The recent launch of the Indian Gas Exchange (“IGX”) marks a new chapter in India’s gas industry to promote and sustain an efficient and robust gas market. IGX will fulfill the demand for transparency in gas trading and could transform India’s gas market as it will drive sustainability, facilitate industrial competitiveness, deliver efficient utilisation of pipeline infrastructure, ensure the revival of gas-based power plants and spur investments in the gas value chain.

By Hirander Misra, Chairman of GMEX Group and GMEX Technologies

Following a 4% drop in 2020 thus far as a result of the pandemic, global natural gas demand is expected to recover in 2021 as consumption returns close to its pre-crisis level in mature markets, and emerging markets benefit from the economic rebound and lower natural gas prices.

The Asia Pacific region accounts for over 50% of incremental global gas consumption, driven in most part by the development of gas in India and China. They together with other emerging Asian markets will account for most of the growth in future LNG imports.

The Indian Oil and Gas Industry

India is the fourth-largest Liquefied Natural Gas (LNG) importer after Japan, South Korea, and China. As a result of consistent economic growth, the demand for energy in India is anticipated to grow faster than all major economies. The oil and gas sector is one of the eight core industries in India and the country’s economic growth is closely related to its rising energy demand making the sector attractive for investment.

The Government of India has introduced various policies to fulfill the increasing demand for natural gas consumption and is investing in extending gas pipelines across the country as well as other fiscal incentives. To date, it has attracted both domestic and foreign investment. 100 percent Foreign Direct Investment (FDI) is permitted in numerous segments of the sector. According to data released by the Department for Promotion of Industry and Internal Trade Policy (DPIIT), the petroleum and natural gas sector between April 2000 and March 2020 attracted US$ 7.82 billion of FDI.

The US, EU, UK, and Australia have all risen to the challenges of developing fully functional gas market hubs. These hubs share the key characteristics of effective gas market hubs yet each one reflects the unique circumstances of its country or region. International experiences like these can give India valuable insights into what makes a gas trading hub thrive and a competitive gas market flourish for the long-term benefit of all stakeholders.

Here are some observations on global trends:

OTC vs Exchange traded volumes

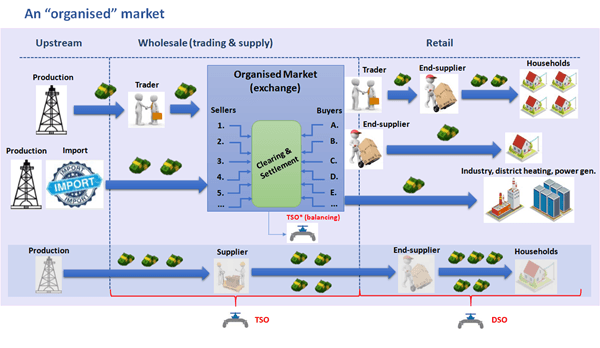

Traded volumes in European hubs are mostly over-the-counter (“OTC”) transactions. IGX has been launched to provide India with an organised trading platform to facilitate a much needed organised market. An example of how an organised market works follows:

The IGX digital trading platform provided by GMEX allows buyers and sellers of natural gas to trade in the spot and forward markets for imported natural gas across three hubs initially —Dahej and Hazira in Gujarat, and Oduru in Andhra Pradesh. Imported Liquified Natural Gas (LNG) is regassified and sold to buyers through the exchange, removing the requirement for buyers and sellers to find each other in the OTC market.

Oil Indexation versus hub pricing and traded markets

Oil indexation and hub-based pricing are two competing price mechanisms. Oil indexation is relatively easier to implement and over many decades has been used as a tool for pricing natural gas. However, some proponents argue it has failed to embody the fundamental values of the gas market. This has led to the development of hub pricing, which advocates argue is less volatile and better addresses demand and supply dynamics.

Hub-based pricing is an instrument used interchangeably with spot or gas on gas competition, and has been successfully implemented in the U.S with the Henry Hub. While the U.S. market only uses the hub pricing mechanism, the European market uses both. In the East Asian market, hub pricing started with an expanding LNG market. In Japan, South Korea and Singapore, the LNG spot market and gas exchanges have seen good growth in recent years. India aims to capitalise on this growth by embracing a hub pricing model driven by a digital trading platform and physical hub development.

The growing popularity of exchange trading

As markets become more organised, the volume of transactions increases due to the centralisation of liquidity. Trust and certainty come with reputable exchange trading, clearing and settlement. As exchange-traded spot markets develop, it also provides opportunity for more sophisticated derivatives market development. Henry Hub futures contracts are traded on the CME and ICE exchanges in the US with the European Energy Exchange (EEX) offering a range of spot and derivatives contracts across Europe.

India needs to be in a position to drive such a price discovery process. Other products and services can in turn be developed, including more sophisticated correlated financial products, which can be used for risk management and hedging.

Regulations in India for exchange gas trading are being developed with policy-level oversight from the Ministry of Petroleum and Natural Gas with clarity expected in due course. IGX meanwhile facilitates efficient market-driven price discovery with a nationwide automated trading platform for physical delivery of electricity, renewable energy certificates and energy saving certificates.

These developments will architect India as a market-based gas economy, whilst also leading to sustainable environmental benefits and become the catalyst for the liberalisation of gas markets and associated products in India. This in turn will expand the market for the benefit of all involved as well as for the economy as a whole.

Read More:

when is the target car seat trade-in 2025

charles schwab a modern approach to investing & retirement

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading