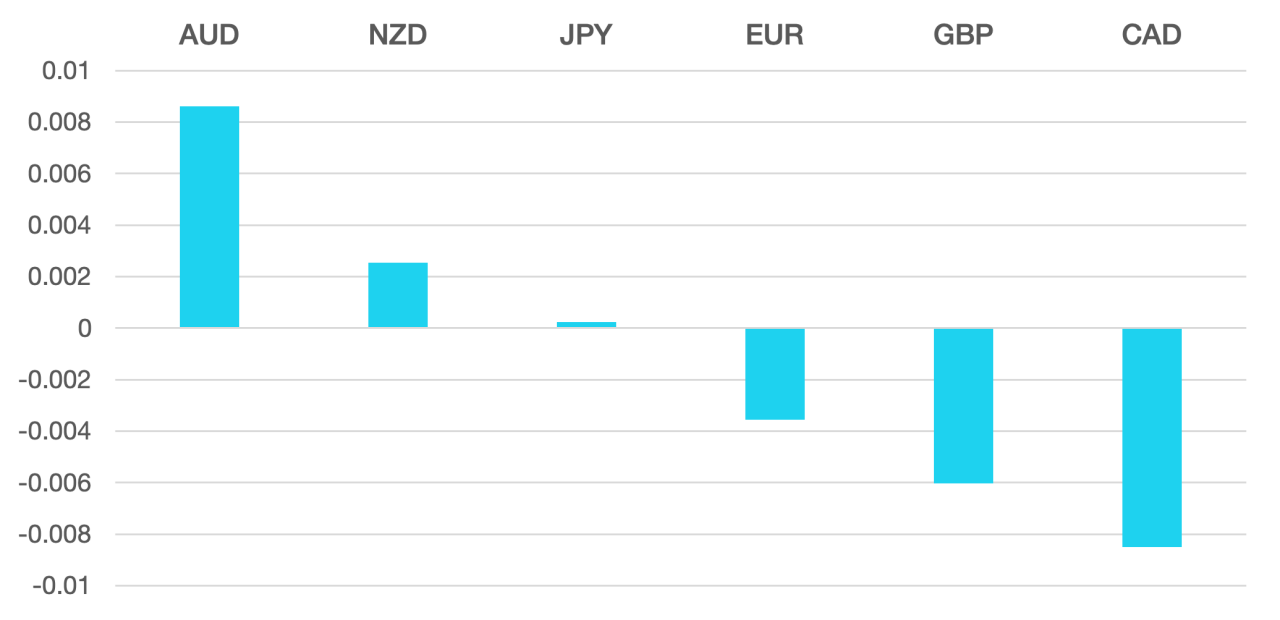

Last week we saw The European Central Bank (ECB) raise rates by 25bps and US CPI numbers. As we saw US inflation continues to remain at elevated levels and higher for the longer has once again been brought back into focus. The USD still maintained its move higher with the DXY gaining around 0.2%.

Euro had a torrid reaction post ECB. The raising of rates wasn’t the catalyst but the narrative. The revised lower inflation and growth expectations took its toll on the single currency. The Euro lost 0.4% and now looks to be moving lower towards the 1.05 level.

GBP again had a quiet losing week with employment and GDP both disappointing during the week. The GBP lost the 1.24 handle during the week cement a 3-month slide from its highs.

Commodity currencies managed a positive week mostly due to rising oil prices. NZD gained a moderate 0.2% and the CAD and AUD both around 1% better on the week.

Oil continued its rally as the market still remains very tight and with further cuts expected. WTI rallied almost 5% to close at 91.17.

The week ahead is a busy one for Central Banks. We have the FOMC rate decision as the highlight of the week with the markets expecting no change, but all eyes will be on any future indication of rate rises.

We also have the SNB, BoJ and BoE all in focus for their rate decisions.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Central Banks Back in Focus first appeared on trademakers.

The post Central Banks Back in Focus first appeared on JP Fund Services.

The post Central Banks Back in Focus appeared first on JP Fund Services.