The Bank of Canada cleared the bar of hawkish expectations and hiked rates yesterday, following that up with fairly hawkish guidance. USDCAD is probing lower on the news and on a weak jobless claim figure out of the US today, but it is difficult to see the relative forward BoC versus Fed expectations curve widening notably from here.

By John Hardy, Head of FX Strategy

FX Trading focus:

– CAD reaction shows much was priced into FX, even as Canadian rates jumped aggressively.

– Choppy USD action suggests opportunities will be difficult to trade until next Tuesday’s US CPI and the Wednesday FOMC meeting are out of the way.

Trading and bias notes:

– CAD: the modest reaction to the Bank of Canada hawkish surprise in USDCAD suggests the market was looking for hawkish outcome (FX reaction far more muted than in rates). CAD strength on the relative repricing of the forward rates curve may be peaking here – will need new factors for CAD strength to extend (improving global outlook, energy prices, etc.).

– AUD: the AUDUSD pair still in limbo as the attempt above 0.6680-0.6700 resistance was repulsed yesterday even as AUD strength still felt elsewhere (AUDNZD has tested most of the way to the 1.1088 resistance). Ditto above comments for CAD on relative repricing of RBA forward curve.

– USD: choppy market here with slight bias for long positioning, but risk/reward difficult ahead of an important week next week. Jobless claims weak, but this can be USD neutral if risk sentiment wobbles broadly.

– JPY: perhaps even more critical week ahead for the JPY as the more hawkish RBA and BoC have the yen on the defensive, while longer US treasury yields have also jumped higher again. Both FOMC and Bank of Japan up next week.

Bank of Canada: surprise consensus with hike plus hawkish guidance

Especially in terms of the forward rate expectations, the Bank of Canada delivered a surprise yesterday in its decision to hike 25 basis points and deliver a hawkish statement on further hikes to come. It was the first BoC rate hike since January. Governor Macklem had made the point recently that his concern level is rising on the bank’s ability to take inflation back to the 2% target, with the last percentage point below 3% the hard part of the journey. The statement noted stickier-than-expected core inflation and a rise in housing prices and “other interest rate sensitive goods”.

Particularly in relative terms to the Fed, the forward policy curve expectations for the Bank of Canada now after this meeting look about as hawkish as possible through the end of this year. We even got a small extension today on release of the US weekly jobless claims (261k and a new cycle high if it holds post-revisions). The Fed is priced for a likely further 25 basis points of hiking in June or July followed by a removal of that hike and a bit more by the end of the year, while the Bank of Canada is priced to hike another 30+ basis points through December. The two-year US-CA yield spread has fallen to the lowest since a year ago to about -35 basis points, with the year-forward Canadian STIR future suggests a policy rate some 20 basis points lower than the current one, while the year-forward US SOFR future is priced for more than 100 basis point slower Fed rates. Hard to see a significant extension wider in this spread. If the US is in recession and the Fed is cutting, the BoC won’t be far behind.

Chart: USDCAD

USDCAD fell further yesterday, but the drop was modest relative to the strong 20 basis point surge in Canadian two-year rates on the back of the decision to hike yesterday and guidance for more policy tightening to come. Given our base case that it will prove difficult for the forward expectations curve for the BoC to continue pricing in more relative tightening than the Fed from here, it may prove difficult for USDCAD to work down through the next layers of support, which start at the pivot lows in recent months near 1.3300 and extend to the low of the year around 1.3261 and then the lows of late last year at 1.3222.

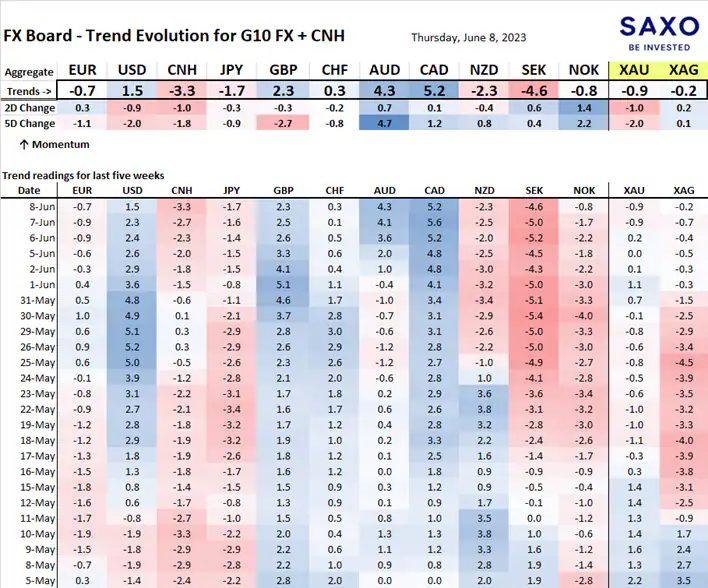

Table: FX Board of G10 and CNH trend evolution and strength

While AUD and CAD are standouts on the strong side, these currencies’ strength may be peaking soon, at least as a function of the shift in the policy outlook. Elsewhere, big week ahead for the US (CPI and FOMC), sterling on labour market data next Tuesday, and JPY on any moves in especially US yields next week plus the Bank of Japan meeting next Friday.

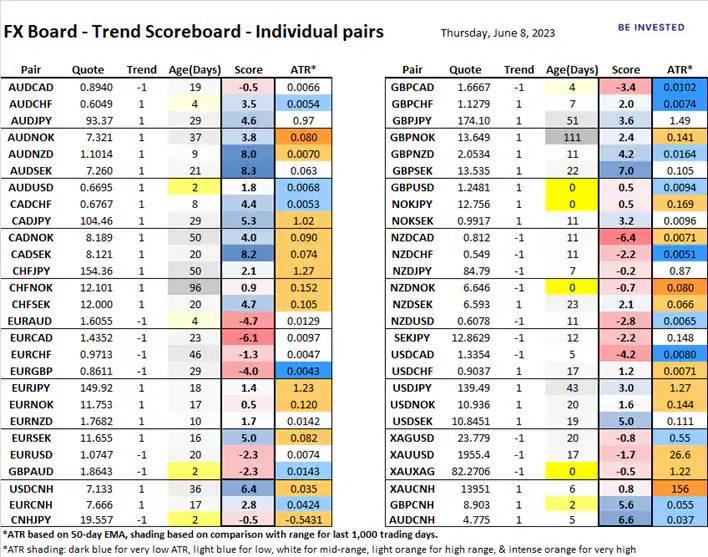

Table: FX Board Trend Scoreboard for individual pairs

Some wild readings in AUD and especially CAD pairs on this mini-theme lately of renewing the rate hike cycle from the RBA and the Bank of Canada – looking at you CADSEK and you AUDSEK and AUDNZD.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading