Last week, the euro began to recover from the previous week’s ECB rate cut shock, while the yen continued its downtrend. Meanwhile, markets remained calm after incoming Fed chair Janet Yellen defended the monetary stimulus programme, indicating that a radical shift of direction under her leadership would be quite unlikely. Jobless claims in the US fell 2,000 and are predicted to fall further, while the euro zone continued its pattern of sluggish growth. In the UK, encouraging employment figures coupled with an upbeat assessment of the country’s economic prospects from Bank of England governor Mark Carney pushed the pound higher.

It’s set to be a big week for the forex market, with plenty of major economic releases. Here are some of the more important ones – all times are GMT:

German ZEW Economic Sentiment: Tuesday, 10:00. The index for this survey of analysts and investors jumped up unexpectedly, from 49.6 to 52.8 between September and October, and another rise to 54.6 is expected.

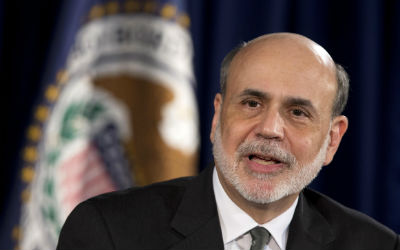

Ben Bernanke speaks: Wednesday, 0:00. Outgoing Federal Reserve Chairman Ben Bernanke will speak in Washington DC, and is expected to talk about Federal Reserve Chairperson-Designate Janet Yellen and the possibility of tapering. This should be a major market mover.

Ben Bernanke speaks: Wednesday, 0:00. Outgoing Federal Reserve Chairman Ben Bernanke will speak in Washington DC, and is expected to talk about Federal Reserve Chairperson-Designate Janet Yellen and the possibility of tapering. This should be a major market mover.

US inflation data: Wednesday, 13:30. Consumer prices in the U.S. were up 0.2% in September, following a rise of 0.1% the previous month. Meanwhile, Core CPI gained 0.1%, the same as the previous month, but less than the projected 0.2%. CPI increased 1.2% on a yearly base, the smallest increase since April and well below the Fed’s target of 2.0%. CPI is forecast to increase by 0.2%, and core CPI is expected to rise by 0.1%.

US Retail Sales: Wednesday, 13:30. In September, U.S. retail sales declined unexpectedly, dropping 0.1% for the first time in 6 months, mainly as a result of a big drop in auto sales. Aside from the auto industry, sales in the majority of other businesses increased, which suggests that the government shutdown had little impact on consumer spending. Excluding automobiles, sales were up 0.4%, possibly helped by the upcoming holiday season. Retail sales are predicted to grow by 0.1%.

US Existing Home Sales: Wednesday, 15:00. Sales of existing U.S. homes fell by more than was expected in September, from 5.39 million in August to 5.29 million. Demand was reduced by higher mortgage rates, while the average house price was up 11.7% on the 2012 figure. The number of sales is expected to fall again to 5.21 million.

US FOMC Meeting Minutes: Wednesday, 19:00. At the last meeting on October 30th, the Federal Reserve kept policy unchanged as was widely anticipated. However, the less dovish tone of the statement, particularly the removal of the “tighter financial conditions” clause, led to increased speculation about the likelihood of QE tapering in December. While it’s unlikely any decision will be made at this meeting, the meeting minutes will nonetheless be pored over by analysts looking for clues as to the Fed’s next move.

US PPI: Thursday, 13:30. In September, U.S. producer prices fell more than forecast, down 0.1% after a 0.3% rise in August, rather than the forecast gain of 0.2%. A drop of -0.1% is expected.

US unemployment claims: Thursday, 13:30. Claims for unemployment benefit have been consistently dropping in recent weeks, and this is a good sign for the US economy. Last week, the four-week average fell 5,750 to 344,000, and another drop to 333,000 is anticipated.

US Philly Fed Manufacturing Index: Thursday, 15:00. Factory activity in the region fell by less than forecast in October, down to 19.8 from 22.3 in September – with economists predicting 15.4. Meanwhile, optimism was up to 60.8, the highest level in ten years, from 58.2 in September. Factory activity is expected to decline to 15.1.

German Ifo Business Climate: Friday, 9:00. German business sentiment fell for the first time in six months in October to 107.4 from 107.7 in September, confounding analyst’s forecasts. However, Germany’s recovery is expected to continue, and a rise to 107.9 is predicted.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading