What is a commodities super cycle? It’s a term used to describe the long-term price movements of basic resources like metals, energy, and food. These resources are essential for human life and our economy, which is why their prices tend to move in long-term trends. Over the past few years, we’ve seen some major changes in the prices of commodities. In this blog post, we’ll take a closer look at what’s been going on and why silver stands to benefit from the current commodities super cycle.

What is a commodities super cycle? It’s a term used to describe the long-term price movements of basic resources like metals, energy, and food. These resources are essential for human life and our economy, which is why their prices tend to move in long-term trends. Over the past few years, we’ve seen some major changes in the prices of commodities. In this blog post, we’ll take a closer look at what’s been going on and why silver stands to benefit from the current commodities super cycle.

Commodities are an important part of our economy, and their prices can have a big impact on our lives. When commodity prices go up, it’s called inflation. This is because the prices of other goods and services go up when the cost of basic resources goes up. For example, if the price of oil goes up, the cost of gasoline will also often go up.

For the mining industry, the price swings of commodities can make or break a project. When prices are high, it’s easier to justify the costs of exploration and development. But when prices are low, mines can become unprofitable and have to be shut down. So, the long-term price movements of commodities can have a big impact on mining companies and their shareholders.

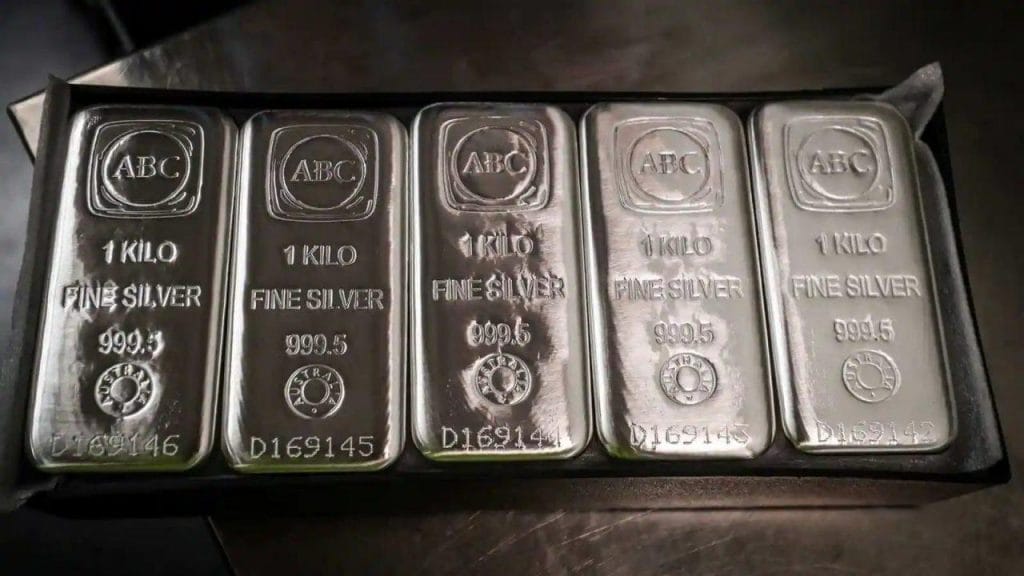

Currently, the mining industry is in the middle of a boom time as commodity prices hit all-time highs across the board. Prices for silver, gold, copper, nickel, and lithium continue to hit new highs, or retrace losses from 2021 to re-enter bullish territory. For investors, there are several options when investing in commodities such as silver.

One of the options with the most upside is to buy silver mining stocks that have a diversified approach to operations. Honey Badger Silver (TSXV:TUF), is a pure-play Canadian silver stock, with a focus on acquiring and developing quality assets with silver resources in one of the best mining jurisdictions in the world.

The company recently acquired the Clear Lake deposit, known to also be an important source of zinc and lead. Honey Badger has built a portfolio of assets with high optionality, and various avenues for profitability in the future, beyond single exploration projects. This is a diversified approach to mining that investors may find more attractive compared to other riskier options.

Commodities are generally moving within bull and bear markets. For example, increasing demand or a lack of supply tend to push prices higher. However, after the initial time lag needed to add supply has passed, oversupply will restore equilibrium in the market. In a super cycle, structural changes often keep prices elevated for decades, creating a long bull market without volatile swings lower.

Commodity supercycles are a one-of-a-kind occurrence, with commodities trading above their long-term price trend for an extended length of time. Since the 19th century, only four commodity supercycles have been discovered, each linked to a society’s transition from one significant economic period to another. During the early aughts, the rapid industrialisation of China and emerging markets around the world fueled a super cycle in raw materials from heightened demand due to growth.

This time, prices for battery metals, precious metals, and other strategic minerals are being driven by the global transition to a low-carbon economy. The decarbonisation of the economy is expected to continue for decades and will require large amounts of commodities, especially metals, to build solar panels, wind turbines, electric vehicles, and energy storage solutions.

This structural change is different from previous commodity cycles and is expected to result in higher prices for a longer period of time. Investors looking for opportunities during the current super cycle – which may have started as recently as the past two years – now have multiple options to choose from. But it may be silver that rises steadily and consistently the most in the coming decades. For companies like Honey Badger Silver developing their own portfolio of valuable silver assets, the commodities super cycle could bring a new era of investment and higher valuations.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading