The week was once again dominated by the continued invasion in Ukraine. Euro was the worse performer of the week as the attack on the Zaporizhzhia nuclear power station brought the real issues of the conflict into focus.

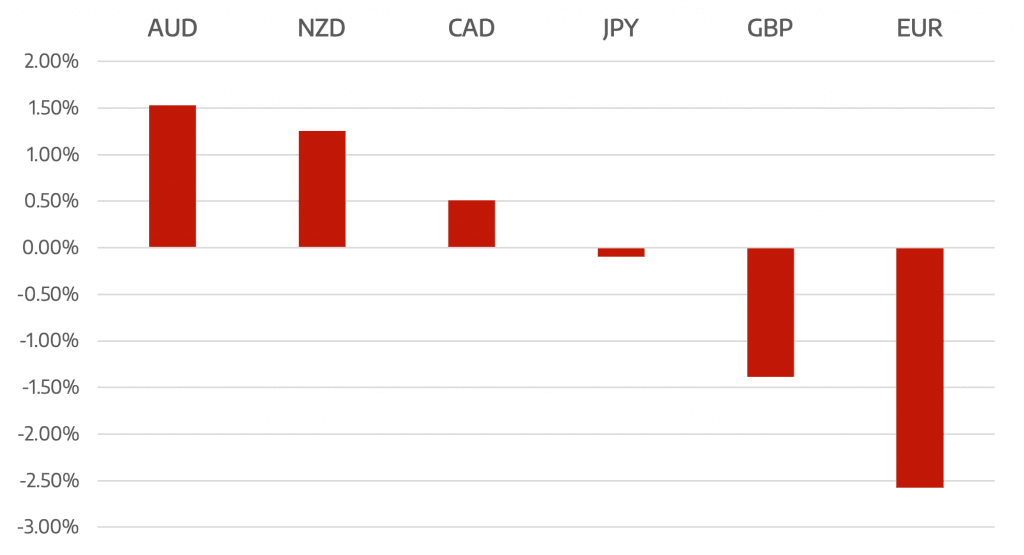

The war in Ukraine has generated two clear effects in FX markets: The European currencies most immediately exposed to the war and its economic fallout have fallen against the US Dollar, while most commodity currencies have strengthened as commodity prices continue to surge.

The Euro pared 3% vs the USD during the week as first the attack on the nuclear installation caused fear about possible repercussions along with expectations for a more hawkish ECB have evaporated.

Australian and New Zealand Dollar both gained significantly against the USD as spiking commodity prices drove the commodity currencies. Oil price rose 25% closing just under $115

The week ahead look to be solely driven by events in Ukraine. We see ECB interest rate decision and inflation data from several countries including the US but all will be overshadowed by any developments in Ukraine.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

War Continues to Take Its Toll

appeared first on JP Fund Services.

The post Cromwell FX Market View War Continues to Take Its Toll first appeared on trademakers.

The post Cromwell FX Market View War Continues to Take Its Toll first appeared on JP Fund Services.

The post Cromwell FX Market View War Continues to Take Its Toll appeared first on JP Fund Services.