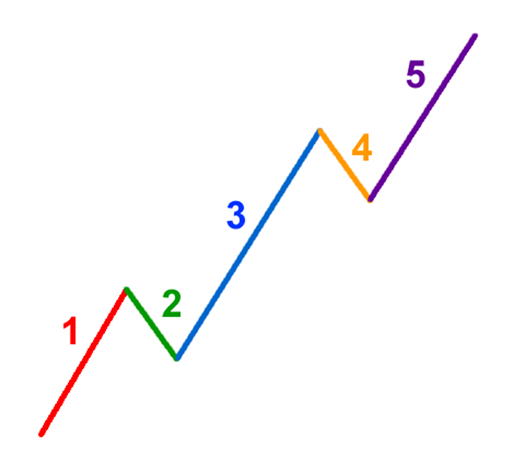

One of Mr. Elliott’s key findings is that a trending market tends to move in what he describes as being a 5-3 wave pattern. The first 5-wave pattern is called impulse waves, while the last 3-wave pattern is called corrective waves. Waves 1, 3, 5 are considered to be motive – i.e. they go along with the overall trend – while Waves 2 and 4 are corrective.

It’s important not to confuse Waves 2 and 4 with the ABC corrective pattern, which we shall discuss in the next installment. For starters, let’s look at the 5-wave impulse pattern:

In this description, we shall use stocks as our example because that’s what Mr. Elliot used, but the same principles can be applied across all markets including currencies, bonds, oil, or gold.

- Wave 1: The initial upwards move of the stock, usually caused by a relatively small number of people who, for one reason or another, believe the stock to be underpriced and therefore worth buying. This causes the price to rise.

- Wave 2: This is the point at which the buyers at the start of wave 1 decide that the stock is now overpriced, and sell in order to lock in the profit from the trade. This pushes the value of the stock down. However, before it hits its previous lows, the stock is considered by buyers to be underpriced again, and this prevents it from doing so.

- Wave 3: This wave is usually the longest of the waves in this formation. By this point, the uptrend has been noticed by the market as a whole, so more and more traders buy it causing the stock price to go higher and higher. The high of this wave usually exceeds that of the high of Wave 1.

- Wave 4: At this point, the stock is considered overpriced by the market as a whole, causing traders to take profits. However, this tends to be a weak wave because there are still likely to be plenty of people that are bullish about the stock that are just waiting until it dips for the opportunity to buy it again.

- Wave 5: At this point in the trend, the market is becoming hysterical about the stock, and the company and its CEO become regular fixtures in the media – for example, Apple at the height of iPad-mania in 2012, when the stock price hit a record high of $700. Despite its obvious over-valuation, traders and investors will come up with all sorts of reasons to invest in the stock, in this case with Apple being predicted (with tongue firmly in cheek) by Jeff Macke of Yahoo Finance as being “the first organization in history to grow forever”. This is the point at which contrarian investors start shorting the stock, which begins the ABC pattern.

Extended Impulse Waves

In almost every instance of the Elliot Wave, one of the three impulse waves (1, 3, or 5) will be “extended”, or longer than the other two. In Elliott’s original study, it was usually the fifth wave that was extended, but over time the market has evolved to the stage where it is now the third wave that is usually the extended one.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading