By the third week of May, the crypto markets saw a bit more volatility coming its way. Did I hear someone shouting, Opportunity? As always in trading asset classes of any kind, patience and a calm-hand are virtues. For those who get emotional, or who are looking to get in and out right quick and hope to make a killing, history shows a huge majority of those traders are apt to lose a fortune, instead, in this type of market. Be in it to win it, and don’t panic! Stay the course and have long-term horizons. According to IntoTheBlock, there are more longer-term holders of Bitcoin than ever, but panic selling with the recent volatility has hurt many shorter-term investors. Goldman Sachs has finally considered cryptocurrency an asset class, reversing what they were espousing only a year ago. Meanwhile, outside the United States, Singapore’s largest, and one of the world’s biggest banks by assets under management, DBS, put forward a bullish case for Bitcoin in a client note during the third week of May. The bank said allocating funds to Bitcoin was an “opportunity that [fiat] money cannot buy.” The Third Week of May also saw major inflows into Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, and we learned more about Polkastarter (POLS), the finance project that provides users with a decentralized launchpad for crowdfunding. As the month came to a close, a British Member of Parliament, who is chairman of Britain’s Foreign Affairs Committee, called for Parliament to have a ‘safe space’ for crypto. We also learned more about the newly formed Bitcoin Mining Council, and Elon Musk’s power to tweet away the blues. He and Michael Saylor, MicroStrategy’s boss, are spearheading the council, which is committed to publishing current & planned renewable energies for usage in Bitcoin mining, and they have requested miners worldwide to do so.

China securities journal sounds alarm on cryptocurrency financial risks

On Sunday, May 16th, as per an opinion piece in the China Securities Journal (CS), a broader consensus on strengthening supervision of Bitcoin and crypto transactions is currently being undertaken. This comes through several commissions – The China Securities Regulatory Commission, China Insurance Regulatory Commission, and The China Banking Regulatory Commission, and the process will entail information disclosure, policy interpretation, and market analysis of publicly available financial instruments. China has been issuing regular advisories and creating policies to deter the use of crypto for years even as the country is preparing to launch its very own digital currency, controlled by the central bank. In part, the report stated that “Bitcoin-related transactions are facing increasingly stringent scrutiny and supervision around the world. At present, the regulatory authorities of many countries have either explicitly banned transactions or issued policies to restrict them.” China’s biggest banks are already deploying blockchain-based financial applications, and its own digital currency, the Digital Currency Electronic Payment (DCEP), once issued, will provide absolutely no anonymity for the user, and so this will afford the Chinese government a brand-new means of monitoring its economy and its people. A ban on bank and payment institution dealings in Bitcoin has been in place since 2013, when the Chinese central bank, together with four of its ministries, jointly released a public statement entitled, “Notice on Preventing Bitcoin Risks.” With that action, Chinese financial authorities claimed to be protecting the property rights of the public while safeguarding the yuan, preventing money laundering, and ensuring the country’s financial stability.

Understanding Polkastarter, and all the hype surrounding this latest fundraising craze in cryptoEWS

You have probably heard of Polkastarter (POLS), the finance project that provides users with a decentralized launchpad for crowdfunding. What makes Polkastarter different from other ICO or IDO platforms? Why do projects launched on this platform show 20x+ returns even with relatively small volumes? IDOs, or Initial Decentralized Offerings, provide participants and projects with a cheap, welcoming, and straightforward path to capital growth. Polkastarter is the leading IDO platform, offering their community access to the best early-stage crypto projects. But the IDO space suffers one major problem in the form of congestion. Since anyone can launch a token, it is difficult for the broader crypto community to consistently identify and invest in quality, high-potential projects. Polkastarter addresses this problem through a highly effective due diligence process before they onboard any project. Being part of Polkastarter’s launchpad adds a great degree of credibility to the project – the crypto community highly values the Polkastarter team for their research and due diligence. Simply put, Polkastarter is an IDO platform which is very successful at connecting early-stage projects with eager community members. Through fixed pool swaps, projects that raise through Polkastarter distribute tokens to these early community members in exchange for capital. The goal of the platform is to provide an all-in-one solution for all blockchain and DEX needs a project might have, which is crucial since decentralized exchanges (DEX) have quickly grown in user base and volume. An important side note is that crowdfunding on Polkastarter is not limited only to ERC-20 tokens on Ethereum, it can be also done using BEP-20 tokens on Binance Smart chain. (COULD END HERE, OR CONTINUE, DEPENDING UPON FAVORED LENGTH AND READERSHIP)

Fixed ratio swaps are Polkastarter’s answer to the rampant problems of blockchain crowdfunding. Aside from preventing the typical volatility of the tokens being sold, they provide better transparency both to users and investors. Fixed swaps enable projects to set a cap on how much an individual can invest. This prevents short-term speculators from pumping and dumping the token being sold while also providing investors with the assurance that their purchase won’t suddenly and aggressively lose its value. To purchase tokens during a Polkastarter IDO, users must participate through a POLS pool, and only individuals whose addresses have been whitelisted are enabled to do so. Your chances of being whitelisted are directly proportional to the number of POLS you own. Auctions may be the engine that give Polkastarter its velocity, but the POLS token is the fuel that powers the engine. POLS are available on Ethereum and BSC as ERC/BEP20. POLS token holders are also eligible to participate in the fundraising of the projects which are open only to POLS holders. The first several projects that launched on Polkastarter all shared the same basic idea—offering an innovative service while solving the problem of current blockchain frameworks. MahaDAO, SpiderDAO, Royale Finance, and FIRE Protocol were among the first ones to utilize Polkastarter’s framework to fund their visions of what the DeFi market should look like. Most of these protocols quickly caught fire and provided their investors with an incredible return on investment (ROI). Always looking for the next big thing, the rest of the crypto market quickly realized the potential that lies in Polkastarter IDOs, rushing in to invest in young projects looking to change the face of DeFi and other verticals. This had an avalanche effect, pushing dozens of new projects to swarm Polkastarter and fight for a portion of the funds that were being poured into the platform. Set to add new features to its auction platform and additional functionality to the POLS token in the near future, Polkastarter is well on its way to change the way DeFi projects raise capital.

Short term Bitcoin holders’ ‘panic selling’ drives crypto downturn

Data from the analytics tool IntoTheBlock showed that the number of addresses holding Bitcoin for more than one year has increased to its highest-ever level. In a tweet, they stated that, “The recent Bitcoin selloff seems to come from short-term holders selling at a loss, as the number of addresses holding #Bitcoin for more than 1 year continues to increase and is at a high in May.” This would suggest that the market downturn was being driven mainly by short-term holders who are panic selling to exit their position. The latest price drop puts Bitcoin at the precipice of a new ‘crypto winter.’ Over the last seven days, the total crypto market cap has fallen near 30% from $2.5 trillion to $1.8 trillion, and the leading cryptocurrency is down 40% from its recent all-time high of $64k, just four weeks ago. Since then, multiple breaks of key support levels have provoked talk of a return to the bear market as analysts noted that Bitcoin is interacting with its 200-day moving average. A daily close below this level would be a bearish sign and possibly the start of a new crypto winter. One analyst wrote that, “The Fear versus Greed Index is currently at fear levels. At the same time, Bitcoin is flowing further down as it is not filling big orders. Most volume is from retail activity. Our last Order Book analysis is still valid, so our recommendation is to stay strong until that structure is broken. However, if this bear run continues, we may face a crypto winter.” In trying to explain the market downturn, the host of The Breakdown Podcast, Nathaniel Whittemore, pointed out there might be a wider scheme to discredit cryptocurrency. Perhaps the biggest of these stories is the news that Chinese authorities have renewed their calls to ban Bitcoin. It has been reported that three government bodies have called on institutions not to conduct business with crypto companies and have warned that the law does not protect cryptocurrency transactions. Regardless of the precise cause, the FUD events (An acronym that stands for “Fear, Uncertainty and Doubt.” It is a strategy to influence perception of certain cryptocurrencies or the cryptocurrency market in general by spreading negative, misleading, or false information) of the past couple of days bring home the precarious nature of investing in cryptocurrency.

Bitcoin VS. All other financial assets, according to Tone Vays

Tone Vays is perhaps one of the most well-known institutional traders-turned-crypto geeks who has been making public calls on Bitcoin for years. As do many traders who view market metrics by relying on a mix of the staunchest fundamental and technical analysis, Vays’s calls have gained him a great following since he has been right on many, long-term directional calls. With vast experience from Wall Street, his expertise is in Economic Trends, Trading, and Risk Analysis, and he has been a Bitcoin bull since 2013. On Cryptonites recently, Vays was asked about everyone’s favorite topic—where Bitcoin is going in the next year, how Tesla affects Bitcoin perception, and how the asset ranked against all other financial assets. Here’s a snippet from his commentary: Regarding Bitcoin versus the dollar. “Bitcoin doesn’t have to go very far to win round one, because just in the last 12 months, the US government alone printed 20% of all the currency in existence than has ever existed. And the US government was one of the more responsible countries printing their money, Canada, what, like 40%, or something insane,” he explained, adding: “and even throughout all that, the US dollar is still dropping versus other currencies like the Euro, which has always been stunning.” Vays added his personal trust in the US dollar was “shaken” after the elections went the other way. “When the election was fraudulently stolen from Donald Trump, and handed to Joe Biden, that’s when I lost all respect and all confidence in the US political system,” he said. Makes you wonder, does this mean that Democracy is officially dead (or has it always been)? Vays added, “I can no longer trust the US economic system. And that means the US dollar days are numbered. That is what caused it. Because this showed that the elites don’t care what the people want, they will do whatever the hell they want.”

Pertaining to BTC vs. CBDC: This round, said Vays, is the ‘exact same story’ as fiat currencies. CBDCs, short for central bank digital currencies, are proposed digital currencies issued by central governments around the world that are backed by the existing fiat reserves. Some like China are already in the advanced stages of testing their CBDCs, while others like France, Korea, and Japan are said to be planning out pilots in the near future. Vays, however, doesn’t consider these a big contender. “I’ve always played down the hype of central banks, and their digital coins and tokens if they already have them. The dollar is a central bank digital coin. The only thing that’s stopping it from being 100% Digital is that there are $100 bills in your pocket,” he noted, adding: “in Europe, there are many countries that barely have any paper money. Pretty soon several countries in Europe will not have any paper money. It’s very difficult for the United States to go fully digital, because these dollars are used all around the world. But for any other country with good technology, good internet – they don’t need paper money anymore. And that’s a dream for central banks,” Vays stated. As for GOLD: “I feel really sorry for the gold bulls that still refuse to admit that Bitcoin is a better version of gold. Because gold just doesn’t have the biggest, most important properties that Bitcoin does.” His belief that bitcoin was much easier to carry around than pounds of gold remains his truest argument as to why bitcoin will edge out gold as a flexible asset. “Bitcoin is the first unconfiscatable (sic) asset that humans have ever owned. And it is still beyond most people’s understanding how powerful that is,” he added.

Check out the rest of Vays’ thoughts on Bitcoin vs. Gold and other financial assets in the Cryptonites Dubai Edition episode, available for streaming at: kelscrypto.com.

Institutional investors bought more Ethereum than Bitcoin last month

For the first time ever, institutional Ethereum (ETH) inflows outperformed inflows into Bitcoin (BTC). Bitcoin (BTC) witnessed the largest on record outflow last week, according to the London-based digital asset manager CoinShares. CoinShares is the second-largest European digital asset manager, and in their report, Bitcoin investment products recorded a colossal $98 million in outflows. The report went on to say, “The outflows were solely from Bitcoin investment products which totaled $98 million or 0.2% of total assets under management. While small, this marks the largest outflow we have recorded, with the second largest at $19 million in May 2019.” Before crypto prices plummeted last week, BTC investment products had major outflows. Meanwhile, the second largest cryptocurrency, Ethereum (ETH), experienced ample institutional investment inflows. Compared to BTC’s $3.1 billion worth of inflows, ETH trading volumes in digital asset investment products totaled $4.1 billion. Only BTC investment products documented outflows while ETH and other altcoins saw sizable inflows last week. Altcoin investment products overall totaled $48 million in inflows, suggesting “that investors have been diversifying out of BTC and into altcoin investment products.” Following on the heels of ETH, which saw $27 million worth of inflows last week, Cardano (ADA) recorded $6 million and Polkadot (DOT) $3.3 million. After hitting an all-time high just under $65,000 in mid-April, the price of BTC fell sharply by a staggering 35 percent, as investors diversified their cryptocurrency assets with new developments in their networks such as ETH. Even though crypto asset investment products registered a major outflow of $50 million, the first since October last year and the largest since May 2019, these metrics are unlikely to impact the general attitude surrounding digital assets. The report by CoinShares finished, “Historical data implies that outflows of this nature have not marked pivotal points in sentiment change for digital assets.”

Bitcoin is ‘potentially a better store of value’ than the Dollar

Singapore’s largest, and one of the world’s biggest banks by assets under management, DBS, put forward a bullish case for Bitcoin in a client note earlier this week. The bank said allocating funds to Bitcoin was an “opportunity that [fiat] money cannot buy”. In the note titled “demystifying cryptocurrency,” chief investment officer Hou Wey Fook said that central banks provided the “rocket fuel” for the eventual growth of cryptocurrencies due to incessant money printing in recent times that further helped popularize Bitcoin among the masses. Currency debasement and the prospects of a bleak economic outlook are narratives similar to those voiced by several technological and investment firms and billionaires in the past year such as electric carmaker Tesla, business analytics firm MicroStrategy, photo-editing app Meitu, and legendary trader Paul Tudor Jones. Each of these entities have turned to invest part of their treasury reserves into Bitcoin in the past year, with Tesla and MicroStrategy leading that list. As for the various factors of why Bitcoin was better than fiat currencies, DBS said the asset’s decentralization provided ‘power to the people’ and its limited supply helped anchor it as an ‘effective store of value.’ He added, “Bitcoin circumvents this conundrum as executive decisions are made by the entire body of users of the payment system, reducing the ability of any one group to discretionarily change the rules of the game.” Meanwhile, Fook stated several negatives—such as slow transaction speeds and high price volatility—which continued to plague Bitcoin, alongside the broader concern of the entire crypto market existing in a regulatory gray area. Finally, Fook noted the meteoric rise in Bitcoin prices was rivaled by the balance sheets of the largest global central banks around the world, including the People’s Bank of China (PBOC). “Such trends would unequivocally drive demand for alternative currencies, even unorthodox digital forms that would potentially represent a store of value more faithfully than physical dollars would,” he wrote.

Goldman Sachs finally considers crypto as an asset class – a year after having stated just the opposite

The powerful American investment bank, Goldman Sachs, has just now recognized that cryptocurrencies are an emerging new asset class—despite stating otherwise just a year ago. According to its recent report, which was part of a paper posted on Twitter by economist Alex Krüger last week, Goldman Sachs has turned to crypto-related companies like Galaxy Digital, Global FX, and Chainlaysis, as well as critics such as Nouriel Roubini, to hear their opinions on crypto. Their report informed that the bank’s researchers have noted that many large cryptocurrencies are unique and rightfully occupy specific niches on the market – Bitcoin is a highly capitalized currency, Ripple’s XRP is a real-time settlement system, Ethereum is a smart contract platform, Binance Coin is a token for practical applications, and Polkadot is a blockchain platform that can interact with other networks. Goldman Sachs now believes that the intrinsic characteristics of each crypto allow it to attract a specific user base, and that the value of Bitcoin, for instance, is built around its use and distribution. Since massive influxes of institutional capital have confirmed the attractiveness of cryptocurrency, there is a high degree of market development, according to Galaxy Digital CEO Mike Novogratz. Grayscale Investments CEO Michael Sonnenschein called the limited emission of Bitcoin “a way to hedge against inflation and currency debasement.” He also noted that while cryptocurrencies failed to escape the turmoil amid the 2020 pandemic, they recovered faster and outperformed other asset classes. It was Nouriel Roubini, the well-known professor of economics at New York University, who dissented, however, when he stated that he “entirely disagrees with the idea that something with no income, utility or relationship with economic fundamentals can be considered a store of value, or an asset at all.” He also doubted “the willingness of most institutions to expose themselves to cryptos’ volatility and risks.” The Goldman Sachs’ analysts compiled a chart that illustrates all of the ups and downs throughout Bitcoin’s history. The chart definitively indicated that Bitcoin has always rebounded to new highs—no matter how deep the declines were—since 2013. Just last year, Goldman Sachs argued that cryptocurrencies were not an asset class. “We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients,” the bank said in late May 2020. Yet, now they are on board, as Goldman Sachs has announced that it will offer Bitcoin and other cryptocurrencies to its private wealth management group and reportedly even launched a crypto trading team.

British MP calls for a ‘safe space’ for crypto, noting that Ethereum ‘Flippening’ is now occurring

In the Queen’s Speech debate, a member of the UK Parliament by the name of Tom Tugendhat argued that the Treasury needs to pick up the pace and open up to crypto. Mr. Tugendhat is a Conservative MP (a member of parliament, or MP, is the representative of the people who live in their constituency, and this category includes specifically members of the lower house, as upper house members often have different titles) for the historic market towns of Tonbridge, Edenbridge, and Malling; and he is a chairman of Britain’s Foreign Affairs Committee. He has been an MP continuously since May 2015, and on Tuesday of last week, Mr. Tugendhat debated that values and concepts of individual ownership; and corporate and private responsibility need an update. “The Queen’s Speech does not cover the changing nature of currency, the changing nature of the economy and the innovations that we are seeing online through various forms of cryptocurrencies,” he said. As he argued that there is no time in the debate for him to cover the details of “the flippening” or “why he is going to be bullish on the ETH and not BTC,” Tugendhat expressed the need for the Treasury to enable innovation that will make “the changes needed in order to remove the restrictions that are holding back the economy.” The Flippening is defined as the transition of other cryptocurrencies (such as Ethereum) growing bigger, more important, and more valuable than Bitcoin. Because the first major cryptocurrency was bitcoin, the prices and technology of most other cryptocurrencies have been compared and aligned to Bitcoin. In order to keep up with future trade and risk sharing trends, Mr. Tugendhat made it quite clear that the UK needed to quickly update their legal system and rethink currencies and contracts for “the new economy.” He tweeted this and then noted in his speech before Parliament that “We’re seeing the flippening from #Bitcoin to #Ether and we need H.M. Treasury to help create space for UK innovation and our legal system to learn what’s needed in a new economy.”

In April 2020, Tugendhat participated in the launching of the China Research Group (CRG), a brain trust set up by a group of Conservative MPs in the UK which had been formed to “promote debate and fresh thinking about how Britain should respond to the rise of China.” For that, Tugendhat was consequently sanctioned by the Chinese government, together with the CRG, since they focused on investigating issues related to China’s industrial and diplomatic policies.

Tugendhat finished by saying, “If we do not get this right, these standards will be set by authoritarian Governments with no interest in innovation, or in wild places where there is no regulation and no accountability,” China’s trade policy, in particular the development, ownership and regulation of platform technologies, are drawing more and more attention overall, as their authorities keep intensifying crypto warnings.

North American miners form ‘Bitcoin Mining Council’ together with Elon Musk

In China, Bitcoin miners are reeling from the after-effects of the country’s latest crypto attacks. Meanwhile, miners on the other side of the planet are forming a new council to promote sustainable mining. North American mining companies, Bitcoin firms, and Tesla CEO Elon Musk himself are currently involved in this council. In a tweet last week, Musk said, “Spoke with North American Bitcoin miners. They committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising.” For those unfamiliar, mining uses a massive computing system that solves millions of complex calculations each second to validate transactions on the Bitcoin network (a process known as ‘proof of work’). However, this requires enormous amounts of energy for the maintenance, cooling, and smooth running of the machines. As the source of this energy is inevitably derived from coal and fossil fuel-powered energy producers, there is a concern that mining leaves behind a huge carbon footprint for seemingly little benefit to the world. This has become a PR issue for companies, and even though most institutional investors seem to know the benefits of holding Bitcoin (or other large-cap cryptocurrencies), none can deny that the ensuing climate damage poses a problem. Tesla, the electric carmaker helmed by Musk, is a prime example of how the PR issue affects crypto. The firm started accepting Bitcoin as a payment method for its vehicles earlier this year, but then just weeks later, said it would cease doing so due to the ‘ecological impact’ of using Bitcoin.

A proposed solution may offer a simple way out. Using renewable, or waste energy, sources to mine Bitcoin would theoretically cut down on the supposed climate problem. Some leading North American miners are already on board with that: in a statement to CryptoSlate, Peter Wall, CEO of Argo Blockchain, said, “Sustainability has always been at the heart of Argo’s mining operations and the newly-formed Bitcoin Mining Council is the next logical step in fostering a sectoral shift towards renewable energy.” Wall added, “I enjoyed speaking with Elon Musk about these issues this weekend, and I look forward to joining Michael Saylor and other leading North American miners in working to future-proof an industry that must collectively improve sustainable mining practices and take ESG concerns seriously.” As it is now, Bitcoin mining is said to consume more electricity than the entirety of Argentina. With positive adaptations, insight, and ingenuity, hopefully that will all soon change.

Bitcoin, Ethereum prices extend gains after ‘green mining’ and a Goldman Sachs push

Bitcoin prices rose last week (after a 40% plunge the week prior) as North American miners formed a ‘Council’ to consider green alternatives for mining in their initial meeting as a council with Tesla CEO Elon Musk. Because the prices rose so starkly, some traders even raised concern that Elon Musk may have too much influence on the cryptocurrency market. As soon as the news hit about the council and Musk’s involvement in it, Bitcoin prices jumped by 12%. Bitcoin had a retest of the $36,624 support and then managed to close above it to make it a successful retest. So often, after a successful retest of lower support the price action seems to move positively, and in an uptrend, according to Bitcoin’s trading charts. At this time, its next resistance is around the $42,130 mark, a level it has already been unsuccessful to overcome, now seen as resistance three times in recent months. However, with positive news surrounding Bitcoin from several sources having resulted in a good fundamental narrative, prices may soon break through the $42,000 resistance, which would then become a stable support area. Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, showed strength and rising institutional inflows late last week. Technically speaking, the ETH chart shows more room to grow when compared to the BTC chart as there are fewer resistance levels on their way to the previous all-time high of $4,300. A major resistance level is around the $2,750 mark, however, with a steady uptrend, it could be broken soon. One of the positive catalysts was a leaked Goldman Sachs report that stated ETH is a better store of value than Bitcoin. Analysts at Goldman Sachs said, “Given the importance of real uses in determining the store of value, Ether has a high chance of overtaking Bitcoin as a dominant store of value. The Ethereum ecosystem supports smart contracts and provides a way to create new applications on its platform.”

Michael Saylor, MicroStrategy’s boss, rebuts conspiracy theories about the ‘Bitcoin Mining Council’

MicroStrategy CEO Michael Saylor denies accusations of clandestine motives behind the newly formed Bitcoin Mining Council (BMC), as per a video interview late last week. The BMC now comprises some of the biggest U.S. miners led by Saylor and Tesla CEO Elon Musk. The organization’s origins followed Musk’s having raised concerns over the alleged overuse of coal in powering mining rigs, and the BMC was formed to combat this problem. “The miners have agreed to form the Bitcoin Mining Council to promote energy usage transparency & accelerate sustainability initiatives worldwide,” Saylor stated. But some sections of the crypto community have slammed the BMC, calling it a trojan horse and an attempt at a centralized power grab. The BMC was set up as a response to addressing the long-term sustainability of Bitcoin mining worldwide, because its practice of mining attracts negative press on the grounds of excessive energy use. Cambridge University estimates the network consumes more energy annually than the Netherlands. More recently, Tesla CEO Elon Musk made allegations that most miners use coal, which he called the most polluting of all the fossil fuels. This is a point debunked by Anthony Pompliano, who claims that nearly seventy-five percent of miners use renewable sources.

Earlier this week, Saylor and Musk announced on Twitter they had held a meeting with executives of prominent mining firms, including Argo Blockchain, Galaxy Digital, Marathon Digital Holdings, and others. Saylor later said the purpose of the meeting was to ensure the success of Bitcoin by improving sustainability. But then Marty Bent, the Co-founder of Great American Mining, said, “This move has absolutely nothing to do with green energy or climate. It has everything to do with CONTROL.” Reacting to feedback on the BMC meeting, Saylor dismissed any talk it was a shady secret meeting with hidden agendas. “If it’s a secret meeting I wouldn’t have told millions of people the next day that there was a secret meeting, trust me,” he stated. To dispel this idea further, Saylor explained what went on in the meeting, saying it was simply a discussion on managing the negative public perception of Bitcoin mining. He added that Musk recommended better data to address the mainstream concerns. “What happened in the meeting, is that Elon met the miners. The miners talked about their approach towards energy and their commitment to sustainability. We asked Elon for his advice about how we might actually manage concerns in the mainstream.” Many comments on social media indicated that the meeting should have included the public.

Police drone finds illegal Bitcoin mine while searching for weed farm

In a quite bizarre case, UK police busted an illegal Bitcoin mining operation while trying to weed out cannabis operations, the local daily Birmingham Live reported over the weekend. Over 100 mining rigs were found by the police, who were using a drone with an attached heat camera to scout out a location suspected to be running a full-fledged cannabis farm. They were acting on a tip-off about wires running into the facility and human movement in and out of it. Instead, they stumbled upon a Bitcoin mining plant instead, one that allegedly stole thousands of pounds worth of electricity to mine the world’s largest cryptocurrency by market cap. Sandwell Police Sergeant Jennifer Griffin said in a statement, “It’s certainly not what we were expecting. It had all the hallmarks of a cannabis cultivation set-up and I believe it’s only the second such crypto mine we’ve encountered in the West Midlands.” She added, “My understanding is that mining for cryptocurrency is not itself illegal but clearly abstracting electricity from the main supply to power it is.”

Illegal miners try to capitalize by using illegal power sources. Many cases have sprung up in the past which see individuals steal electricity to power the mines, get Bitcoin rewards, and pocket a major chunk of the revenue (because minus the power bills, the cost to run a mining unit falls drastically). Meanwhile, the Birmingham police said that all computers were seized and that inquiries with Western Power, the region’s energy supplier, revealed their electricity supply had been bypassed. “We’ve seized the equipment and will be looking into permanently seizing it under the Proceeds of Crime Act. No one was at the unit at the time of the warrant and no arrests have been made – but we’ll be making inquiries with the unit’s owner,” Griffin added.

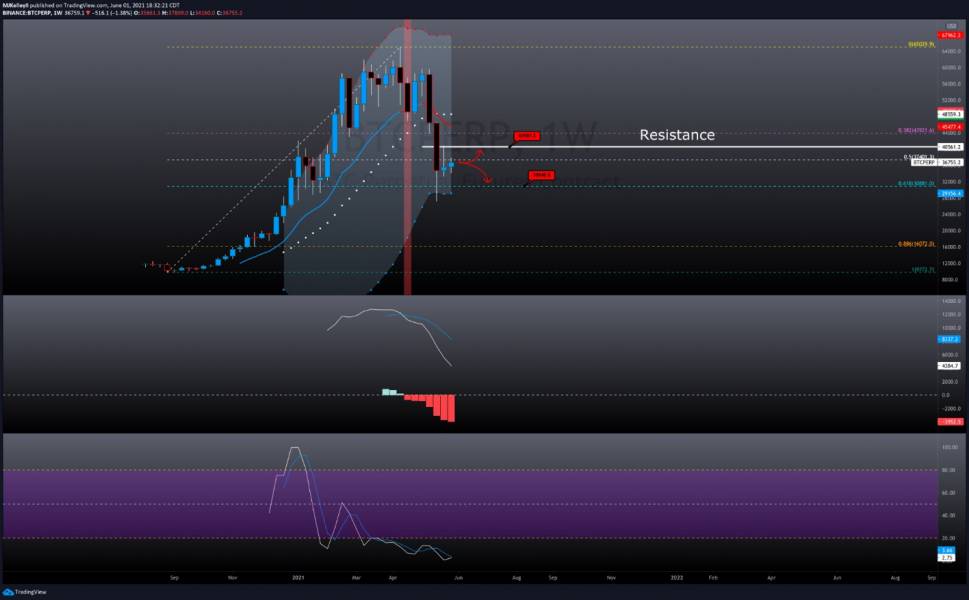

Bitcoin

#BTC had a nice little selloff and is now trying to find her identify again. As of now we are still bearish until we break the resistance around $41,100 area which we were once rejected a few days past. Hopefully we will find support around the 61.8% Fibonacci.

The post The Digital Asset Landscape May 2021 appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading