The World Bank set a downbeat tone for the long-term outlook for economies over the weekend after warning the damage done by the coronavirus crisis will take even longer to repair than the Global Financial Crisis of 2008.

The World Bank’s new chief economist Carmen Reinhart said hopes of a rapid V-shaped rebound are off the mark, with any recovery likely to take more than five years on a per capita income basis. She told The Sunday Telegraph: “We are talking upwards of five years. Look, the damage being done is being done really to every sector.”

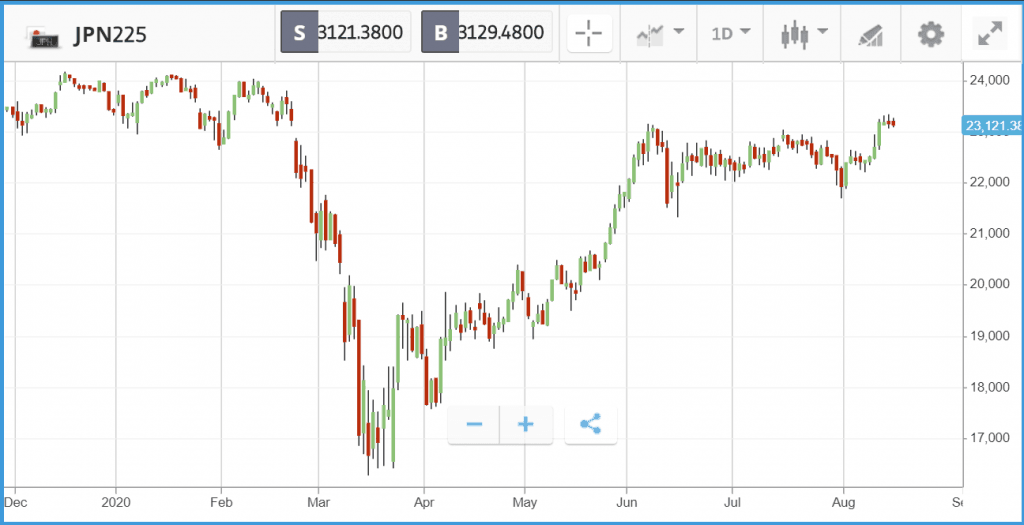

The economic data continues to be downbeat globally, with Japan this morning reporting its worst ever GDP figures. The world’s third largest economy shrank 7.8% in Q2, annualised to a loss of 27.8% of GDP. It presents the worst drop since records began in 1980 and the third consecutive quarter of contraction for the troubled island nation. The country has recorded 19,000 new coronavirus cases in August, nearly a third of all the cases it has had so far, harming its prospects for a speedy recovery.

Meanwhile, politics continues to play a central role in the US amid election year. Leader of the House Nancy Pelosi has recalled congress early from its summer break over the US Postal Service crisis, with the national mail carrier in dire straits financially and the Trump administration undermining it ahead of the Presidential election on November 3rd. Democratic lawmakers have also demanded the USPS leaders testify at an emergency hearing regarding mail delays on 24 August. Trump said last week he was blocking $25 billion in emergency funding for the service and $3.6 billion proposed by the Democrats in extra funding for states to manage the election.

US markets tread water as data suggests recovery slowing

US markets finished the week broadly flat as data from the world’s largest economy, including unemployment and retail sales, suggested it was recovering but at a slower rate. The S&P 500 and Nasdaq both dipped marginally on Friday, while the Dow Jones gained a modest 0.1%. Just two stocks rose by more than 1% in the Dow on Friday – Walgreens Boots Alliance led the index higher, up 2.2%, followed closely by Boeing, up 1.9%. No stocks in the index lost more than 0.6%.

In the S&P 500 medical supplier McKesson Corp led the index higher, up 4.3%, President Trump said it would be partnering with the US government in distributing coronavirus vaccines to the general population under ‘Operation Warp Speed’.

S&P 500: -0.02% Friday, +4.4% YTD

Dow Jones Industrial Average: +0.1% Friday, -2.6% YTD

Nasdaq Composite: -0.2% Friday, +22.4% YTD

UK indices lower as markets baulk at new travel restrictions

The FTSE 100 and 250 indices were led lower on Friday by travel stocks which sold off thanks to fresh quarantine impositions on six countries, including the UK’s number two destination, France. Fresh quarantine rules means travellers returning from France will have to quarantine at home for 14 days, and will cast a pall over an already dismal summer season for holidaymakers in Europe. With the FTSE 100 down 1.5% on Friday, International Consolidated Airlines Group (IAG), owner of British Airways and Iberian Airways led the index lower, down 4.8%. Aveva Group, off by 4.2% and Rolls Royce, down 4%, were some of the other notable losers on the day.

Meanwhile in the FTSE 250, which was down by a more modest 1%, the world’s largest tour operator TUI was down 8.4% on the quarantine news, while easyJet was off by 6.6%. Meanwhile Greencore Group’s share price was down 6.4% thanks to an outbreak of coronavirus among its workers at a food packaging plant in Northampton. Nearly 300 employees tested positive for the illness, raising questions over the firm’s safety policies amidst the pandemic.

FTSE 100: -1.6% Friday, -20.6% YTD

FTSE 250: -1% Friday, -19.8% YTD

What to watch

BHP: Mining firm BHP (formerly BHP Billiton) reports its full years at 08:30am Tuesday Melbourne time. Investors will be keen to see how it has fared during the crisis, but the share price has already been given a boost by the high price of iron ore. Iron ore’s price is soaring thanks to supply and demand issues in China. Fellow iron ore miner Rio Tinto paid out higher dividends thanks to the price spike making BHP one to watch for similar. The stock is, however, subject to some noise around ethical divestment, with the UK’s largest pension fund, the government-backed National Employment Savings Trust (NEST), announcing it was ditching fossil fuel-related investments on environmental grounds, which is set to include BHP.

Persimmon: Housebuilder Persimmon is set to report its interim results tomorrow, with analysts expecting a decrease from the £513 million in profits it made last year. The firm has already signalled its half-year profits are down 33% to £1.1 billion with the completion of 4,900 house sales, down from 7,584 last year, but June 2020 experienced a 30% pickup in activity in this area. July and August data will be key to see whether the firm was able to keep up the pace of regrowth as other house builders muscle back in. Analysts at UBS expect an interim dividend for 2020 of 110p.

Crypto corner: US Postal Service touts blockchain-based mail-in voting

The US Postal Service has submitted patents for a proposed blockchain-based mail-in voting system for the November Presidential election, according to Decrypt.

The service faces major challenges, with a funding crisis ahead of the election the central one, and cost-cutting measures likely to slow down the service significantly. But with mail-in voting seen as crucial thanks to the coronavirus crisis and President Trump routinely railing against the process, the USPS has proposed an innovative potential solution.

Patents published this week, first submitted back 7 February this year, outline plans for a mail-in voting system based upon blockchain technology. While the patent is quite broad, one suggestion includes paper-based unique ID codes sent out to voters that can then be verified with a mobile device to confirm identification, with a ballot cast digitally. The system would use blockchain technology to keep voter ID and voting preference separate to maintain anonymity.

All data, figures & charts are valid as of 17/08/2020. All trading carries risk. Only risk capital you can afford to lose

Read More:

when is the target car seat trade-in 2025

charles schwab a modern approach to investing & retirement

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading