Monetary aggregates can help increase accuracy in inflation forecasts. It is nice to see such ideas finally catching on again, but don’t get carried away either.

One of the great joys of economic thought is that in the long run, most old ideas tend to come back to life eventually. Take money supply numbers, which in their heyday during the 1970s and 1980s seemed like the holy grail of economic forecasting. Among many economists, they have steadily fallen out of fashion ever since. The link between too much money chasing too few goods resulting in increases in general price levels is intuitive. Unfortunately, it also turned out to be quite unstable[1].

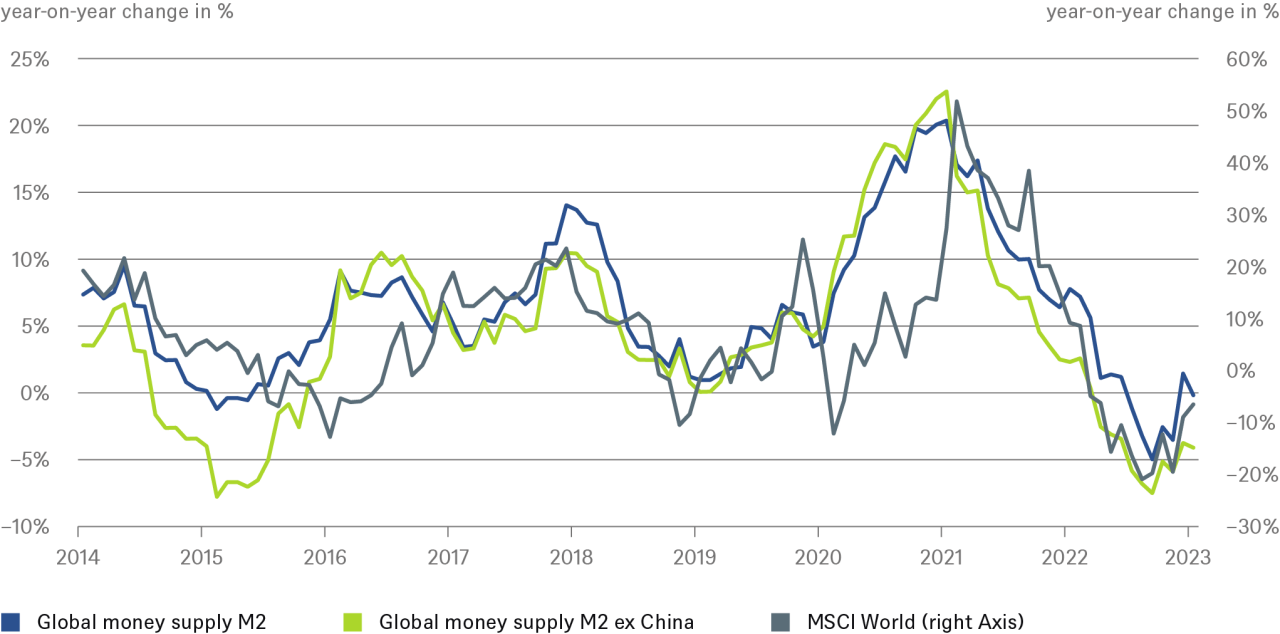

By contrast, practitioners in financial markets, particularly on the fringes, never quite lost their faith in money supply numbers to explain market developments. Our Chart of the Week helps to illustrate why, as well as the hazards involved. It shows the price evolution of the developed world’s stock markets, as measured by the MSCI World, against two broad measures of year-on-year growth in global money supply M2, one that includes and one that excludes China. Intuitively, it sure looks like stock returns have moved in tandem with how much money there is around the world. No wonder than, that some of those making a living forecasting markets should want to keep an argus eye on money supply.

Look more closely, though, and it is hard to tell which curve leads the other(s). Moreover, including the measure of Chinese money supply tends to result in a better fit. That seems paradoxical. The MSCI World does not included Chinese stocks. China relies heavily on capital controls, which probably were even harder to circumvent in recent years, due to Covid related travel restrictions[2]. To offset shrinking money supply in the rest of the world now would require epic amounts of Chinese tourists squirreling their cash savings across borders.

Prices on global equities seem to move in tandem with global money supply – so what?

* Sources: Bloomberg Finance L.P., DWS Investment GmbH as of 2/21/23

Finding correlations that “worked” well in the past is easy, particularly with something like global money supply, where you can pick and choose which measure best fits during the period considered. But relying on them is unwise, without a clear understanding of the causal mechanisms involved and assessments of how and why they might hold going forward or fail to do so.

“That said, for several major economies, we have always looked at monetary aggregates quite closely for our inflation forecasts, even when that was deeply unfashionable”, explains Johannes Müller, DWS Head of Macro Research. “Doing so provided valuable early clues that inflation might prove less transitory than widely expected.” As a recent paper by staff members of the Bank for International Settlements shows, countries with stronger money growth also saw markedly higher inflation in recent years[3].

This confirms our longstanding conviction that handled with care, including monetary aggregates in inflation forecasts can at times increase accuracy. It also underlines, though, why relying on “money” alone to correctly forecast market developments is a lot trickier than it seems. From our point of view, a lot of improvements in the fundamental data are now already priced into the global equity markets, not least, relatively rapid drops in inflation rates. But whether these declines happen quite as quickly is still very much an open question, not least when glancing at various global monetary aggregates.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading