Japanese yen’s status as a global safe-haven was bolstered Friday, pushing the USD/JPY to nearly one-year lows following another rout in the Chinese equities market.

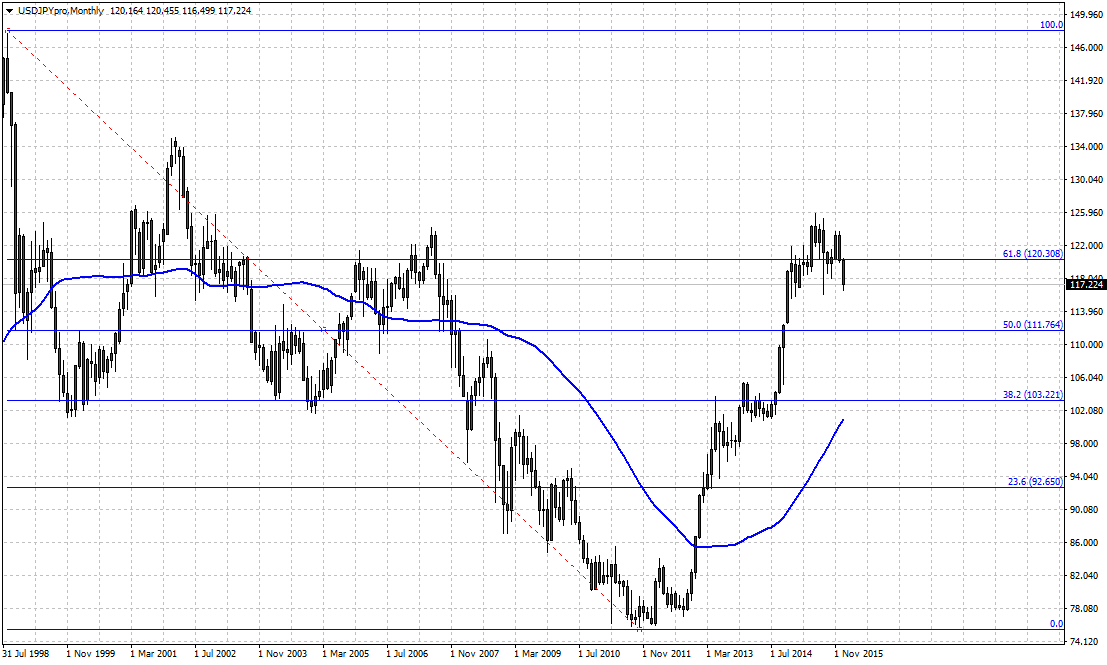

USD/JPY plunged 1.1% to 116.84, putting the pair on track for its lowest close since January 2015. The USD/JPY has settled below the 100 and 200 simple moving averages, indicating further downside may be in store. Initial support is likely to be found at 116.68, the low from January 11. On the upside, the initial resistance test is at the 118.32 technical level.

The USD/JPY has plunged 4.6% since December 18 amid sharp fluctuations in the US dollar and renewed volatility in global equities. Most of the pair’s losses over the past month have occurred in the last two weeks in response to plunging Asian stocks. As a funding currency that is also seen as a global haven against risk, the Japanese yen is typically more attractive during periods of economic and financial tumult.

Volatility returned to the global financial markets on Friday, with China’s benchmark Shanghai Composite Index closing at its lowest level since December 2014. The Shanghai Composite closed down 3.6% at 2,900.97. With the loss, the Shanghai Index is down a staggering 18% since the start of January, putting the pressure back on the People’s Bank of China to nurture the market back to health.

Japanese stocks continued to slide on Friday, with the Nikkei 225 Index falling 0.5%. That marked the Nikkei’s eighth decline this year, a vicious streak that has shaved nearly 10% off the major index.

European markets were down across the board, with the Euro STOXX 50 Index falling 2.5%. All of Europe’s major stock averages were down more than 2% in midday trading.

American stock futures plunged in pre-market activity, with the Dow Jones trading nearly 400 points lower. Investors on Wall Street are likely to be weary of disappointing retail sales figures out of Washington on Friday that showed a decline in consumer spending during the holidays.

US retail sales fell 0.1% in December following a rise of 0.4% the previous month. Excluding automobiles, retail sales were still down 0.1%.

Separately, industrial production figures fell for a third consecutive month in December, a sign the country’s manufacturing recession was worsening amid warmer than usual weather. Industrial production fell 0.4% in December following a 0.6% drop the previous month. The industrial sector’s capacity utilization rate also fell to 76.5% in December from 76.8% the month before.

Read More:

What is emotionless option trading?

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading