In the previous installment of this series, we looked at using Fibonacci extensions to set take profit orders. In the final part of our series, we’re going to show you how to use Fib levels to place stop losses – which is at least as important if not more so than knowing where to take profits.

One popular tactic is to place the stop loss just past the next Fibonacci level. So, if you were intending to enter the trade at the 38.2% Fibonacci level, you might place your stop at the 50% level. If you think that the 50% level is going to hold, then you might place your stop at the 61.8% level, and so on.

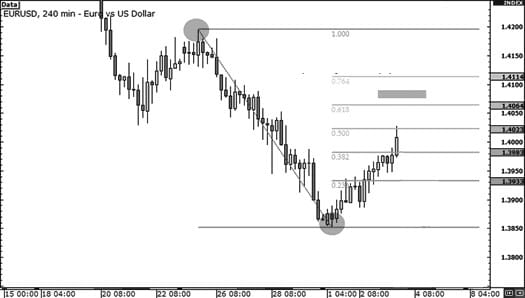

Let’s take a look at a 4-hour EUR/USD chart to illustrate how this might work in practice:

In the event that you had shorted at the 50% Fib level, then the stop loss could be placed just past the 61.8% level. This is based on the assumption that you believe that the 50% level will hold as resistance, and if the price rises beyond this, then the whole idea behind your trade would be proved wrong.

In order to use this technique for setting stops, you need to have a perfect entry point, as setting a stop just past the next retracement level indicates that you are confident that the support or resistance level will hold. This can be problematic, as any tool that involves drawing lines manually is far from being an exact science. The market might rally strongly and hit your stop before going in the direction that you had predicted.

The more conservative you are with your stop losses, the more often this is likely to happen, which makes it imperative that you let your profits run when you do get a trade right. That’s why this type of stop placement is best suited to short term trades that you can monitor continually, rather than longer-term trades that you might leave unattended for periods of time.

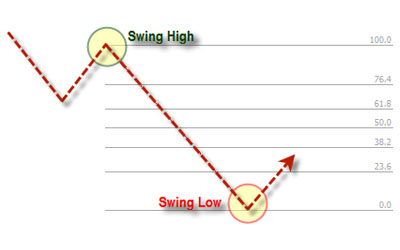

Another method is to set your stop past the recent Swing Low or Swing High. This gives your trade more of a chance to come good, although it does increase the potential size of the loss if you get it wrong – so be sure to set your position size/leverage accordingly.

In the event that the price moves beyond the Swing High or Swing Low, this might mean that the trend is reversing, and that your trade idea or setup was incorrect. Setting bigger stop losses is better suited to long-term swing trading strategies, and can also be used as part of a ‘scaling in’ strategy.

Because bigger stop losses mean bigger potential losses if the trade goes against you, you need to take a smaller position size and/or reduce your margin, especially if you enter at one of the earlier Fibonacci levels. It can also lead to risk/reward ratios that are less than ideal, especially if you have a wide stop that isn’t in a favourable proportion to your potential reward.

As was the case with combining the Fibonacci retracement tool with other technical analysis strategies to find entry points, setting good stop loss levels requires experience and a comprehensive knowledge of other forms of analysis. The Fibonacci tool is just one of the reference points you should use when deciding where to place these, and a stop-loss placement strategy based solely around Fib levels would be unlikely to be successful over the longer term.

At the most, using Fibonacci levels (in combination with other tools) to set your stop losses will help to tip the odds in your favour, giving you a better exit point, a more favourable risk/reward ratio, or more leeway for your trade to come good.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading