Bitcoin Explained from Duncan Elms on Vimeo.

How Big Is the Bitcoin Ecosystem? History, Context and Scenarios.

Are you trading Bitcoin? Are you following its trends? Are you looking at Bitcoin as a commodity? Are you an activist using Bitcoin for your causes? Are you a tech geek hacker mining Bitcoin? Are you an investor looking to catch the next train of opportunities for startups exploring new innovations in blochain and fintech new currency banking processes? When it comes to Bitcoin there is no easy and simple way?

The Bitcoin ecosystem is a complex, powerful, full of dreams and conflicts – a bigger and bigger universe where technology, genius and profound finance and economic disruption flow with egos, willing to change the world, make a financial and economic revolution and surrounded by technology mavens, criminal master minds, capitalists and liberal extreme activists.

Looking at this fantastic data visualisation of the History of Bitcoin – The world’s first decentralized currency we can see its evolution, vision and complexity since its inception.

Moreover querying in the data visualisation of Google Trends with the search term “bitcoin” it shows that popular interest in Bitcoin has waned despite increased media, social media continuous trending, and corporate/financial sector interest in the fast-growing fintech lovable blockchain (so-called among other things “Open Ledger Technology”).

Despite the myths and legends the bitcoin network was released initially on January 3, 2009, when the first piece of technology named block in the blockchain was launched. This event would open teh doors of massive disruption and love and hate escalation of a disruptive distributed ledger technology behind bitcoin, that was mined by its founder (real or not real) known by the name of Satoshi Nakamoto.

Like many other technologies, that had appeared in the history of money, this one has been different. Bitcoin was created in a nest of polemics and genius announcements and had to come a long way until it reached the global reach and known widespread slowly adoption by financial companies across the world. In the meantime, such events as the closure of the Silk Road black marketplace and the collapse of the Mt. Gox exchange, negatively affected the digital currency. Following these cases, early advocates of the technology lost millions of dollars in digital currency.

However, the industry is still growing, with bitcoin being widely used for micro-transactions, international remittances, smart contracts, securities trading and machine-to-machine transactions.

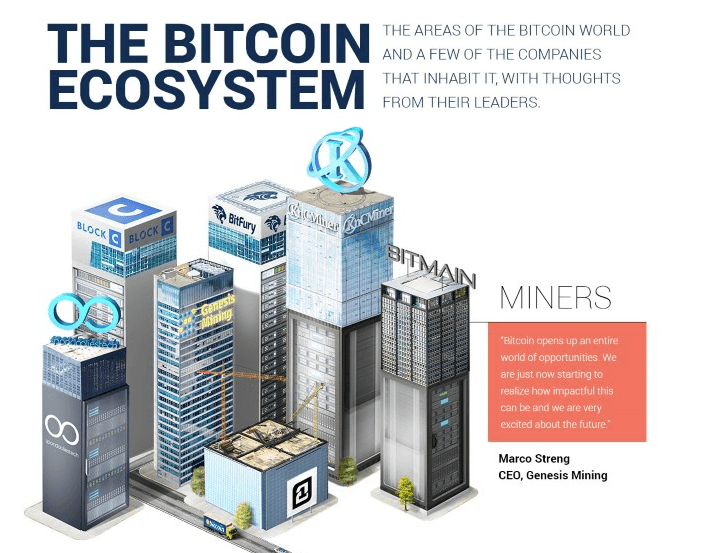

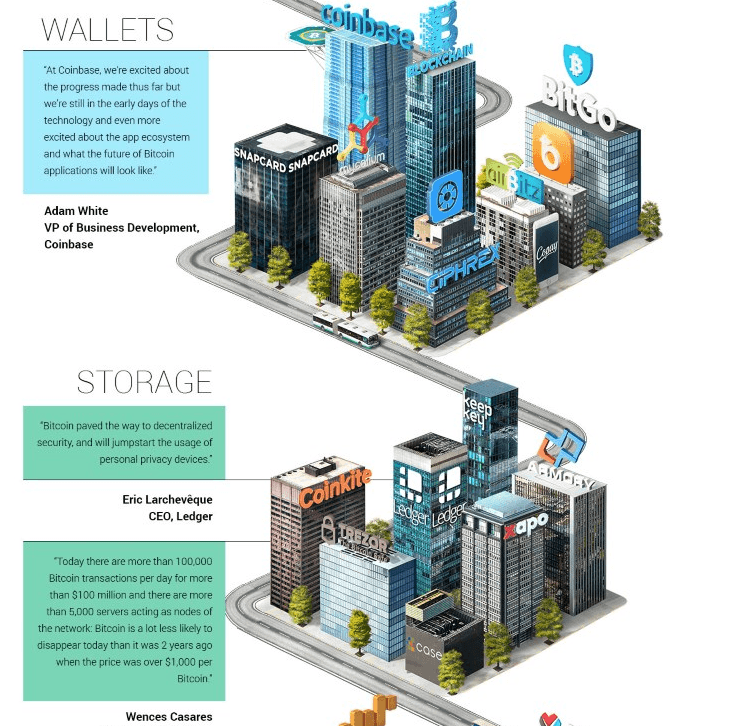

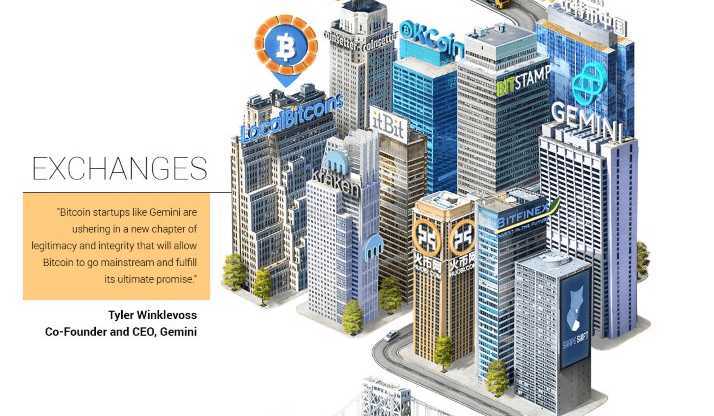

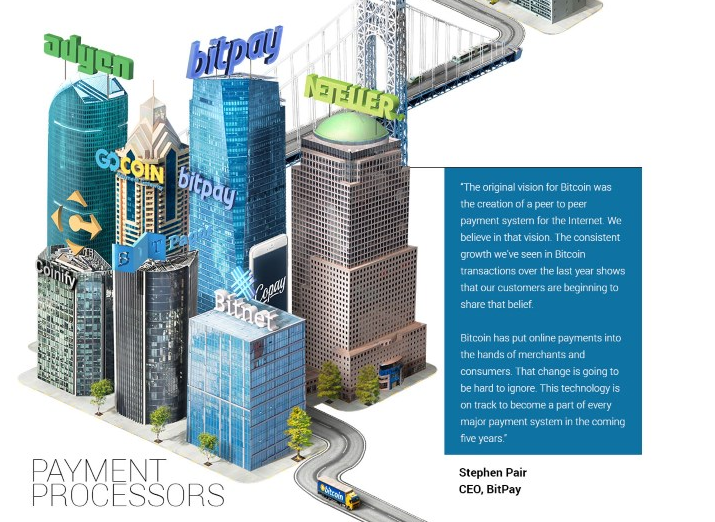

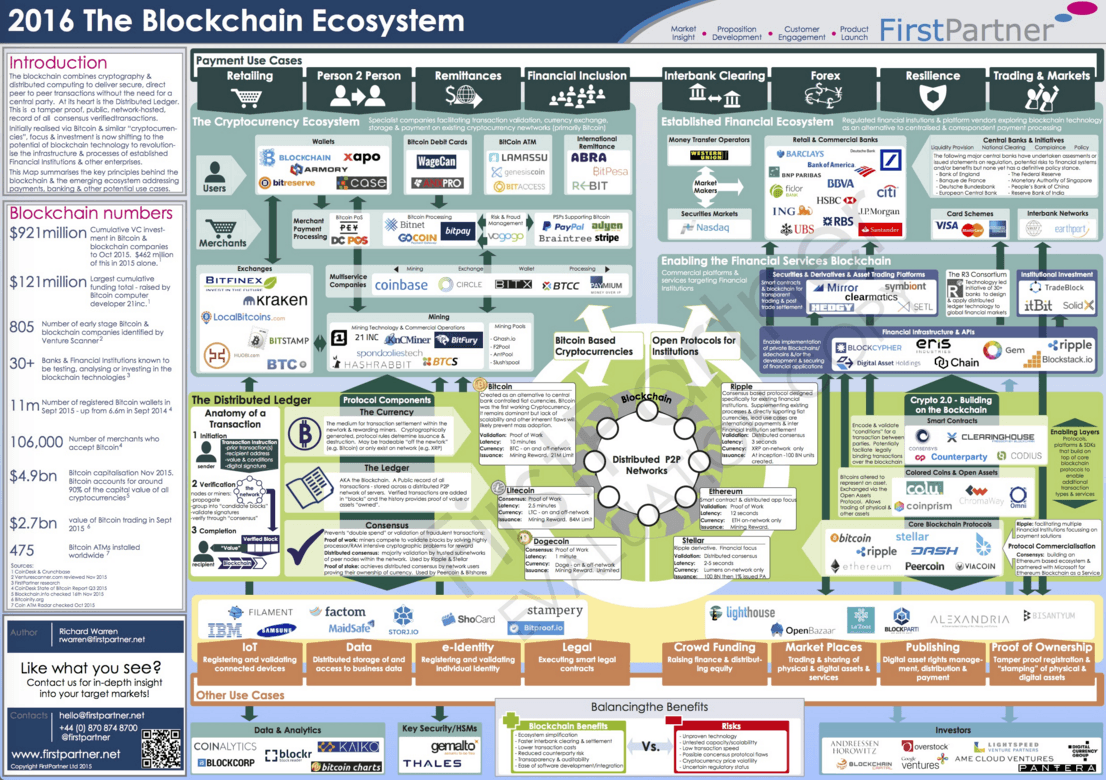

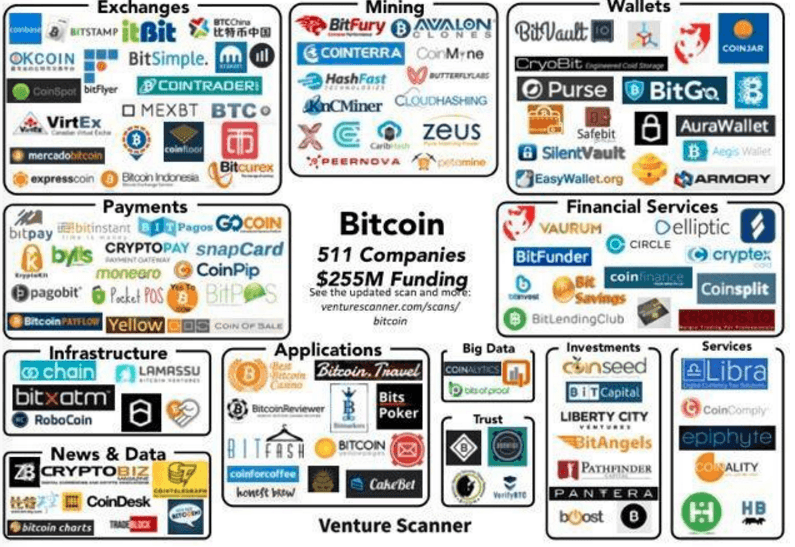

Looking at the bellow infographic (sources http://www.coinspeaker.com/2015/11/19/the-bitcoin-ecosystem-infographic/?utm_content=bufferb33e8&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer) there is a good visualisation demonstrating how strong, sustainable and the real power of the ecosystem behind bitcoin that has been a critical element for finance, innovation and technology.

Bitcoin has created one of the biggest disruptions in the history of finance, economics and technology since it was developed six years ago. Independent of how many times people tried to kill it and give it birth again it continues its work of disruption and innovation.

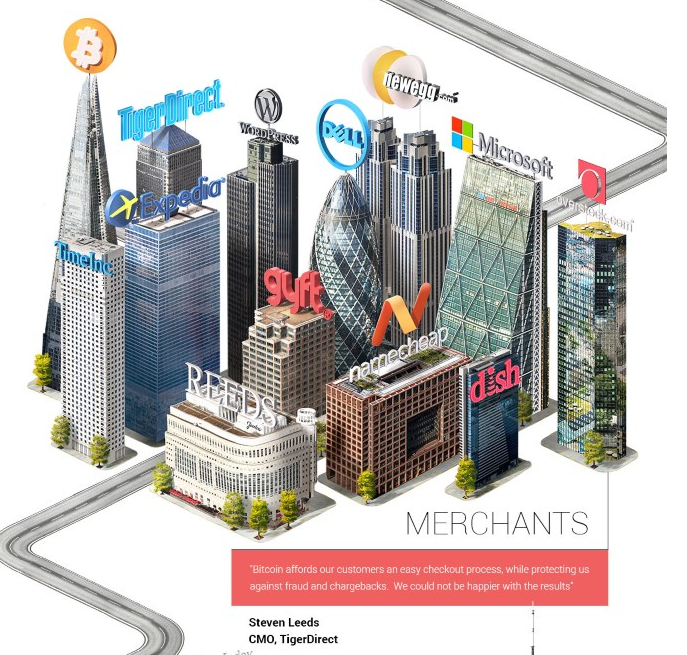

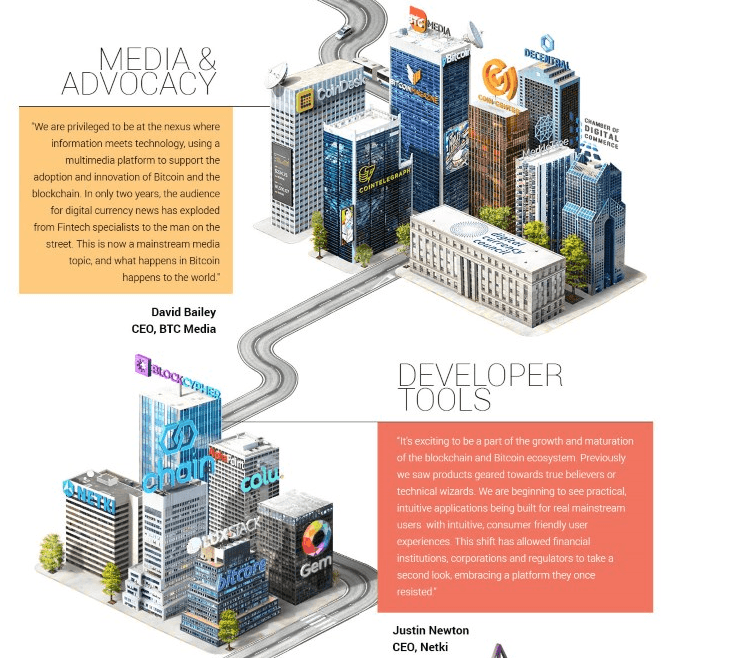

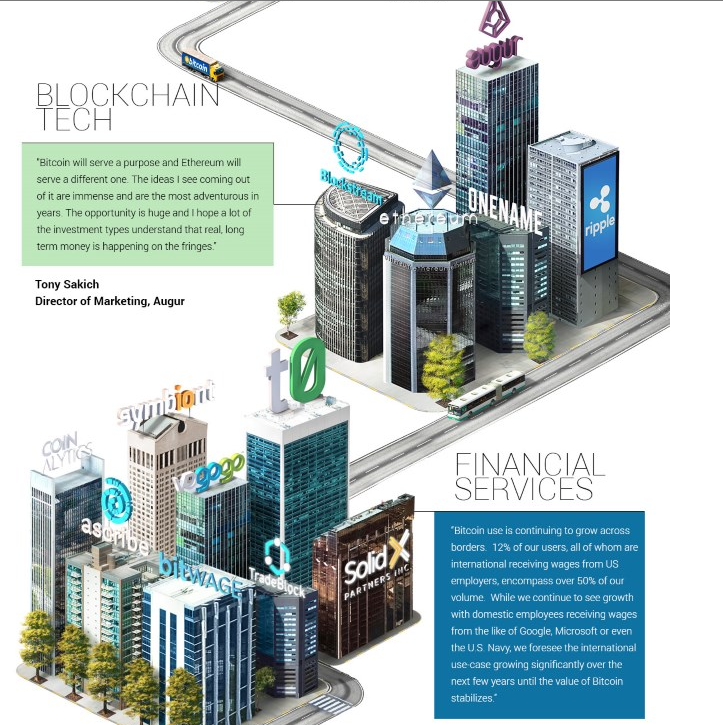

The previous infographic created in partnership with Bitpay, the “Bitcoin City” shows the main areas where the crypto-currency ecosystem and some of the key bitcoin companies operate and the main players.

The Market Size and How to Scale Bitcoin

With over $1 billion of venture capital invested in bitcoin startups to date Bitcoin is still in its early days. During 2015, bitcoin firms raised over $1 billion in funding, what shows that venture capital investment in the sector is rapidly growing. In comparison, last year bitcoin startups raised around $314.7 million.

The Bitcoin Market has been growing and has a Potential Index that can be conceptualized and ranked the potential utility of bitcoin that is somehow used across 178 countries. Some studies such as this from London School of Economics http://www.lse.ac.uk/economicHistory/study/PhDProgramme/JOb-Market-papers/Bitcoin-Market-Potential-Index-Hileman.pdf manage to show which countries have the greatest potential to see bitcoin adoption.

While the scale of bitcoin mining is steadily rising, with its critics and fans and with the hardware and software that is growing in power and sustainability. At the moment Bitcoin hackers, miners are establishing multi-megawatt data centers all over main areas equipped with high-powered computers.

Regarding tech evolution for this digital currency In 2014, the bitcoin network hashrate amounted to just 10 million GH/s, whilst in 2016 it totals 504 million GH/s showing a progress that will allow much more operations. However and showing how fast Bitcoin is moving within the same time period, the bitcoin consumption network daily capacity increased from 50,000 transactions to 170,000 transactions which shows how much Bitcoin is now traded.

To add to this meanwhile, the growing snumber of merchants accepting payments in virtual currency is growing too with big operation websites and institutions such Wikipedia, WordPress using it. In mid-year 2015, there were 100,000 merchants who integrated bitcoin, while in mid-2014 the number of traders totaled 65,000.

In August 2015, the Bitcoin company, BitPay, processed about 70,000 transactions, what shows that crypto-currency as a mean of payment is steadily growing in popularity.

As Bitcoin price continues in its reattempting into a move higher, in a context of capital markets that is far from standard in a time where Central Banks struggle to hold their economies and ongoing battles with inflation, rates and deflation. Having said this Bitcoin progress is most of the times still slow and both technical and sentiment analysis shows the bearish moods in the charts. Of course we cannot look at Bitcoin as a single tech and finance evolution out of the scope of the global capital markets, economy and finance industry at large which it is now major part as Banks start adopting blockchain technologies.

The most profound disruptive era of change for financial services, markets companies since the 1970s!

With the advent of the fats forward velocity of fintech and special lead by Bitcoin and blockchain there is no doubt we have entered the most profound disruptive era of change for financial services, markets companies since the 1970s brought us index mutual funds, discount brokers and ATMs. Moreover with evolution of big data advanced tech, internet of everything and algorithms we will have a lot of new layers to add to this.

No fintech or investment firm is immune from the coming disruption and every company, whether a startup or a corporate financial player must have a strategy to harness the powerful advantages of the new financial technology (“fintech”) revolution. Most of the global banks are now investing in related Bitcoin tech, special blockchain as a way to simplify global money transactions.

The battle or disruptive process already underway is creating surprising new players, winners and stunned losers among some of the most powerful names in the financial world and a lot of new players that with access to a bold vision and agile tech and financial overview are taking over the new financial landscape being created as we speak.

The most contentious areas of conflicts (and partnerships) will be between new innovative startups that are completely re-engineering decades-old practices among financial organisations with no capacity to adapt their old heavy systems. These traditional power financial corporate players who are furiously trying to adapt with their own innovations, and total disruption of established technology & processes are thus trying to catch the train but it is a difficult marathon where regulation, compliance and technology shifts with sensitive areas of difficulty such as regional versus global, central banks versus global flows, tech and cyber security, money laundry and ethic flows.

Traditional Retail Banks vs. Online-Only Banks? Startup fintech robo-advisers, search engines and financial algorithms will all play a substantial role as alternative finance as a whole gets in the middle. Traditional retail banks are now in a cross road that has to catch up with being both financial players and tech innovative disruptive capable being able to provide a valuable service to their clients. Now an easy task when Apple and Google have more data than any government in the world and online-only banks can offer many of the same services with higher rates and lower fees than the old established ones .

Another area to bear in mind in this ecosystem is how traditional Lenders vs. Peer-to-Peer Marketplaces, crowdfunding will play in the Bitcoin / Blockchain process…

Another are to look at is the traditional Card Processors vs. New Age Payment Processors: Square processed $24 billion in payments from over 2 million customers last year—will traditional processors like Visa who own the payments pathways be able to defend their territory from new invaders and use as well Blockchain tech and Bitcoin?

Last but not least is the wealth sector as traditional Asset Managers are now in a dialogue / competition vs. Robo-Advisors: Robo-advisors like Betterment offer lower fees, lower minimums and solid returns to investors, and have capacity to adapt blockchain and other related tech but the much larger traditional asset managers are conscious of this as they are also investing in Bitcoin / Blockchain tech and creating their own robo-products while providing the kind of handholding that high net worth clients are willing to pay handsomely for.

As you can see, this is a very complex and fluid environment that is still in its inception and already creating winners and losers and special hybrid players…and it’s also creating new fantastic opportunities, the potential for new cost savings or growth opportunities for traders, investors and entrepreneurs.

Future What Will Happen with Bitcoin as Japan Considers to Make Legal?

A Very Big Development for Bitcoin is to add on the top of this as Japan governmental financial organisations consider to Make it a Legal Currency. Will this make Bitcoin explode as one of the global biggest economies and currencies and take Bitcoin to a new legal, official credibility definition?

For sure this is or will accelerate the Bitcoin industry, and give it the credibility it so hard needs! The next months will be critical for the industry as these new developments, plus the global volatile situation in currency – Forex markets shift the whole ecosystem as investors look for assets that are more credible and out of politic relative issues.

Richard Smart from the Guardian in Tokyo recently reported that Japan considers making bitcoin a legal currency and proposed changes would bring bitcoin, dogecoin and other crypto-currencies under definition of currency. He stated that Japan’s governing Liberal Democratic party is planning to propose legal changes that would define bitcoin and other crypto-currencies as currencies.

The changes would mean bitcoin could be more tightly regulated and taxed, and are likely to lead to more investment in developing crypto-currency infrastructure in Japan.

Japan considers bitcoin a commodity. The new definition would consider anything that can be exchanged for goods and services or legal tender as a currency, bringing bitcoin, dogecoin and many other crypto-currencies into the fold.

Summary

The Bitcoin Blockchain ecosystem is BIG! and will be much bigger.

With the advent of Bitcoin there are significant opportunities for traders and investors. Anyone that is trading and investing needs to take it very serious. From big banks to innovative startups the process is irreversible now the question is in what companies to invest only one or two will become the global powerhouses of this new tech and financial DNA.

As Reid Hoffman put it in this fantastic article Reid Hoffman: Why the block chain matters (Wired UK) :

At least one global cryptocurrency will achieve mass-market adoption. That cryptocurrency will either be Bitcoin or a derivative inspired by it. The chance that it will be the former is so strong that in 2014 I invested in Bitcoin startups Xapo and Blockstream. And yet, perhaps surprisingly, when one of the very smart people I know in Silicon Valley recently told me he’s a major “Bitcoin sceptic” who has not yet seen “many real use cases” for the technology, I considered it a good sign.

Read More:

What is the best definition of economic data?

plataforma iphone de trading en forex

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.