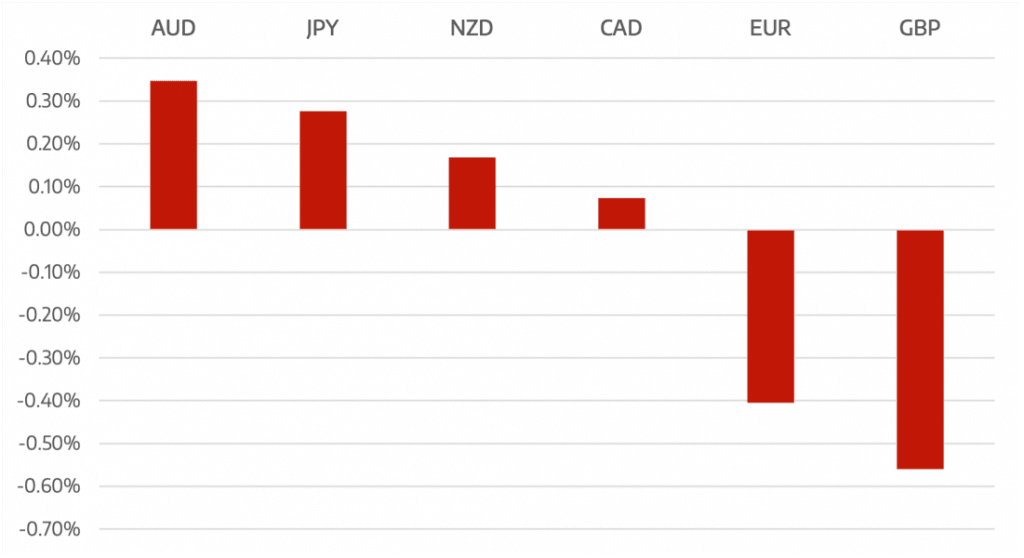

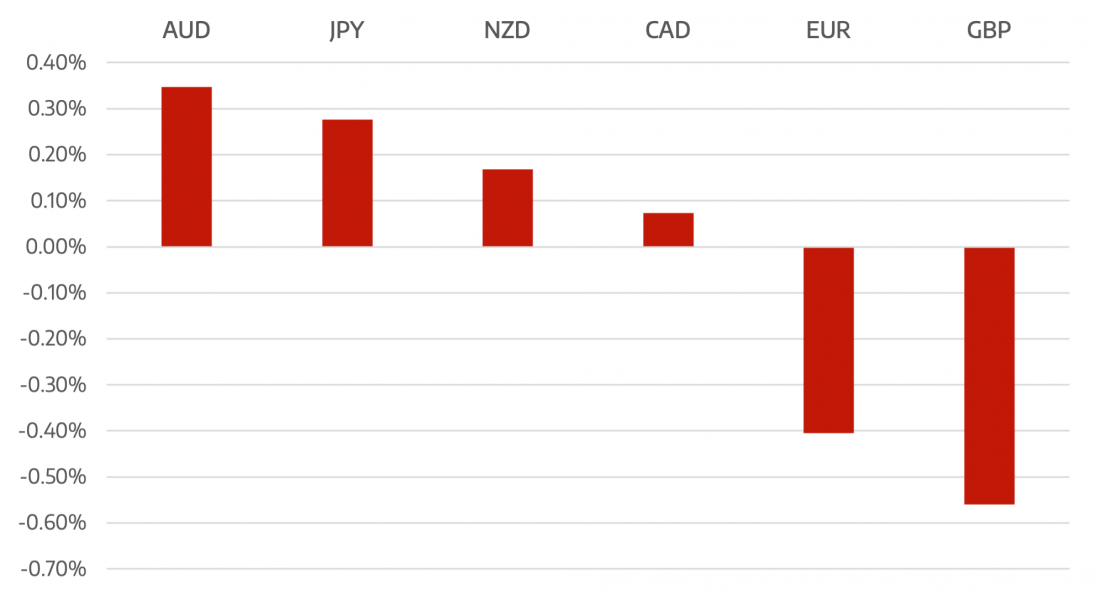

The Euro ended the week as one of the worst performers as the post ECB rally faded. Markets see the Eurozone lagging other major central banks in reducing their stimulus plans and raising interest rates.

Australian Dollar ended the week the strongest of the major pairs as the RBA stopped defending the yield curve and the New Zealand dollar rose on potential further RBNZ rate hikes.

The BoC decision to taper its QE program and look to a rate rise around mid 2022 was well received but gains in the currency were limited as oil prices retreated into month end.

The week ahead has a large amount of data. FOMC policy announcement is expected to see the timeline to taper QE through mid 2022 setting the stage for rates hikes to follow in 2H 2022. The BOE will announce its interest rate decision Thursday also announcing the timeline and value of its QE strategy with the market pricing in a 15bps.

Friday US payrolls will be a look into future Fed decisions. Expectations of +450-500k is enough to keep the Fed on track to announce tapering in November.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Euro selloff to continue? Fed and BOE meet</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading