In the final part of our series on the Inside Bar Breakout strategy for trading Forex, we shall be revealing how to interpret patterns of multiple inside bars, and understand the breakout traps that form an essential part of trading this strategy effectively.

Multiple Inside Bars

At key support levels, the major market participants tend to begin a process of distribution, and at key resistance levels they tend to start the process of accumulation. These processes can last for several days, with the range getting smaller from day to day, and this can result in a phenomenon known as ‘multiple inside days’.

The longer the consolidation, the longer the movement after the breakout is likely to be. Therefore, multiple inside days present an excellent trading opportunity, because the breakout tends to lead to big movement in price.

While the profit potential is greater with multiple inside days, the chances of being wrong-footed by these formations is also greater. The key to successfully trading these patterns is to understand the psychology that underpins the formation of multiple inside days, and the breakout that follows them.

The most reliable method of trading these patterns is to trade the breakout of the initial inside bar – providing it has the momentum to follow through – and place the stop just below or just above the first inside bar depending on whether it is a long or short position.

Following the strategy of trading with the trend, a short order is place just below the low of the first inside day, and the stop is placed just above the high. Note that the breakout has a high momentum.

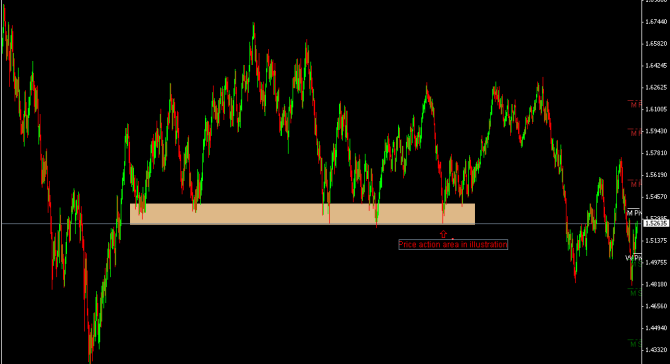

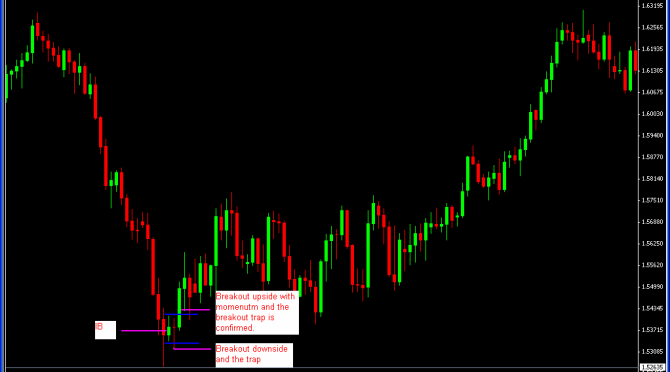

Understanding Breakout Traps

In order to trade this strategy effectively, you need to understand the phenomenon of breakout traps, and learn how to avoid getting caught up in them. Breakout traps occur when the price breaks out in one direction, and a lot of big players jump on the trend in the direction of the breakout. This is followed by a reversal and a breakout with momentum in the opposite direction to the initial breakout.

This usually means that traders who entered their positions on the first breakout are trapped in a bad trade, but there are ways that you can avoid this fate. Firstly, you should always trade with the trend, as we have already emphasised. Secondly, you should steer clear of making long trades in a strong resistance area, and also avoid making short trades in a strong support area. Trading the breakouts against the trend is also to be avoided, as these breakouts are more likely to form breakout traps. An alternative approach to this would be to wait for the breakout of key areas to be retested, as this will mean that you avoid getting stuck in the bad trade.

Source: Forexcrunch

Source: Forexcrunch

Conclusion

The Inside Bar breakout strategy can be a very powerful – not to mention profitable – trading technique when you follow the rules set down in this series and apply appropriate diligence to each trade. Inside bars are very common, and you need to be able to discern the ones that expose you to high risk trades from the more reliable types, as well as avoiding getting caught in a breakout trap.

The key to success with this strategy is patience, which takes discipline. It’s better to keep an eye on the market for a long time and wait for inside bars that exhibit the kind of low-risk / high reward characteristics that make for consistently profitable trades, rather than jumping on every single one that comes your way. Unless you are extremely lucky, it is inevitable that some of these trades will turn out to be losing trades, but if you stick to trading only those opportunities with a high risk/reward ratio, the size of the wins from these trades should compensate for any losses that you incur along the way.

Previous articles in this series:

Trading Strategy: Inside Bar Breakouts Part 1

Trading Strategy: Inside Bar Breakouts Part 2

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading