The Swiss division of the Spanish banking giant, Banco Bilbao Vizcaya Argentaria (BBVA), became the first traditional bank in Europe to include Ethereum into its service when it recently expanded its crypto offering and announced the addition of Ethereum to the bank’s investment portfolio. Back in June, BBVA Switzerland had initially made Bitcoin available in its trading and custody service to all its private banking clients. Alfonso Gómez, CEO of BBVA Switzerland, in a statement released early last week, said, “We decided to add Ether to our crypto asset ‘wallet’ because, together with Bitcoin, they are the protocols that spark the most interest among investors, while also offering all the guarantees to comply with regulation.” The bank revealed its plans to continue expanding their cryptocurrency portfolio in the coming months, “thus making it easier for its customers to invest in this new digital world,” according to the announcement, which then added that the “expansion to new countries or other types of customers will depend on whether the markets meet the right conditions in terms of maturity, demand and regulation.”

Starting with Bitcoin, the Spanish banking giant’s Swiss franchise launched its crypto offering back in June. Following the launch of the Bitcoin trading and custody service, Gómez had then explained, “This gradual roll-out has allowed BBVA Switzerland to test the service’s operations, strengthen security and, above all, detect that there is a significant desire among investors for crypto-assets or digital assets as a way of diversifying their portfolios, despite their volatility and high risk.” BBVA Switzerland’s private banking clients and customers with a New Gen account can view Bitcoin and Ethereum, along with other traditional investments, on the BBVA app. New Gen is the bank’s 100% digital investment account, which can be accessed with an initial deposit of $10,000, and is available for residents of the European Union, Mexico, Colombia, Argentina, Peru, and Chile, among others. The account offers access to a catalog of companies and funds, and it also features a cryptocurrency wallet.

Following Bitcoin’s Price Dip, Kraken’s CEO Sees a Major Buying Opportunity

By the middle of last week, the Bitcoin market had become rattled to see that Bitcoin had dipped below $48,000, and several market players expressed worry over the plunge. Jesse Powell, the CEO of Kraken, has long been a big supporter of Bitcoin’s price, stating that a price below $40,000 would be a good time to buy. Powell’s ability to foresee Bitcoin’s price swings has been quite remarkable, and he had made the price call on Bloomberg TV after being asked if he agreed with Galaxy Digital CEO Mike Novogratz. Due to the current year-end selloff, Novogratz recently told Bloomberg that he believed Bitcoin will bottom out at $42,000 or slightly lower, but that it would then gain momentum, as would the crypto market, in the medium run. On Wednesday of last week, BTC was maintaining around the $47,500 level and had a trading volume near $30,219,475,014 with a market cap of $900,272,666,300. The Kraken CEO said that it would be difficult to foresee short-term price movements since he thought of Bitcoin as a long-term investment. “In many ways, it’s a speculative asset, but you can’t help but be impressed by how far it’s come and how much innovation is going on around it,” he said. Powell also predicted a grim outlook for the US dollar. He warned that the price might drop to zero and advised people to stock up on gasoline and milk. During its high-stakes Wednesday meeting, the United States Federal Reserve had been expected to announce that it would be moving away from monetary easing, setting the stage for the first interest rate hike in years.

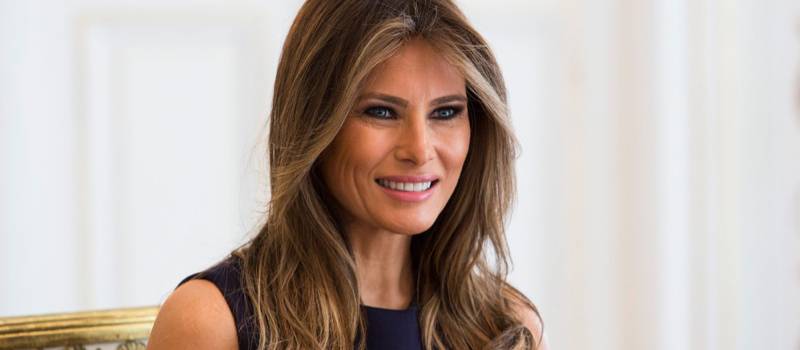

Melania Trump NFT Collection Set to Be Released

Last Thursday, the former first lady of the United States, Donald Trump’s wife Melania, announced the upcoming launch of her very own NFT platform. Posting to her official Twitter @melaniatrump, she stated that she was “Excited for this new venture, which combines my passion for art and commitment to helping our nation’s children fulfill their own unique American Dream.” Also added to her post was the hashtag #MelaniaNFT, which was a link to where the NFTs will be released – MelaniaTrump.com – and a copy of the press release, Melania Trump NFTs. The full announcement from the office of Melania Trump mentioned that the first NFT will be named ‘Melania’s vision,’ and that it would become available to purchase for a limited period, between December 16th – 31st, 2021. That non-fungible token will be a watercolor artwork by Marc-Antoine Coulon, priced at 1 SOL. It will also include an audio recording from Mrs. Trump. More NFTs will follow at regular intervals, and there is an auction scheduled for January 2022.

Melania Trump’s NFT’s will be available for purchase using Solana (SOL) or credit card payments through Moonpay. Solana can be purchased on the regulated cryptocurrency exchange eToro. A portion of all of the proceeds will go to various children’s foster care charities. Melania has a history of charity work over the years, including with 4KIDS in Florida. “Through this new blockchain technology-based platform, we will provide children computer science skills, including programming and software development, to thrive after they age out of the foster community,” Melania added. NFTs are potentially a good investment at this time, as the crypto markets may have found a bottom last week. With no negative news coming from last

XRP TRAPPED BETWEEN $0.75 AND $0.85, AS THE MARKET REMAINS STAGNANT

A Brief Market Overview: For the past week or two, the crypto market as a whole has remained stagnant. BTC largely changed hands between $45,000 and $50,000, with lower lows and highs along the way, and this alone clearly represents a slack market. XRP itself seems trapped between $0.75 and $0.85, and there have been very few bullish signals for the token. Within a bullish environment, crypto would be expected to make higher highs and higher lows. Similar price action has been exhibited by almost all the other mainstream cryptocurrencies, with most of the top coins seeing lackluster performance, except for a few. Avalanche would be one of those, and it has gone up by nineteen percent during this period. As for Ripple – XRP Technical Analysis shows that it is the most stagnant among the top 10 cryptos, and during this period it has recorded a high of $0.88 and a low of $0.77, with very slight change the past few days of last week. While XRP shows resistance at $0.85, it also has a support at $0.75, and presently, the token remains trapped in between.

If it manages a break in either direction – through the current support or resistance levels – it would then redefine those at $0.70 and $0.90, respectively. The first major technical indicator in this scenario would be XRP market volume, which seems to be quite flat in the last seven days, as the token fails to bring any adequate momentum to deviate from the current price range. Secondly, XRP’s Relative Strength Index (RSI) does show some bullish signals, as the chart makes higher lows. At the moment, XRP’s RSI stands below 50 points, and to generate some momentum the coin must break through it. As we head towards the year’s end, there could be a bullish wave, as we can recall that it was in December 2020, that Bitcoin had risen from $18,000 to surpass $29,000, and, as they say, the rest is history…

5 TOP NFT CRYPTOCURRENCY TO INVEST IN NOW – DECEMBER 2021 – WEEK 3

Non-fungible tokens (NFTs) have gained mainstream adoption in the past year, and this emerging sub-sector has since recorded over $10 billion in trading volume. Naturally, investors are searching for the top NFT cryptocurrencies to put their money into, and these five have come up among the best possible candidates. In no particular order, they are:

#1. Decentraland (MANA):

Decentraland has become a beacon in the fast-rising NFT and metaverse ecosystems. It is an Ethereum-based protocol which focuses on 3D virtual reality experiences, enabling users to create, share, and monetize virtual items. Catering to businesses, Decentraland facilitates the purchase of virtual plots of lands which creators and developers can build on for large gains. Ever since Facebook rebranded Meta and announced its decision to redefine its focus into the crypto space, Decentraland has become a popular NFT. Soon after the rebranding, MANA shot up to a record high of $5.85 on November 25. And yet, The ERC-20 token has since dipped 45.6% from its all-time high (ATH) of a month prior. Year-to-date (YTD) increase stands at 4233.98%, and the 12-month trailing increase is at an impressive 3775.46%. Decentraland-based RTFKT Studios have recently joined the Nike team, further boosting the platform’s appeal as a top NFT cryptocurrency to invest in now.

# 2. The Sandbox (SAND):

The Sandbox is another top NFT cryptocurrency, and, not surprisingly, the asset is very similar in makeup as Decentraland. It has an Ethereum protocol which aims to revolutionize the gaming industry and how users interact with digital content. The Sandbox features developer and user-friendly tools that enable anyone to create, share, and monetize in-game assets. These include The Sandbox Game Maker, which encourages the creation of 3D games for free. Also, the VoxEdit enables the animation of 3D objects while users can tap The Sandbox Marketplace to sell their digital creations. The Sandbox, a late starter in the year, zoomed to prominence following Meta’s foray into the NFT discourse, at which time SAND hit a record figure of $8.40. SAND has lost almost 45% of its record price since then and sits at $5.2511, down 5.11% in a largely bear climate. As with close rival Decentraland, SAND has posted a remarkable YTD of 14659.94% so far this year. This follows strong fundamentals, with the latest being the purchase of a virtual 6 X 6 estate on The Sandbox by Uniqly for $500,000.

# 3. Axie Infinity (AXS):

In a year of remarkable growth in blockchain-based gaming, Axie Infinity is a prized jewel for the NFT niche. A Pokemon-inspired gaming platform, Axie Infinity’s phenomenal success year-to-date is due mostly to the partial share gamers have in the protocol’s core operations. Axie Infinity is the most popular blockchain game and has become one of the top NFT cryptocurrencies. Players get to breed, collect, battle, and then monetize in-game characters called Axies. Each Axie comes with unique capabilities, and players can exchange these NFTs for real cash. Axie Infinity has largely seen bullish returns in the run-up to the top spot on the global gaming chart. Its governance token AXS has remained an outlier through much of the crypto winter that characterized the second half of 2021, with the digital currency hitting an ATH of $164.90 in early November. Although the ERC-20 token has since slipped by 40.7%, AXS has traded close to the $100 mark. Its YTD increase stands at an outstanding 14659.94%, with a yearly gain of 10,634.83%. Axie Infinity also has the highest NFT sales, per data from NFT aggregating platform DappRadar.

# 4. Enjin Coin (ENJ):

Enjin Coin has real-world applications and is another NFT which has roots in the gaming industry. As well as hoping to revolutionize the gaming space by driving up a player-driven economy, Enjin Network enables the tokenization and subsequent transfer of in-game assets across several platforms. As well as this, the Ethereum-based protocol operates as a social platform where gamers and users can chat, create websites, clans, and host virtual item stores. These virtual items can then be swapped for real-world value. The Enjin Network is also closely working on enabling a new gaming society. The Enjin Network is expanding into the heterogeneous network Polkadot to slow the increasingly high gas fees inherent in the Ethereum network. Enjin’s Efinity aims to become the first NFT platform to launch on the shared network. YTD growth stands at 14659.94%.

# 5. MyNeighbor Alice (ALICE):

Although still under development, MyNeighbor Alice is an NFT-driven protocol which has continued to make milestone price gains throughout this year, with the digital token hitting a record high of $40.93 in mid-March. MyNeighbor Alice is set to be a shrewd investment in the coming year as the protocol operates as a multiplayer builder game where users can buy and own virtual islands, collect and build in-game items, and make new friends. The game features a 3D gaming experience while adding to the excitement of collecting NFTs. To further propel the growth of NFTs and the subsequent metaverse, MyNeighbor Alice has launched an $80 million Metaverse Grant in collaboration with Chromia blockchain. ALICE is currently trading at around $13.00.

Holy doubletake, Batman! Seems like everyone is now jumping on this bandwagon….

The post <h5>Digital Asset Insights #46</h5> <h3>BBVA Switzerland becomes the first traditional bank in Europe to add Ethereum to its crypto offering</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading