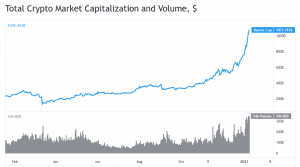

The total market capitalization for crypto assets has passed $1 trillion in dollar-denominated value, according to CoinGecko’s index of 6,124 assets. This high water mark comes amid an ongoing market rally, which is showing little signs of abating.

This time last year, the total value of all crypto assets stood at $200 billion, according to Coin Metrics data. And in 2017, during the last prolonged crypto bull run, the market’s total capitalization hovered around $760 billion before collapsing.

“All I can think about is how sustainable it all feels,” Messari founder Ryan Selkis wrote in a newsletter yesterday, preceding the milestone metric. Selkis cited the increasing use and exposure of stablecoins, the imminent improvements to Ethereum’s blockchain and the strengthening foundation for a crypto-based Web 3.0 as particular reasons for the sustainability of this rally.

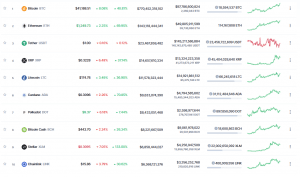

Oh, and “BTC is at the beginning of its institutional supercycle,” he wrote. Indeed, bitcoin is soaring, having set a new high above $39,000 today after several days of remaining in the green. Bitcoin’s $726.5 billion market cap accounts for just under three-quarters of the entire crypto market cap.

In fact, “bitcoin is more valuable than all but seven publicly traded companies, sitting between Tesla at $758.8 billion and Tencent at $723.0 billion,” CoinDesk news editor Kevin Reynolds wrote. The crypto’s next closest rival, Ethereum, is valued at $140 billion, according to the CoinDesk 20.

In 2020, bitcoin became an attractive investment for hedge funds, corporations and high-net worth investors seeking to hedge their bets against forecasted inflation. A spout of coronavirus relief and a loosening of monetary policy by the Federal Reserve has many analysts concerned about a coming devaluation of the U.S. dollar.

To be sure, inflation has failed to meet the Fed’s target of 2%. Though bitcoin, and other cryptocurrencies, still represent an intriguing investment in a world beset by uncertainty. Cryptographic assurances and public ledgers have value for certain types of monies or assets.

“The $1 trillion mark cements cryptocurrency as a investable asset class that no longer sits on the fringes of Traditional Finance as a toy for retail investors,” Jack Purdy, a Messari analyst told CoinDesk’s Zack Voell. “It demonstrates that this asset class is large enough to absorb large orders like we’ve seen recently with the slew of institutions entering over the last few months.”

Bitcoin Leads The Way

Bitcoin has seen a massive surge in the last months and it is becoming a regular news for experts worldwide. Simon Peters, cryptoasset analyst at multi-asset investment platform eToro, said about the $1 trillion market cap: “Another day, another dollar record. Bitcoin has hit yet another all-time high. Demand for alternative assets is surging and institutions around the globe are now looking at bitcoin as both a growth asset and as a way to hedge against the big fear of 2021: inflation.

The expert went on to say that the financial largesse we have seen from central banks and governments has eroded the value of traditional assets such as cash and bonds. This shows no sign of abating, so the momentum behind bitcoin is unlikely to drop away any time soon.

“There will be volatility, which is natural after the gains we have seen, but the long-term trend is clear. Crypto is moving into the mainstream, and more and more investors are adding exposure. On 4 January 2021, eToro had 61% more unique bitcoin holders than on the same date in 2020 and 49% more unique Ethereum holders.

“I believe, with this positive momentum, bitcoin is well on track to hit my price target of $70,000-$90,000 by Christmas 2021,” he noted.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading