135 secondary offerings raised £14.7 billion to 5 June, compared to £9.8bn last year. Prior to the lockdown in the UK, the amount of money raised in January and February 2020 was almost twice that of the same period in 2019 (£3.4 billion vs £1.9 billion).

Overall secondary offerings have reached £14.7 billion across 135 transactions in the UK for the year to date, according to new analysis from Deloitte. A secondary offering refers to the sale of shares in a listed company occurring after a company’s IPO, with the transaction taking place through either London’s Main Market or AIM.

Deloitte’s latest Equity Capital Markets update contains commentary on recent UK stock market performance in the wake of the COVID-19 pandemic; levels of equity market issuance and macroeconomic considerations; how businesses can recover from COVID-19; methods of raising secondary equity capital and trends in public to private transactions.

Prior to the lockdown in the UK, the amount of money raised in January and February 2020 was almost twice that of the same period in 2019 (£3.4 billion vs £1.9 billion), signalling increased business optimism. Despite a drop in March, April and May both saw elevated levels of equity fundraising in London.

Chris Nicholls, Head of Equity and PLC Advisory at Deloitte, said: “The UK market has very much been open for existing listed companies seeking additional equity capital, including those from the retail and hospitality sectors. Typically this has been to strengthen balance sheets and improve liquidity in the wake of the pandemic. I would expect fundraising activity to continue into the rest of the year, albeit with only a modest trickle of IPOs.”

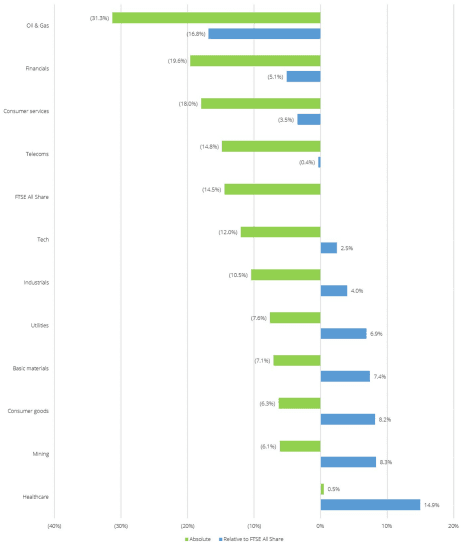

Since 23 March this year, the FTSE 100 and S&P 500 have risen 29.8% and 42.8% respectively, boosted by the gradual reopening of world economies and bold government and central bank stimulus measures. However, volatility levels remain elevated compared to long-term averages with the global VIX Index currently in the region of 24, substantially higher than the 2019 average of approximately 15.

Chris Nicholls concludes: “Whilst volatility has substantially reduced from March levels, any VIX reading above 20 traditionally represents a difficult environment in which to launch IPOs. However, global equity markets are recovering strongly from the unprecedented shock to the economy caused by COVID-19.”

Global Equity Markets on “Recovery Mode”

Global equity markets are very much in ‘recovery’ mode as the dawn of a new global economy emerges. The most costly pandemic since the start of the twentieth century, both in terms of human lives lost and financial impact, has birthed a new normal for businesses and society alike. The long-term impact of the Great Lockdown remains uncertain, but it is clear that businesses will be forced to adapt and change as economies recover.

“Central banks and governments were quick and relatively coordinated in their response to the COVID-19 pandemic, providing measures to stimulate the economy that outweigh even those put to use during the Great Financial Crisis (“GFC”). In terms of monetary policy, the Bank of England cut interest rates twice in the space of 8 days, initially from 0.75% to 0.25%, and then further to a record low of 0.1%. The governor of the Bank of England, Andrew Bailey, has not ruled out cutting rates into negative territory, which would be a first for the UK. On the fiscal policy side, the government introduced numerous measures to protect jobs and businesses in the form of tax and business rates relief, the Coronavirus Job Retention Scheme and emergency loans to affected companies,” was said in the report.

The wider impact on the health of global economies has been apparent through revisions to global growth forecasts, drops in measures of economic activity such as manufacturing and services Purchasing Managers Indices and rates of unemployment. The UK economy

contracted by 2.0% in Q1 2020, with expectations of a 16.6% contraction in Q2 2020, before returning to growth in Q3 2020. Overall UK GDP growth for 2020 was forecast to be around 1.0% at the beginning of the year, but is estimated to now be a contraction of 6.5%. Similarly, UK and Eurozone composite PMI readings for Q1 2020 fell to far below 50,

signaling contraction. In April, about a third of the UK’s 33m workforce were being supported by the government, through the furlough scheme, self-employment income support or Universal Credit.

The resulting global economic outlook contributed to elevated levels of volatility in March 2020 with the CBOE Volatility Index (“VIX Index”) hitting a high of 82.7. The VIX Index did not reach that level even at the height of the GFC in late 2008, but has returned to less volatile readings much quicker in 2020. As at 5 June 2020 the VIX Index has fallen to 24.5, which still represents an elevated level compared to the 2019 average of 15.4.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading