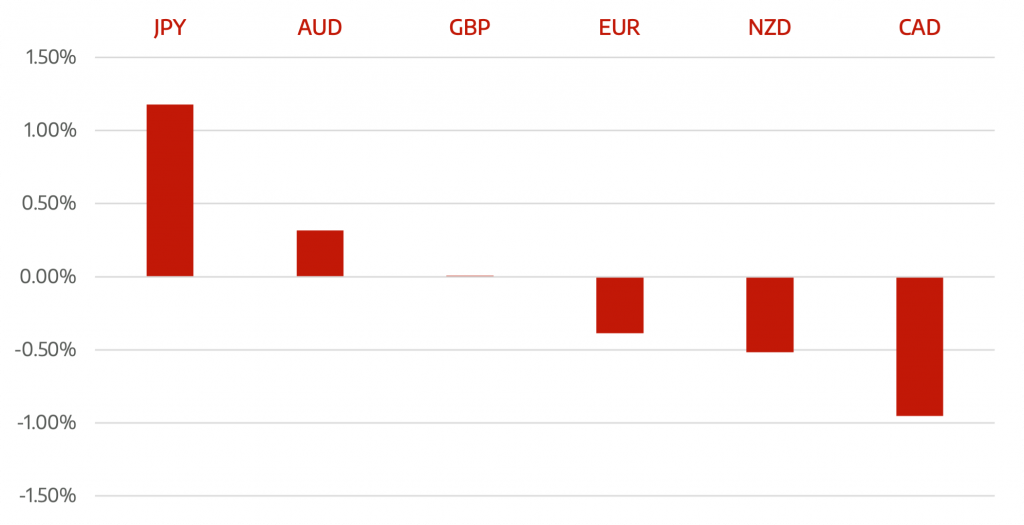

Despite a disappointing NFP on Friday the Dollar remained generally in control during the week. Yen lost across the board as treasury yields continued to rally. New Zealand dollar lost ground despite the RBNZ delivering its anticipated rate hike. Euro lost ground again as inflation pushed up to 3.4% YoY. Eurozone had expected higher inflation but not this high and it appears that the ECB is happy to warn against over reaction.

The Canadian Dollar continued its rise for another week. Firmer than expected employment numbers and the continued rise in oil prices which moved through 80 for the first time since 2014 pushed the currency higher. Aussie Dollar also gained due to continued strength in raw materials especially coal.

A quieter week ahead is expected with the US holiday on Monday and no central bank announcements. UK and Australia release their September job reports and later in the week the US release CPI and Retail Sales.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

NFP disappoint but USD remains in control

appeared first on JP Fund Services.

The post Cromwell FX Market View NFP disappoint but USD remains in control first appeared on trademakers.

The post Cromwell FX Market View NFP disappoint but USD remains in control first appeared on JP Fund Services.

The post Cromwell FX Market View NFP disappoint but USD remains in control appeared first on JP Fund Services.