Denmark is the equivalent of stuck between a rock and a hard place. The Danmarks Nationalbank (Danish Central Bank) has tried different policies intended to keep the all-important Euro peg in place to prevent akin to the policy set forth by Swiss National Bank before they removed the peg earlier in the year after caving to speculative pressures. The Danes have yet to fold in the dangerous game they are playing after receiving a brief respite following the rebound in the Euro and extended timeline for a US rate hike. The outlook for Denmark is closed tied to the developments in Europe, the nation’s single largest trading partner, hence the peg to keep the currency competitive.

However, with the global currency war picking up in momentum, devaluation has had ripple effects and the cost of maintaining the peg is growing for the Danes as they seek to protect the domestic economy.

The Fundamental Picture

Denmark was one of the few European nations to reject the entreaties of the Euro, having voted down joining the currency in 2000. While a member nation of the European Union, the lack of interest in joining the Euro has necessitated a differing set of monetary policies to keep the currency competitive and avoiding haven status. Strictly by the numbers, Denmark is ostensibly one of the better positions European nations considering the top-down view of the economy. Gross domestic product is growing at a 1.70% annualized pace, unemployment stands at a mere 4.70% and inflation is trending around 0.70%. By comparison, the Euro Area is exhibiting 1.20% annualized growth, last recorded unemployment at 11.10% and is nearing deflationary territory with the latest CPI print at 0.20%. More concerning is the sheer level of debt of European peers with the aggregate Euro Area showing debt-to-GDP of 91.90% compared to Denmark’s 45.20%.

While on the surface the Danish economy is in strong shape considering economic fundamentals that trounce neighbouring countries, it has not come without a cost. Denmark was one of the earlier countries to start experimenting with negative interest rate policy, following the Swiss in crossing the zero bound in an effort to prevent speculative inflows that would drive the Krone higher against the Euro. The problem for policymakers is that haven inflows would have made the Krone far more expensive than reasonable, reducing competitiveness and eroding market share with its biggest trading partner, Europe. By taking interest rates below the zero bound to present levels at -0.75% they have effectively warned speculators that depositing funds in the nation will result in interest paid, not received. Defending the peg nevertheless comes at a cost, mainly the need for the Central Bank to buy Euros and sell Krone to defend the peg by growing the Central Bank balance sheet.

Currency pegs are very difficult to maintain in the long run as evidenced by the recent carnage piling up in financial markets. Many emerging economies have been forced to devalue in recent weeks as the global economic outlook shifts from positive to negative, forcing countries to take drastic measures to defend market share. Even for developed economies and their respective central banks, currency pegs can be costly, case in point, the decision by the Swiss National Bank to abandon the peg earlier in the year. Although Denmark’s explosive balance sheet growth has eased and even declined slightly with the recent rebound in the Euro, pegs historically do not work, even with a country practicing the policy for nearly 15 years. It may lead to the Central Bank adopting a more flexible approach to the exchange rate, similar to the Swiss, as they seek to reduce the risk of startling large balance sheet losses should the ECB expand easing or conversely the Euro begin to depreciate once more.

The Technical Take

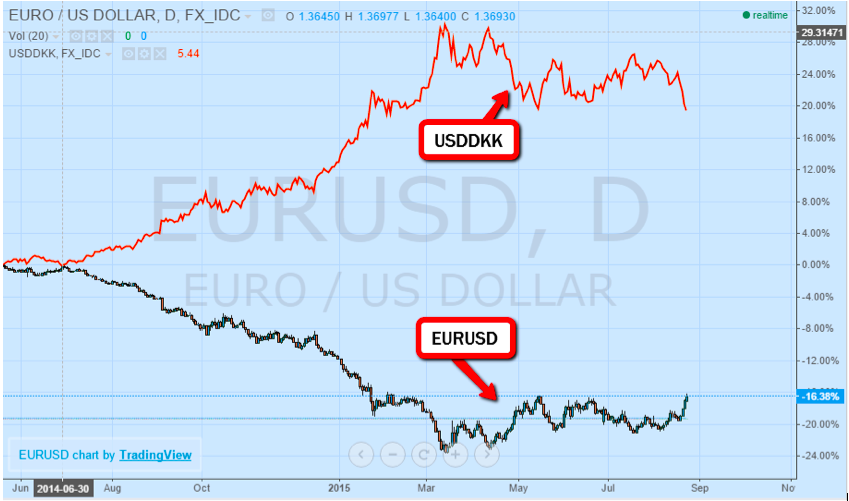

From a technical perspective, there are two major factors worth observing when evaluating the USDDKK currency pair. The Krone is very sensitive to movements in the dollar, specifically the Euro-Dollar pair. The EURDKK peg means that the Krone moves minimally within a trading band. This translates to a situation whereby EURUSD and USDDKK have a very strong inverse correlation because the EURDKK pair has hardly any volatility by comparison. The chart above shows how the two currency pairs move lockstep in opposing directions because of this feature. From another viewpoint, the USDDKK pair is sitting right on a major support level. The pair is currently setting up in a longer-term descending triangle pattern exhibiting a strongly bearish bias. The formation which began in March is bound by the consolidation between a medium-term downtrend line and support standing firmly at 6.5000. A move below the support line would be considered a triangle-based breakout to the downside targeting support at 6.3850 and 6.2760. Should the Federal Reserve decide to raise interest rates, it could see USDKK break above the downtrend line, indicating a potential reversal and resumption of the longer-term trend higher.

The Outlook

Based on the combination of technical and fundamental factors, USDDKK is likely to continue weakening over the near-term especially considering the brighter outlook for Europe and revised timeline for the Federal Reserve to begin liftoff. On that basis, the ideal way to take advantage of the USDDKK pair in the near-to-medium term involves taking Put positions above 6.5000 targeting the key support levels at 6.3850 and 6.2760. A deeper pullback is occurring in relation to the longer-term strengthening of pair, making this an ideal time to play the technical retrace to the downside.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading