The pound sterling (GBP or £) is the official currency of the United Kingdom, and is also used in several territories including Jersey, the Isle of Man, Guernsey, South Georgia, and the British Antarctic Territory. In addition, several other countries use non-sterling currencies called the pound, such as Gibraltar, the Falkland Islands and Saint Helena, although these currencies are pegged at parity with the pound sterling.

The pound sterling is the world’s oldest currency to be still in use, and is the fourth most traded currency on the forex market after the US dollar, the euro, and the Japanese yen. It is also the third most held reserve currency worldwide, accounting for around 4% of global reserves.

Early History

The pound has its roots in Anglo-Saxon England, and as the name suggests, it was originally equivalent to one pound weight of silver, which at the time was 240 silver pennies. Silver pennies themselves were introduced by King Offa of Mercia (757-796), and the accounting system connected with them (4 farthings = 1 penny, 12 pence = 1 shilling & 20 shillings = 1 pound) was copied from the one introduced by Charlemagne to the Frankish Empire, as France was then known.

The first pennies were made from the purest silver that was available at the time. This changed in 1158, when King Henry II introduced the Tealby penny, which was struck from 92.5% silver. This remained the standard until the 20th century, and due to its association with the currency, this material is known as sterling silver. Sterling silver is much harder than the fine silver (99.9%) that was initially used, which meant that the coins were harder-wearing. Up until the introduction of the gold nouble in 1344, silver was the exclusive currency of England, and remained the legal basis for sterling until 1816. The penny was first reduced in weight to 0.97g during the reign of Henry IV (1399-1413) and was then reduced to 0.78g in 1464.

The currency went through much more drastic devaluations during the Tudor era of Henry VIII and Edward VI, with a new penny consisting of just 33.3% silver was introduced, and the sterling silver penny being reduced in weight to 0.52g.

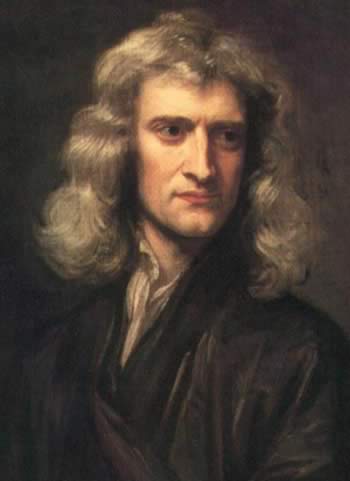

A new gold coin, based on the 22 carat fine guinea, was introduced in 1663, and the value of this coin fluctuated wildly in the ensuing years. Efforts by Sir Isaac Newton, Master of the Mint, to reduce the guinea’s value, gold continued to be overvalued in relation to silver when compared with valuations in other European countries. This led to British merchants paying for imports in silver while receiving payments in gold, and with silver flowing out of the country while gold flowed in, Britain was effectively put on the gold standard.

As you might expect, this situation led to a chronic shortage of silver coins, a situation made worse by the fact that silver was the only commodity accepted by Chinese exporters during this period. This meant that, in order to trade with China, Britain had to trade with other European nations first to receive silver, which was something of an inefficient process.

The Introduction of Paper Money

In 1694, the Bank of England was founded, and the Bank of Scotland was founded a year later. These institutions both began to issue paper money, which was much more convenient than trading directly in precious metals, which were heavy and wore down over time. The pound scots started off at parity to sterling, but a trade imbalance led to it becoming severely devalued, up to the point where 1 pound sterling became equivalent to 12 pounds scots. The merger of the Kingdoms of England and Scotland in 1707 to form Great Britain brought about the end of the pound scots, which was replaced by sterling at this value. The Irish pound followed suit in 1826 at the value of 13 Irish pounds to 12 pounds sterling.

The Gold Standard

The gold standard was officially adopted in 1816, with silver coins ceasing to contain their value in precious metal. The following year, the sovereign was introduced, containing 7.3g of 22-carat gold, and replaced the guinea as the standard British gold coin. In the late 19th and early 20th centuries, several other countries adopted the gold standard, which meant that currency exchange rates could be easily determined from the various gold standards. For much of this period, the pound sterling was worth 4.85 US dollars, 26.28 French francs (or other Latin Monetary Union currencies), and 20.43 German marks. The possibility of Britain joining the Latin Monetary Union was discussed in 1867, but the government eventually decided against it.

The outbreak of the First World War in 1914 led to the suspension of the gold standard, due to the huge expense involved in gearing up for war. Before the war, the UK had one of the strongest economies in the world with over 40% of the world’s overseas investments. By the end of the war, however, the economy was in tatters, with the government owing £850m (equivalent to £35 billion in today’s money) to the United States, and interest payments accounting for 40% of all government spending.

The gold standard was reintroduced in 1925 in an attempt to bring back some stability to the exchange rates, but was again abandoned in 1931 following the onset of the Great Depression. with sterling immediately facing a 25% devaluation.

Bretton Woods

Under the terms of a 1940 agreement with the United States, the pound was pegged to the US dollar at a rate of $4.03, having been $4.86 just a year before. This rate remained throughout the Second World War and became the basis of sterling’s valuation under the Bretton Woods Accord, which determined international exchange rates in the post-war years.

Under severe economic pressure, the UK government was forced to devalue the pound by 30.5% to $2.80 in 1949, which was the catalyst for the devaluations of several other currencies. It came under further pressure in the 1960s, with the dollar exchange rate being deemed much too high. This led Harold Wilson’s Labour government to tighten exchange controls, one of which prevented tourists from taking more than £50 out of the country – a measure which, somewhat remarkably, remained until 1979. Under this increasing pressure, the pound was devalued by 14.3% to $2.40 in 1967.

The widely-understood but somewhat awkward system of pounds, shillings, and pence was replaced with the onset decimalisation in 1971, which led to a simpler system of 100 new pence = 1 pound. That same year, the breakdown of the Bretton Woods system led to the pound becoming one of the first free-floating major currencies. Initially, it appreciated slightly, rising to nearly $2.65 in March 1972.

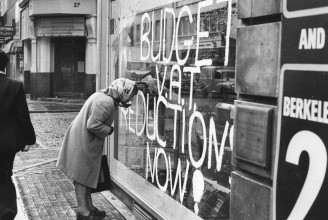

However, by 1976, the UK economy was in deep trouble, still reeling from the effects of the 1973 oil crisis and so-called ‘hyperinflation’ of over 27% in 1975 alone. The pound was widely considered to be overvalued, and in April of 1976, the Wall Street Journal published an article entitled ‘Good-bye Great Britain’, which advised the sale of all sterling investments. At this point, the government was running a huge budget deficit and incoming Labour Prime Minister James Callaghan was forced to accept the imposition of painful austerity measures in exchange for an IMF bailout, or face a catastrophic freefall in the value of sterling. Callaghan reluctantly accepted the deal, in a situation eerily reminiscent of the recent Eurozone crisis.

The Thatcher Years

The election of Margaret Thatcher’s Conservative government in 1979, with promises of tight fiscal austerity, saw the pound rally strongly in response to the high interest rates brought about by the monetarist policy of targeting money supply. This high exchange rate, however, was widely blamed for the deep recession of 1981, and sterling began to plummet in value, hitting a low of $1.03 in 1985. By the end of the decade, though, it had rebounded to a high of $1.70 in December 1989.

Thatcher’s Chancellor of the Exchequer Nigel Lawson decided in 1988 that the pound should ‘shadow’ the West German Deutsche Mark. This had the unintentional effect of making inflation rise rapidly, and the low interest rates that ensued ushered in a credit-led economic boom. However, the high borrowing costs that followed German re-unification in 1990 led to interest rates in countries that shadowed the DM to skyrocket, leading to falling house prices and a deep recession.

Britain Forced Out of the ERM

In October of that year, the government decided to join the European Exchange Rate Mechanism (ERM), with the pound being set at DM2.95, in preparation for joining what would become known as the euro. However, they were forced to abandon this policy in 1992 after the events of ‘Black Wednesday’, where the exchange rate was made unsustainable by the country’s economic performance. Famously, speculator George Soros made around $1 billion by shorting the pound on this day. Interest rates jumped from 10% to 15% in an ultimately unsuccessful effort to keep the pound in the ERM.

The exchange rate fell dramatically afterwards to DM2.20, and this cheaper pound encouraged exports and brought about the economic boom of the mid-1990s.

The New Labour Years

One of newly-elected Labour Chancellor Gordon Brown’s first acts was to hand over control of interest rates to the Bank of England, taking them out of direct government control. Under the terms of this new arrangement, the Bank is required to set interest rates at such a level that inflation remains around the 2% mark. If inflation goes above or below this by 1%, the Governor of the Bank of England has to write an open letter to the government explaining why the target had been missed, and this occured for the first time in 2007, shortly after the onset of the financial crisis.

The End of the Pound?

While the UK, as a member of the EU, could theoretically lose the pound and adopt the euro as its official currency, successive UK governments have declined to take this step. While Tony Blair’s Labour government had pledged a referendum on the issue, this would only be triggered if five key economic tests were met to ensure that the move would be in the nation’s economic interest. In recent times, support for the adoption of the euro has waned considerably, particularly in light of the Eurozone crisis, and it looks likely that Britain will retain the pound for the foreseeable future.

Other Articles in this Series:

Major Currencies: The US Dollar (USD)

Major Currencies: The Euro (EUR)

Major Currencies: The Swiss Franc (CHF)

Major Currencies: The Japanese Yen (JPY)

Major Currencies: The Australian Dollar (AUD)

Major Currencies: The Canadian Dollar (CAD)

Major Currencies: The New Zealand Dollar (NZD)

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading