The US Dollar rally from the previous week ran into some resistance in the past few days ahead of the ECB meeting. With exception to the Japanese Yen the greenback traded lower against the currency majors by the mid-week session. Other noticeable movements in the financial markets were the softer yields offered by both US and European government bonds. Equity indices traded broadly higher with investor confidence growing. The ECB economic forecasts are expected to lean towards the upside, justifying the stimulus efforts to boost grow in the region.

Comments provided by JP Funds.

By the time the weekend is approaching post-ECB talks, the market outlook is reversed. Capital markets and stock indices traded lower. Earlier in the week the Euro advanced towards the psychological $1.20-level, however the common currency has since retraced and halted the underlying technical trend. Another key level this week was when Sterling touched $1.4000 before reversing lower on a bearish trajectory. As for the US Dollar, it reversed its path against the broader markets as it pushed towards a position of strength. Emerging market currencies were generally lower as market risk dissipated slightly.

Looking to the week ahead, Asia will be the standout point. The key report will be the volume of industrial production in China for February. Market participants will be keen to interpret how quickly China can recover from the sluggish January figures, which were exhibited following the slowdown relating to the Lunar New Year holidays. Later in the week the economic sentiment data from German will provide insight on how Europe’s largest economy has handled the nationwide lockdown. Similarly the release of US jobless claims will provide a measure against the rate of recovery the US economy.

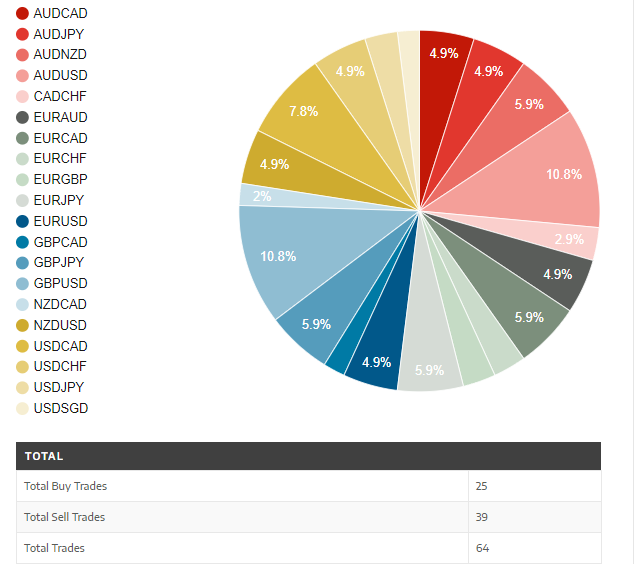

FX Multi Core Trade Overview

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading