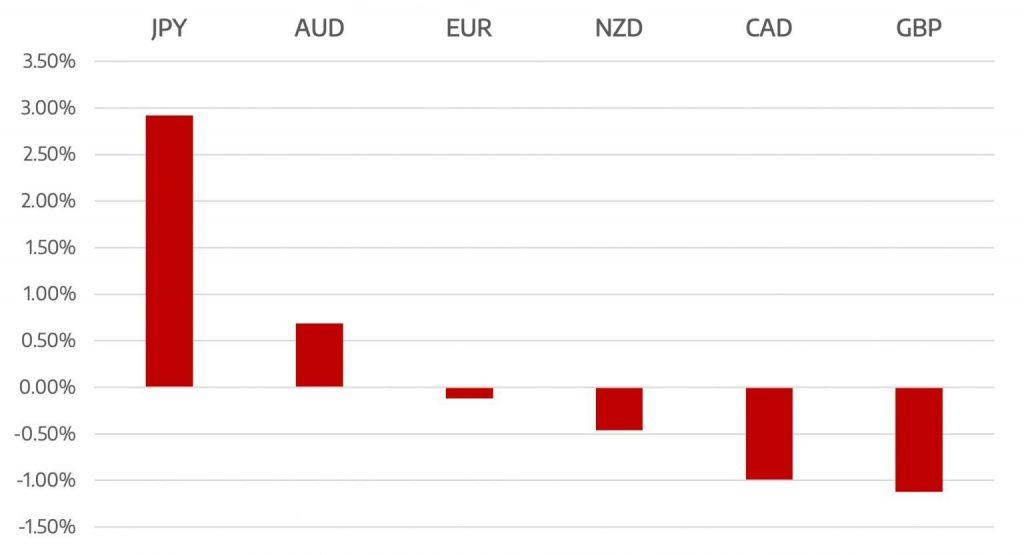

Last week the US dollar reversed the decline seen over the last couple of weeks. Modest gains were made as rising yields and stronger than expected NFP number saw elevated volatility in risk assets

The Euro had a mixed week as more ECB comments became hawkish. With Eurozone inflation running in excess of 8% the pressure is mounting on the ECB to act and act decisively

The pound had a troublesome week. The market is finding it hard to turn positive with the UK economy continuing to show strong signs it is turning lower and stagflation risks continue to rise.

Commodity currencies had a quiet week with only CAD making any moves. the CAD gained almost 1% during the week gaining strong support as WTI gained nearly 5% during the week to close above $120.

The Yen was the weeks worst performer losing almost 3% vs the US Dollar. and underperformed vs all the majors. This was as bonds began to react to inflationary and central bank pressure. benchmark yields rose in the US and Europe.

The week ahead sees the RBA interest rate decision but overall lighter on the economic front allowing markets to settle down.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

US Dollar Rebounds. Markets Look For Direction

appeared first on JP Fund Services.

The post Cromwell FX Market View US Dollar Rebounds. Markets Look For Direction first appeared on trademakers.

The post Cromwell FX Market View US Dollar Rebounds. Markets Look For Direction first appeared on JP Fund Services.

The post Cromwell FX Market View US Dollar Rebounds. Markets Look For Direction appeared first on JP Fund Services.