The market is inherently unpredictable, and retracements can turn into reversals without any warning. That’s why it’s important to use trailing stops when trading in a trending market environment. By using trailing stop losses, you can save yourself from exiting a position too early during a retracement, or if it is a reversal, it can help you to get out before you make a sizeable loss.

Ultimately, it takes time and experience to be able to distinguish retracements from reversals. Knowing how to do this will go a long way towards reducing losses and preventing winners from turning into losers.

One of the keys to this is being able to see when a trend is weakening, and there are plenty of tools that you can use to this end, such as:

- ADX (Average Directional Index Indicator) – shows the strength of a trend, the higher the number, the stronger the trend. If this number is falling, it may indicate that the trend is weakening.

- SMA (Simple Moving Average) – When you place three SMAs of different time periods on a chart, it can indicate when a trend is beginning or ending. Usually, if the lines compress then fan out, it indicates a reversal, so if they start to compress, it could be a sign that the trend is weakening.

- Bollinger Bands – by setting up two Bollinger bands on your graph with different standard deviations, you create three zones – a buy zone, a sell zone, and the space in between. When the price action edges from one zone to another, it may indicate that the trend may change soon.

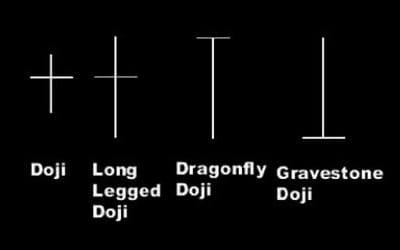

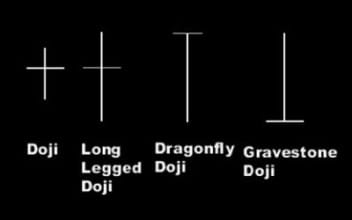

- Doji – These candlestick formations, with a narrow real body, can sometimes occur before a reversal. For more about using Doji to predict reversals, check out Part 2 of our Guide to Forex Trading with Candlestick Charts.

Using indicators such as these, along with plenty of practice and experience, you should eventually start to get a feel for when a trend is ending and a reversal is on the way. This, together with the use of trailing stops to lock in profits and shield you against downside risk, can be a very useful tool for increasing your profits and minimising losses.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading