps now.This should provide some bullish upside in the dollar broadly.

GBP

BoE hikes to 0.25% with fears of growing energy prices there was a split 4 of the members favored an even more aggressive hike. The next meeting is 17/03/2022 the day after Fed I would expect this will give them more room to be aggressive but will be overshadowed by the Fed first hike with little room to the upside for Cable.

EUR

Lagarde went from a dove to hawk and sent shock waves through the EUR pairings it seems even the EU is feeling the strain of inflation. Although policy change is not expected till at least Q4. the ending of pandemic emergency purchase programme (PEPP) should happen by March. This gives room for hiking rates if inflation does not a abate by Q4. If the ECB does turn more hawkish expect out performance in the EUR as no one believes it will happen.

JPY

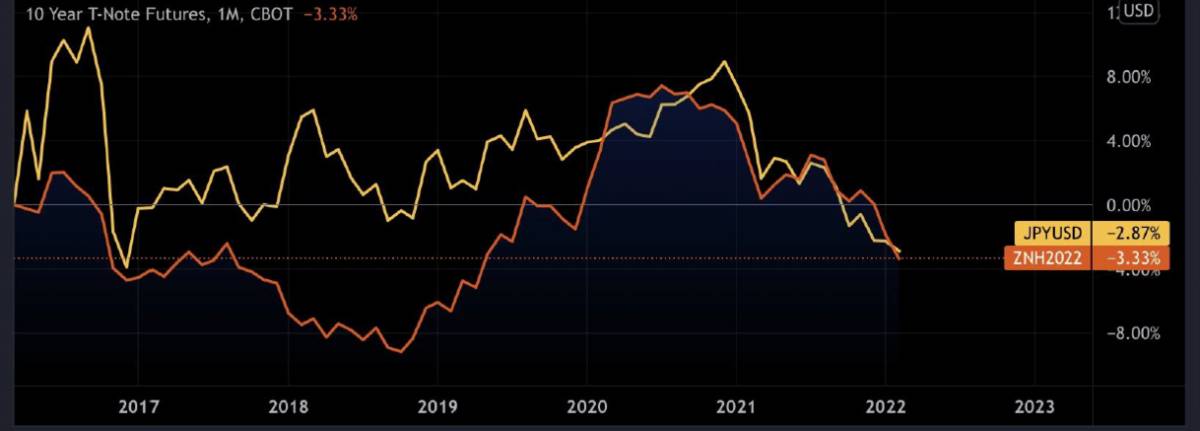

The JPY is moving in lock step with US 10 Year yield this has been the trend since 20/08/2020 as displayed below. The question for the JPY is how much can long end yields go before people start searching for yield especially if the curve inverts. Long term I’m bullish JPY especially if we get a bid to safety or a risk off event.

AUD

The RBA have been dragging their feet in terms of hiking. although the RBA will be stopping their bond purchase. That being said in risk off scenarios the AUD general gets sold off so I personally wouldn’t be holding my breath.

CAD

Canada is suffering from the same problem of inflation as Row Dec figures are at 4.8%. Add in the recent truckers protest that are sure to hurt supply chains this is where inflation problems can become worse. Normally with high oil prices the Loonie should be benefiting. That correlation has started to come down recently. With central banks hiking taking place and possible US/Iran deal oil may take a tumble further putting downside pressure on CAD.

The post <h5>Macro Research</h5> <h3>Is The Yield Curve About to Invert?</h3> appeared first on JP Fund Services.

Read More:

how much money do day traders with $10,000 accounts make per day on average

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading