In the first part of our series on FX swaps and interest rate swaps, we’ll be explaining what they are, how they work, and delving a little bit into the history of this relatively new financial instrument.

FX Swaps, or Forex Swaps, are a family of financial derivatives for trading the currency market. An FX swap agreement is essentially a contract where one party simultaneously borrows one currency from and lends another currency to a second party.

FX swaps can be viewed as form of collateralised borrowing and lending, with the repayment obligation to the counterparty being the collateral, and the repayment being fixed at the FX forward rate at the commencement of the contract.

Source: Bank for International Settlements

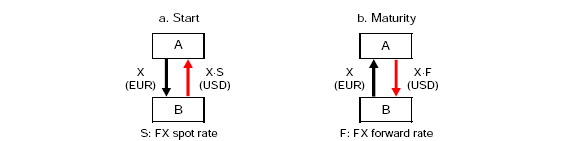

The diagram above illustrates the fund flows in a typical euro/US dollar swap. At the beginning of the contract, party A borrows X·S USD from, and lends X EUR to party B, with S being the FX spot rate. At the expiry of the contract, A returns X·F USD to B, with F being the FX forward rate at the beginning of the contract, and B returns X EUR to A.

FX swaps have a number of uses for businesses, investors, and speculators. They can be used to raise foreign currencies by financial institutions and their customers, such as exporters and importers. They are also used as a hedge by institutional investors, and for speculative trading, usually by combining two positions with differing maturities.

The majority of FX swaps have maturities of less than one year, and it is this time frame that exhibits the greatest liquidity. However, transactions with maturities longer than this have been on the increase in recent times.

The Swaps Market

Unlike the majority of standardised futures and options contracts, swaps are not traded on exchanges like stocks and shares. Rather, they are customised contracts traded between private parties in the over-the-counter (OTC) market. The market is largely dominated by financial institutions and companies, and it is comparatively rare for individuals to participate in it. The fact that swaps are traded OTC means that there is always a risk that the counterparty will default on the swap.

Swaps are a relatively new phenomenon, with the first interest rate swap taking place between IBM and the World Bank in 1981. However, they caught on fast, and by 1987 the swaps market had total notional value of US$865.6 billion. According to the Bank for International Settlements, this figure had ballooned to more than $250 trillion by 2006 – more than 15 times bigger than the entire US stock market.

Swaps are not limited to the FX market, and in fact the most common type of swap is an interest rate swap, which we shall explain here:

Plain Vanilla Interest Rate Swap

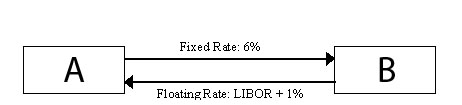

The simplest type of swap is known as a ‘plain vanilla’ interest rate swap. With this type of swap, party A agrees to pay party B a fixed rate of interest, determined in advance, on a notional principal on specified dates for a certain length of time. Simultaneously, party B agrees to make payments on the same notional principal on the same dates for the same length of time, but with a floating interest rate.

With this type of swap, the two cash flows are denominated in the same currency, the payment dates are known as settlement dates, and the times between them are known as settlement periods. These contracts are non-standardised and can be customised to suit the preferences of both parties, so the payments could be agreed to be annual, quarterly, monthly, or any other interval.

Let’s do an example to show you how plain vanilla interest rate swaps work:

On February 1st, 2014, parties A and B enter into a five-year swap with the following terms:

A pays B a fixed rate of 6% interest per annum on a notional principal of $10 million.

B pays A a floating rate based on the one-year LIBOR rate + 1% per annum on a notional principal of $20 million.

These simultaneous payments take place once per year on the 1st of February, beginning on 1st Feb 2014 and ending on 1st Feb 2019.

The LIBOR (London Interbank Offer Rate) is the average interest rate that leading London banks would expect to be charged to borrow money from other banks. In most cases, interest rate swaps use LIBOR as the basis for the floating rate.

In February 2015, the first settlement date, A has to pay B $10m x 6% = $600,000.

Lets assume that the one-year LIBOR for 2014 is 5.45% – the previous year’s rate, valid at the start of the settlement period, is always used in the calculations. So…

On the same date, B has to pay A $10m x (5.45% + 1%) = $645,000

In most cases, swap contracts allow payments to be netted against each other, so that only the difference has to be paid. In this case, B only has to pay A $45,000. The principal never changes hands, which is why it is referred to as a ‘notional’ amount.

Plain Vanilla FX Swap

This is the simplest type of FX swap, and also the most common. It involves exchanging the principal and fixed interest payments on a loan in one currency for the principal and fixed interest payments on the same type of loan in another currency. It’s important to note that, unlike interest rate swaps, FX swaps involve exchanging the principal amounts at the beginning and end of the swap. The two principal amounts are set to be roughly the same as one another based on the exchange rate at the beginning of the swap.

Here’s a worked example:

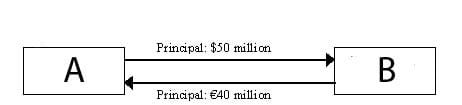

Party A is a US firm, and Party B is a European firm. They decide to enter a five-year currency swap for $50 million.

At the time the swap is arranged, the EUR/USD exchange rate is $1.25, which means the dollar is worth €0.80.

At the outset (December 31st 2013), the companies exchange principals, so A pays B $50m, and B pays A €40m, as in the diagram below:

This gives each company the funds denominated in another currency that they need, which is the main reason for the swap.

They agree to make payments annually on the 31st of December, starting a year after the exchange of principals.

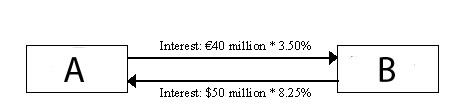

Because A borrowed euros, it has to pay interest in euros based on a euro interest rate. Similarly, because B borrowed dollars, it has to pay interest in dollars based on a dollar interest rate.

In this case, the agreed dollar interest rate is 8.25%, while the euro interest rate is 3.5%.

Every year, company A pays €40,000,000 x 3.50% = €1,400,000 to Company B. At the same time, company B pays company A $50,000,000 x 8.25% = $4,125,000, as in the diagram below:

Like with interest rate swaps, payments are netted, so only the difference – at the prevailing exchange rate – is paid. So, if the exchange rate is $1.40 per euro at the one year mark, company A’s payment is $1,960,000, and company B’s payment would be $4,125,000. So, only the net difference of $4,125,000 – $1,960,000 = $2,165,000 is paid by company B to company A.

At the end of the swap, which is usually the date of the final interest payment, the original principal amounts are exchanged back again at the same exchange rate as at the commencement of the contract. So, B pays A $50m and A pays B €40m.

That’s about it for today. In FX Swaps & Interest Rate Swaps Explained: Part 2, we’ll be looking at the possible motivations behind getting involved in a swap deal, and also the methods that can be used to get out of a swap before the agreed termination date.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading