Canadian Conditions Crumble Amid Heightened Double Dip Anxiety

After emerging from the recession in 2015 following a significant combination of monetary and fiscal stimulus, Canada is once more facing the music as the most recent quarterly GDP results foreshadow a potential double dip recession. Although second quarter results were heavily impacted by the Fort McMurray fires which took a substantial portion of oil sands production in the Alberta region offline, other areas of the economy remain unable to pick up the slack. Besides lower automobile and metals shipments, exports of consumer goods also missed expectations, sparking fears of another imminent economic downturn, especially since many of the figures posted were the worst since 2009. With oil prices once again on the verge of decline following a noteworthy rally during the first half of the year, the third quarter might prove no better, hurting chances of any further recovery in the USDCAD pair.

Down Across the Board

Even though losses in the oil patch were blamed as the main culprit behind the most recent GDP disappointment, tremendous fiscal stimulus measures enacted by the government have been unable to offset the sustained weakness in global energy markets. Excluding oil and gas, Canada’s main exports fell across the board, with metals and minerals shipments plunging -17.50% followed by a -6.80% tumble in consumer goods and -6.60% quarterly loss in vehicle exports. While household and government expenditures rose 0.50% and 1.00% respectively, the latter was mostly due to efforts to repair damage from the wildfires that ripped through the oil sands region of the country. When stripping out the more volatile crude oil component, the economy actually expanded by 0.10% during the second quarter. However, the annualized -1.60% pace on contraction marked the fastest pace of decline since the second quarter of 2009.

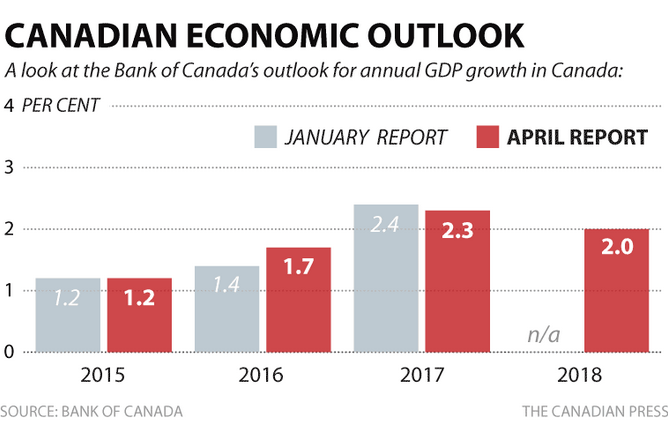

The sheer pace of decline in economic activity is raising serious questions about the outlook for Canada, especially if the third quarter experiences another contraction. With monetary policy already highly accommodative, many market participants are questioning the direction of interest rates considering the upcoming September 7th Bank of Canada meeting. Although no imminent action on rates is anticipated, especially amid the more hawkish outlook from key FOMC members ahead of the Federal Reserve’s own decision later in the month, consensus currently expects the BoC to ease rates another 25 basis points in the fourth quarter of the year. Now that annualized headline inflation pressure has cooled from 2.00% in January to 1.30% as of July, the Central Bank has more room to act. However, should the pace of GDP contraction accelerate over the coming months, the USDCAD pair may resume its upward momentum with greater force.

Technically Speaking

Examining USDCAD price action from a technical perspective makes it evident that the currency pair is approaching a major turning point after trending mostly range bound since May. At present, USDCAD is trending higher in an equidistant channel formation that has provided for the upper and lower bounds of prices over the last three and a half months. The channel has a most bullish bias, with ideal positions established near the lower channel line targeting the upper channel line for an exit. However, more important than the channel is the potential for a directional breakout, especially with volume and volatility in the pair trending lower over time. A candlestick close above the upper channel line could be an early breakout sign, especially if accompanied by higher than average momentum and turnover, however, resistance stands in the way.

Coinciding with the upper bound of the equidistant channel formation is the 200-day moving average which is trending lower above the price action. Although acting as strong resistance against a prolonged upside rally, considering USDCAD recently crossed the 50-day moving average to the upside, the stage may in fact be set for another test of the level. Furthermore, should the 200-day moving average start trending higher and be crossed to the upside by the 50-day moving average it could be a strong bullish signal for traders. Additionally, the recent MACD signal line crossover below the zero line also provides additional evidence of a more bullish bias in the pair. Although not an ideal place to currently enter USDCAD considering it is trending in the middle of the range, it is worthwhile to keep the channel up on the radar when examining potential entry and exit points.

Looking Ahead

The major upcoming data point that could readily shift USDCAD momentum remains US nonfarm payrolls due on Friday. If the payroll figure matches or beats the consensus expectations, it opens the door for potential action on rates as soon as the next FOMC Meeting. However, any disappointment could see the US dollar reverse its most recent climb, forcing USDCAD lower. Aside from US payrolls, next week’s Bank of Canada meeting could also greatly impact momentum, especially if the prospect of another recession forces the BoC to reduce rates to 0.25% in an effort to stimulate other areas of the economy. An additional rate cut or another period of losses in oil prices could decimate the Canadian dollar’s value, making it a crucial aspect of any forward-looking momentum. However, given current conditions, the outlook for the Canadian dollar will continue to mirror the bearishness of the economy.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading