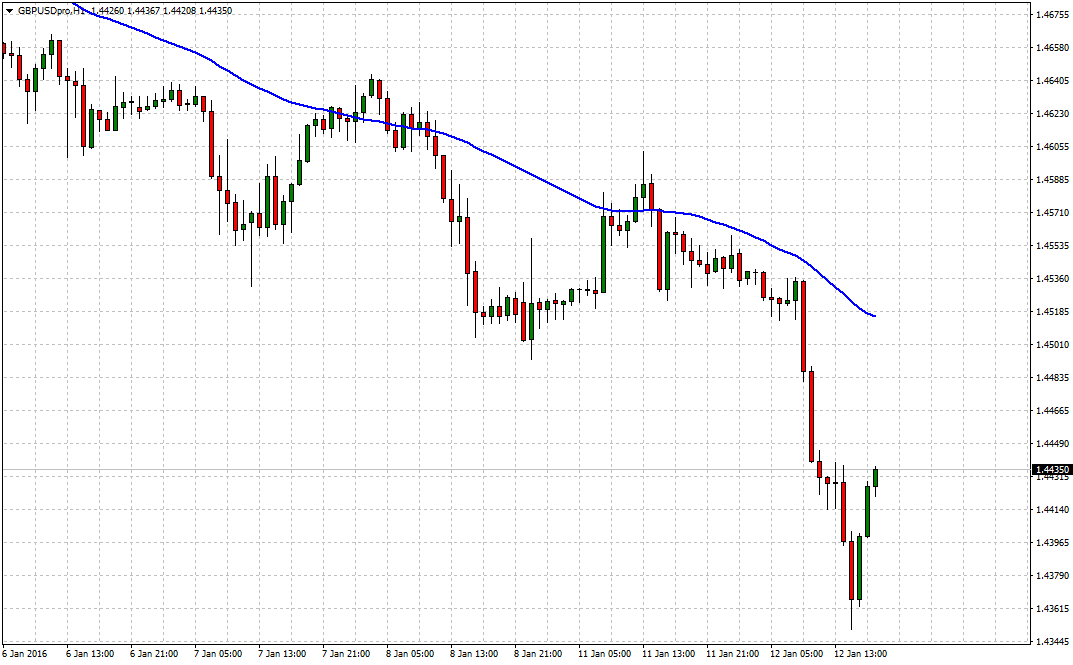

GBP/USD plunged on Tuesday, falling to five-year lows on weak UK factory data and rising demand for the dollar in the wake of China’s recent stock market selloff. It found a bottom at 1.4415, levels not seen since May 2010. The pair was last seen trading at 1.4435, declining 115 pips of 0.8%. The GBP/USD is likely to see immediate support at the psychological 1.4400 level. On the upside, initial resistance is likely found at 1.4947, the Christmas Eve high.

Cable came under pressure after government data showed the UK manufacturing recession intensified in November, raising warning signs about the domestic economy and pushing back expectations for a Bank of England rate rise.

UK manufacturing output declined 0.4% in November following a similar drop the previous month, the Office for National Statistics reported on Tuesday. In annualized terms, manufacturing output was 1.2% lower.

Industrial production, a broader measure of factory output that includes mining and utilities in addition to manufacturing, fell 0.7% in November. Output rose 0.9% compared with a year ago. Data came just two days before the Bank of England’s first scheduled policy meeting of the year. The Bank is not expected to make changes to the short-term interest rate any time soon.

Higher demand for the safe-haven US dollar will likely keep the GBP/USD under pressure for the foreseeable future, as investors monitor troubling developments in China. Chinese stocks ended mixed on Tuesday after plunging 5% at the start of the week. Chinese authorities suspended trading twice last week after the major averages in Shanghai and Shenzhen plunged 7% on two separate occasions.

Global financial tumult lifted the US dollar to higher ground on Tuesday. The dollar index climbed 0.2% to 98.91, its third consecutive increase.

A firmer greenback weighed on gold and other precious metals. Gold for February delivery fell $8.80 or 0.8% to $1,087.40 an ounce on the COMEX division of the New York Mercantile Exchange. Silver futures also fell 7 cents or 0.5% to $13.80 an ounce.

Oil prices stabilized on Tuesday, but remained near 12-year lows, forcing the Organization of the Petroleum Exporting Countries (OPEC) to consider emergency measures to end the massive rout that has shaved more than 65% off crude prices in 18 months. West Texas Intermediate (WTI) futures settled up 49 cents or 1.6% at $31.90 a barrel. North Sea Brent crude added 65 cents or 2.1% to $32.20 a barrel.

According to Nigerian oil official and OPEC President Emmanuel Kachikwu, the cartel is considering an emerging meeting as early as next month.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading