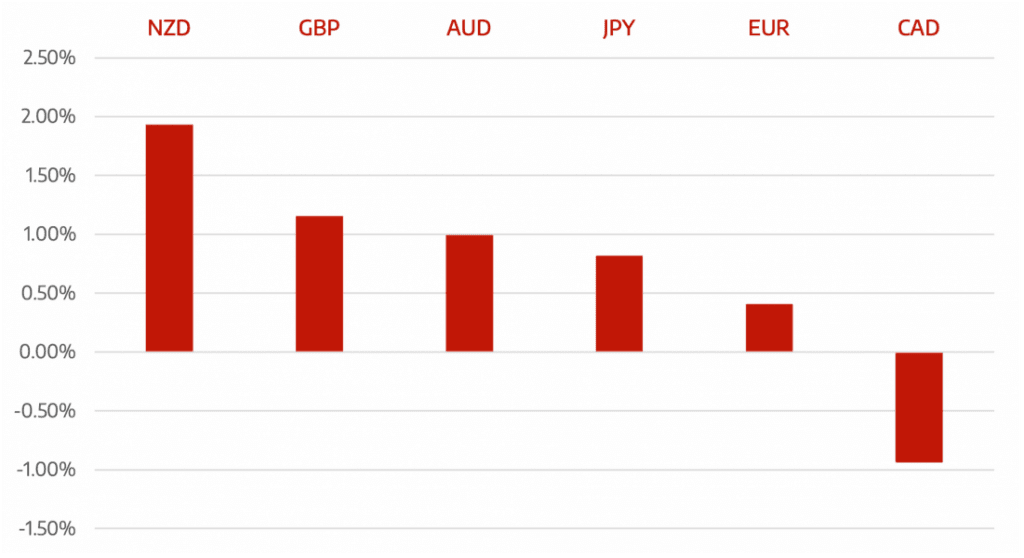

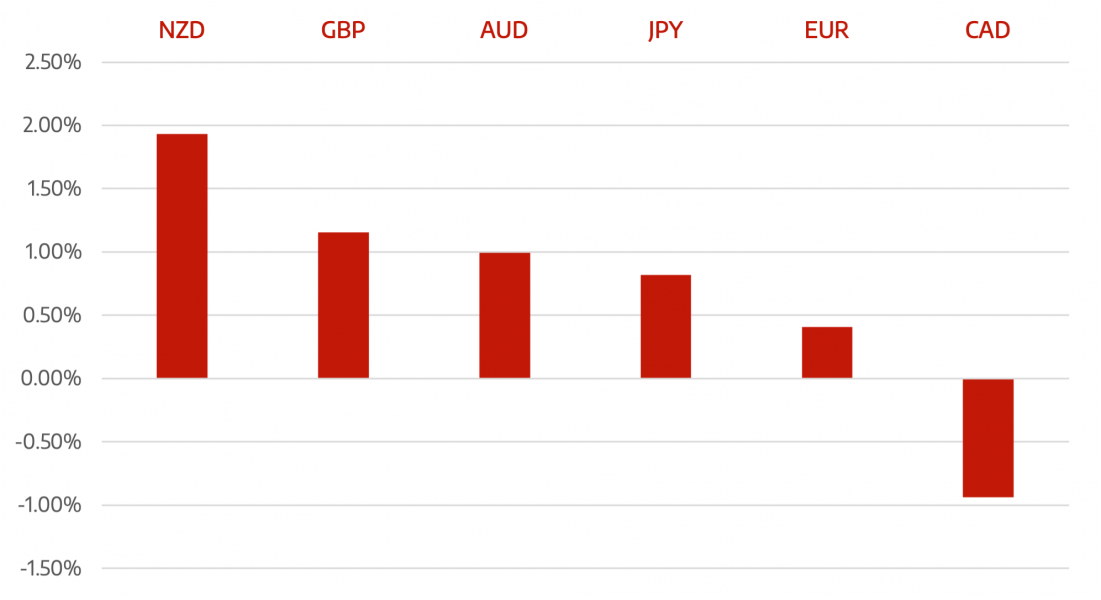

The Yen selloff continued through the week as a broader risk on strategy was adopted which spilled over into USD pressure. With little economic announcements the market was left to it’s own devices and the continued strength in energy and commodity prices pushed the main commodity backed currencies higher. The USD long term strength remains and should be well supported as the Fed prepares to taper and the market price in tighter monetary policy.

GBP moved stronger as despite fears of stagflation, the currency has rallied, buoyed by the possibility of an early BoE rate change. Markets are now pricing in 25bps move in December.

The week ahead could see some continued USD pressure as risk on assets gain traction. The economic calendar releases move away from the US this week. Inflation data will be released from New Zealand, Germany, Eurozone, Canada, and Japan.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Strong Energy and Commodities Dominate</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading