The dollar fell against the euro yesterday, after the Chinese central bank stated that it would phase out its policy of regular intervention in the currency market. This could eventually pave the way for a free-floating yuan,with a convertible yuan being one of the conditions for it be included in the the International Monetary Fund’s drawing rights basket.

Such a move would see reserve managers flock to the yuan as an additional reserve currency, reducing the demand for overweight reserve currencies such as the US dollar. Speaking to Reuters, MD of Chapdelaine Foreign Exchange Douglas Bothwick said “All announced moves from China over the past eight years toward further flexibility have been followed by a marked reduction in the value of the dollar index,”

This news, which was published in a book of reforms published by the People’s Bank of China on Tuesday, follows last week’s announcement of sweeping reforms to make the Chinese economy more market-driven.

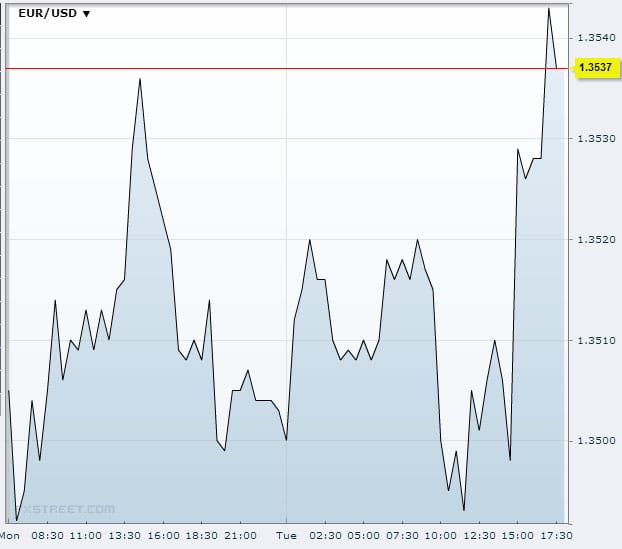

Source: FXstreet.com

The dollar index, a measure of the US currency’s value against a basket of six major currencies, was down 0.2% percent at 80.682, while the Australian dollar continued its recent rally, rising 0.3% to US$0.9413.

The euro was up 0.2% at $1.3537, after recovering from a low of $1.3486 earlier in the day after the German ZEW survey came in below forecasts. It was pushed upwards by the weakness in the dollar caused by the China news, but the outlook overall for the euro is bearish, with the ECB taking a very dovish stance towards monetary stimulus in an effort to keep the eurozone from entering a deflationary spiral, and the expectation that the Fed will begin trimming its own stimulus package at some point in the near future.

On Monday, Federal Reserve Bank of New York President William Dudley expressed his optimism about the US economy, but added that he expected the Fed’s “very accommodative” monetary policy to be in place “for a considerable period of time”.

Today, all eyes will be on the release of the Fed’s October meeting minutes for clues as to when tapering might begin. If there is any suggestion that it might be sooner rather than later, expect the dollar to gain some support.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading