Interest in alternative investment opportunities appears to be on the rise in continental Europe, according to the just-released eVestment Advantage Viewership Report covering activity on eVestment.

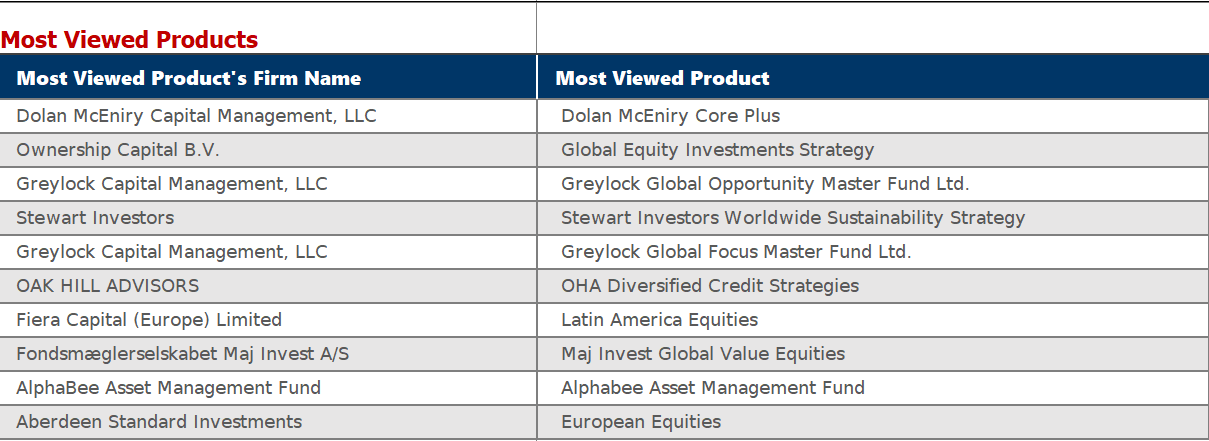

Seven of the top 10 rising universes by continental Europe investors and consultants using eVestment were non-traditional; UK-based Sagil Capital LLP’s Latin America Opportunities Fund LP was the most viewed within the Fundamental – Long/Short Equity universe and Luxembourg-based AlphaBee Asset Management Fund was the most viewed within the Fund of Funds – Multi-Strategy universe. Greylock Capital Management LLC’s Global Opportunity Master Fund Ltd., the most viewed product within the Event Driven – Distressed universe, was also the top rising product overall by investors and consultants in Europe ex-UK.

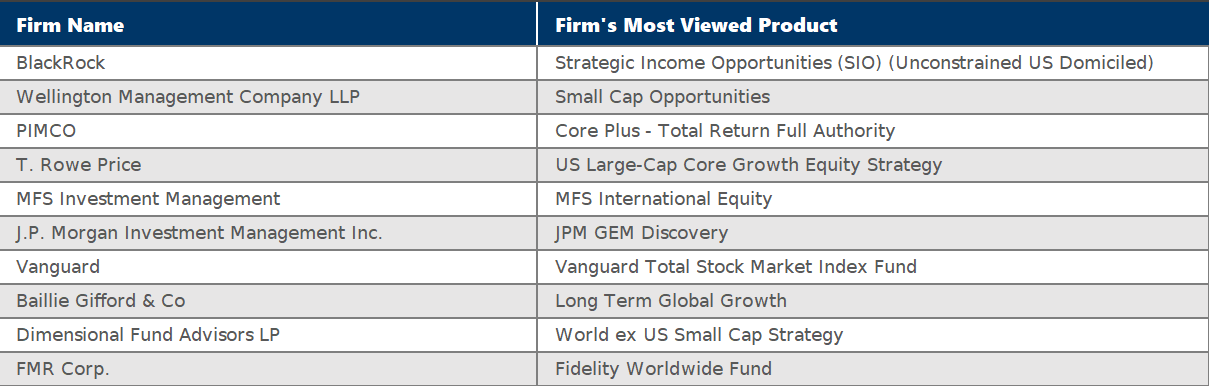

The monthly eVestment Advantage Viewership Report highlights the top asset managers and investment themes of interest to institutional investors and consultants around the world. According to the report, some of the most viewed products by investors worldwide range from national equities, credit strategies, sustainability strategies, asset management funds and enterprise investment schemes (EIS), among others.

The report looks at data globally and from various countries and regions, including the United States, the United Kingdom, Europe ex-UK, Africa, Japan and Asia ex-Japan. Putting this data into context with global and local political, markets and corporate news can offer a unique perspective into how investors are responding to that news and how they may shift assets or investment strategies over time.

Some other interesting points from the new report include that the impact investing strategy tops all Japan-based investor and consultant lists. Baillie Gifford & Co was the most viewed firm by clients in Japan and its Positive Change strategy was the most viewed product, while also attracting the most rising interest. The Positive Change strategy helped propel the Global All Cap Growth Equity universe to the top of the most viewed universes and rising universes lists as well.

On the other hand, dimensional Fund Advisors LP and FMR Corp. replace SSGA and Lazard in the global top 10 most viewed firms list. Dimensional’s World ex US Small Cap Strategy and FMR’s Fidelity Worldwide Fund helped push each firm into the top 10. Dimensional’s World ex US Small Cap Strategy was also the firm’s rising product in June; for FMR Corp. however, its rising product was the Fidelity Capital & Income Fund (a US High Yield strategy).

Likewise, in Asia, ex-Japan and Africa/Middle East concentrate on US and global equities. The most viewed and rising universes among clients in Asia ex-Japan were all either US-focused or globally focused. The same was true among clients in Africa/Middle East except for Global Emerging Mkts All Cap Core Equity in its most viewed universe list and Global High Yield Fixed Income in its rising universe list.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading