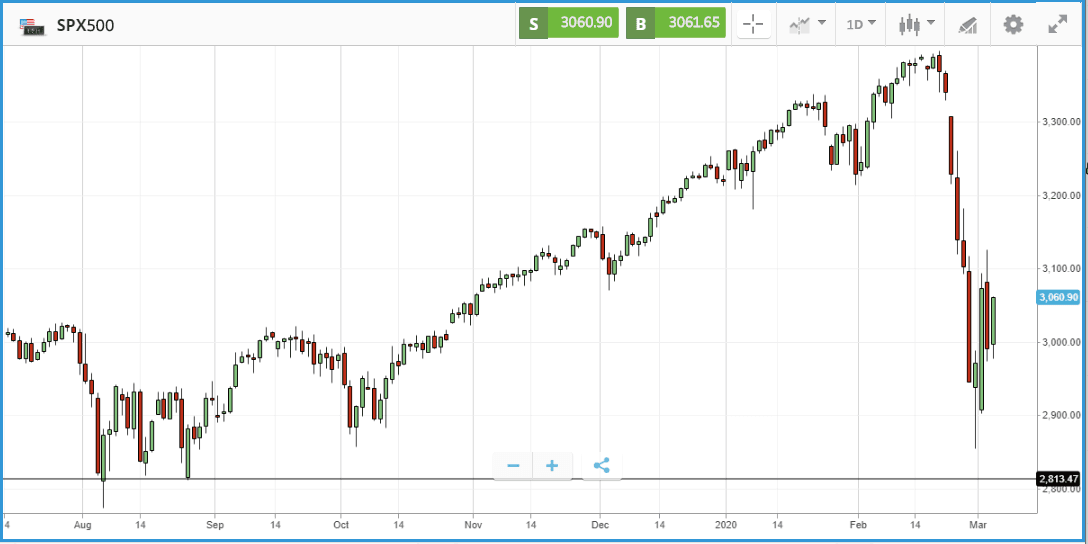

Markets have bounced as investors react to potential stimulus measures, including the Federal Reserve’s emergency rate cut, which has been made to mitigate the effect of the coronavirus on the economy. There is now a 90% chance of a cut from the ECB and Bank of Japan Governor Kuroda warned of the economic damage from the coronavirus and also hinted at action being taken.

US markets initially responded badly to the Fed’s rate cut yesterday, while the yield on US Treasuries sank below 1% for the first time in history. Investors took the cut as a sign that major economic impacts from the coronavirus epidemic are increasingly likely, after Fed Chairman Jerome Powell said at a press conference on Tuesday that “the virus and measures being taken to contain it will weigh on economic activity here and abroad for some time”. The cut was the first time since the financial crisis that the Fed has acted outside of its regularly scheduled meetings and major US indices all fell by around 3%, wiping out a chunk of the gains made on Monday. The IT and financial sectors fared worst according to data from Fidelity Investments, while real estate was the only sector in the black. Among the Dow Jones Industrial Average’s 30 constituents, Coca-Cola was the only company to post a positive day, gaining 0.3%.

In comparison, demand for US debt soared, with the yield on the 10-year US Treasury falling to 0.97%. Asian shares were muted overnight in reaction to the cut in the US, with the Nikkei barely closing up just 0.08%, and the Hang Seng equally flat, off just 0.06%.

Away from the markets, Joe Biden racked up victories through the South in an impressive Super Tuesday performance that throws the Democratic nominee for President up in the air. This could also be contributing to the bounce as Biden is seen as more moderate than his rival Bernie Sanders, with many Democrats believing he is a more likely to oust Trump from office.

Chevron planning $80bn in dividends and buybacks

The three major US indices are increasingly diverging as 2020 progresses, with the tech-heavy Nasdaq Composite – which is benefiting from the blow dealt to value optimists hoping for a manufacturing recovery by the coronavirus epidemic – down 3.2%, versus 9.2% for the Dow Jones Industrial Average. On Tuesday, financial stocks weighed heavily on the S&P 500, which fell 2.8%, including 8% plus drops for Charles Schwab, Lincoln National and Raymond James Financial. Hotel giant Marriott and MGM Resorts International were also major losers, at 7% apiece. Marriott stock has now fallen 23% since February 19th, despite reports that the firm is already re-opening some of its China hotels after the epidemic forced closures. In corporate news, oil firm Chevron’s chief executive Michael Wirth said that the firm could return up to $80bn to shareholders through dividends and share buybacks over the next five years, after a three-year period in which its share price was essentially flat until the recent sell-off where it fell double digits.

UK stocks enjoy bump post Fed rate cut, IAG rallies

London-listed stocks delivered a more positive reaction to the Fed’s rate cut news, which dropped in the afternoon, with the FTSE 100 gaining 1% and the FTSE 250 up 2%. Both are still seeing double digit losses year-to-date. Investors also had to digest a Tuesday statement from the finance ministers and central bank governors of the G7 nations, in which they announced they are “ready to take actions…including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase”.

British Airways parent IAG, which we highlighted yesterday had fallen more than 30% since February 21, found itself at the top of the FTSE 100 on Tuesday with a 7.2% gain. Investment firm M&G and food delivery service Just Eat rounded out the top three with gains of 4.7% and 4.5%. In the FTSE 250, Games Workshop was one of 14 stocks to deliver a 5% plus daily share price increase. The company’s share price has held up relatively well in 2020 and is up more than 9% year-to-date, despite the sell-off. In corporate news, Anglo American’s takeover of fertiliser miner Sirius Minerals received approval from Sirius shareholders.

Analysis written by Adam Vettese, UK Market Analyst at eToro

Read More:

how to avoid revenge trading forex factory?

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading