MOSTA, Malta, Sept. 19, 2012 — Online forex broker and asset manager RTFX yesterday announced updates to its successful currency asset management service and launch of a new dedicated website. Since 2009 RTFX is one of the only regulated European entities licensed to offer forex managed accounts for private individuals.

The new website was launched to better inform the public about this unique liquid investment, which has earned positive returns since inception for each of its three strategies available to clients. The main features of the RTFX Asset Management service are:

- Proprietary algorithms generating different sell and purchase transactions on spot forex contracts power the strategies

- Clients can monitor their account, performance and positions that RTFX has executed on their behalf via secure online access

- RTFX only partners with major global banks such as UBS, Morgan Stanley, Bank of America Merrill Lynch, Deutsche Bank and HSBC in order to ensure competitive pricing and liquidity

- No lock-in period thus allowing clients to withdraw their investment at any time

- Proactive risk / return management with built-in stop loss and progressive profit mechanisms

Improvements to the service include:

- Annual benchmarks per strategy preceding any performance commission earned by RTFX in order to lower volatility in returns

- Selection of preferred performance forex commission structure providing flexibility to investors

- Inclusion of EUR/JPY in Standard Strategy

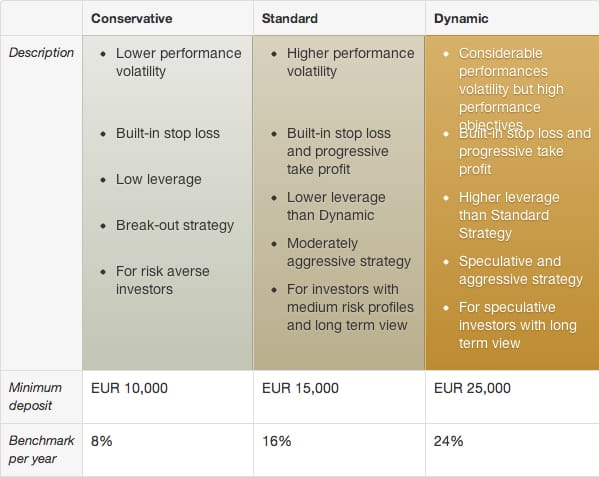

RTFX proposes three different strategies that will cater your investment profile: Conservative Strategy, Standard Strategy and Dynamic Strategy.

Strategies Comparison table below provides the brief summary on every type of strategy and differentiates by their main features.

Mainly, the difference between the strategies lies in their risk level. Conservative Strategy is more risk averse, while Standard Strategy is more moderately aggressive with substantial risk, higher volatility but ambitious returns. And third type is a Dynamic Strategy for those investors who are willing to expose their assets to a higher risk in order to potentially achieve greater returns.

On September 26h, at 5:00pm CET, RTFX will hold a Life Presentation called “20 minutes to learn what RTFX can do for your investment portfolio”. If you wish to understand how their Currency Asset Management Service may be considered a viable diversification tool, join the presentation by filling in the form.

Visit am.rtfx.com to find out more about this unique service including detailed performance of all three strategies, minimum investments and information about the trading system.

| About RTFX: RTFX Ltd is a pioneer in the online Foreign Exchange market with a history dating back to 1995. RTFX is one of the very few regulated entities licensed to offer managed accounts on the FX market for private individuals. RTFX is licensed and authorized to provide broker/dealer services throughout Europe. |

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading