The emergence of Bitcoin and other digital currencies has without a doubt been the hottest topic in currency trading circles over the past couple of years. While the concept of digital money, as opposed to fiat currency, has been around since the 1990s, it was never really taken seriously outside of uber-geek circles. To many observers, there seemed to be little difference between the likes of WebMoney and Bitcoin and the virtual currencies used in online games such as Second Life or Facebook Credits.

This all started to change in 2011 with the launch of the Silk Road website. This underground website is effectively an eBay or Amazon for contraband, where users can buy anything from illegal drugs to handguns and have them mailed out to them. In order to make this work and preserve the anonymity of the operators and users of the website, it was located on the ‘deep web’, requiring amongst other things a special browser, and a secure encrypted payment system. The operators of the site opted for Bitcoin, a relatively new, untraceable peer-to-peer online currency with a strictly limited supply.

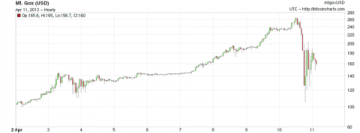

Soon, the value of Bitcoin began to inflate, reaching a high of $32 in June 2011 before falling 94% to just $2 by November, as shown in the Mt. Gox price chart to the left. These wild price swings naturally attracted the attentions of currency traders, with a whole industry springing up almost overnight. Without any regulations in place, Bitcoin trading became a kind of financial wild west, with trading sites that offer a facsimile of the highly regulated offerings from the mainstream financial industry, without any of the legal obligations. One of the highest-profile sites of this nature was Bitcoinica, a Bitcoin CFD site operated by 17-year-old Chinese high school student Zhou Tong, which has since ceased trading.

Soon, the value of Bitcoin began to inflate, reaching a high of $32 in June 2011 before falling 94% to just $2 by November, as shown in the Mt. Gox price chart to the left. These wild price swings naturally attracted the attentions of currency traders, with a whole industry springing up almost overnight. Without any regulations in place, Bitcoin trading became a kind of financial wild west, with trading sites that offer a facsimile of the highly regulated offerings from the mainstream financial industry, without any of the legal obligations. One of the highest-profile sites of this nature was Bitcoinica, a Bitcoin CFD site operated by 17-year-old Chinese high school student Zhou Tong, which has since ceased trading.

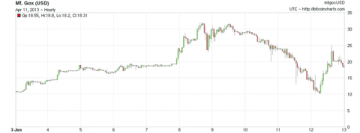

The cycle of price bubbles continued apace, and briefly hit the $260 mark in April of this year before swiftly dropping to $140, as you can see in the price chart opposite. When compared with the relatively small price fluctuations on the fiat currency markets, these types of money-making opportunities have proved impossible to resist, even for traders at some of the world’s biggest investment banks. According to Reuters, employees of Goldman Sachs and Morgan Stanley have been visiting Bitcoin exchanges up to 30 times a day, and the daily trading volume of Bitcoin is now around the $4.3 million mark. If you needed any further assurance of the emergence of Bitcoin as a credible financial force, take a look at this video produced by the Wall Street Journal:

While governments are understandably keen to regulate Bitcoin, its decentralised structure makes this very difficult indeed. Opinions vary as to whether this is a good thing or not. Speaking at the Digital Money Forum in London in March, banking and payment expert Simon Lelieveldt was quoted in Reuters as saying that “Bitcoin is not going to fly because there is no central bank or power base. It’s doomed to fail.”

However, it was the reaction of governments to the financial crisis that informed the unique structure of Bitcoin in the first place. The creator of Bitcoin, who was known by the online name of Satoshi Nakamoto before disappearing from the web in 2010, was vocal in his disapproval of quantitative easing, blaming banks for creating the credit bubbles that were causing so much economic turmoil across the world. His disapproval was made clear with the time-stamp attached to the first block of Bitcoin transaction history, which carried the message: ‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks’.

That’s why there are only, and there will only ever be, 21 million Bitcoins. Initially, these were released by ‘mining’, a block reward system for exchanges that is used instead of a central issuing authority, although there are now very few Bitcoins left unmined. The whole thing is managed by a computer algorithm, rather than a human, so there will never be the temptation or the opportunity for human interference with the currency. This makes its particularly attractive to merchants in countries such as Greece and Cyprus that have felt the effects of the Eurozone crisis most acutely. But while the currency itself is untouchable, for the time being at least, the exchanges are not.

That’s why there are only, and there will only ever be, 21 million Bitcoins. Initially, these were released by ‘mining’, a block reward system for exchanges that is used instead of a central issuing authority, although there are now very few Bitcoins left unmined. The whole thing is managed by a computer algorithm, rather than a human, so there will never be the temptation or the opportunity for human interference with the currency. This makes its particularly attractive to merchants in countries such as Greece and Cyprus that have felt the effects of the Eurozone crisis most acutely. But while the currency itself is untouchable, for the time being at least, the exchanges are not.

A recent legal dispute between French bank CIC and one of the leading Bitcoin exchanges, Mt. Gox, centred around the French bank’s decision to close Mt. Gox’s account because it said the company was illegally behaving as a financial intermediary and that using their account made the bank an accomplice. The court ruled in favour of Mt. Gox, ordering CIC to reopen the account and compensate the exchange, but the issue of whether Bitcoin is classed as a virtual currency under French law was not resolved, and the matter has been passed on to another court. Regulators in Germany and the UK are also looking into the issue.

At the moment, nobody knows how the whole Bitcoin story is going to pan out. If the regulators succeed in cracking down on it, the chances are that it will continue to exist, but it might lose credibility as a clean alternative payment system, and lose value as a result. Another threat to Bitcoin’s emergence as a viable alternative currency is the profusion of other virtual currencies that have sprung up in its wake such as Litecoin and Feathercoin that claim to be much more secure. These have been growing steadily, without the disruption or crime-tainted reputation of Bitcoin, and these may eventually surpass it in terms of the potential mass market for virtual currencies. Because they are new, they are much easier to ‘mine’, making them more attractive to long-term investors, and if regulators do succeed in cracking down on Bitcoin, there could be a sudden surge in demand for alternatives.

At the moment, nobody knows how the whole Bitcoin story is going to pan out. If the regulators succeed in cracking down on it, the chances are that it will continue to exist, but it might lose credibility as a clean alternative payment system, and lose value as a result. Another threat to Bitcoin’s emergence as a viable alternative currency is the profusion of other virtual currencies that have sprung up in its wake such as Litecoin and Feathercoin that claim to be much more secure. These have been growing steadily, without the disruption or crime-tainted reputation of Bitcoin, and these may eventually surpass it in terms of the potential mass market for virtual currencies. Because they are new, they are much easier to ‘mine’, making them more attractive to long-term investors, and if regulators do succeed in cracking down on Bitcoin, there could be a sudden surge in demand for alternatives.

Other alternatives to Bitcoin include Webmoney, which has actually been around since 1998 but has found its usefulness limited by it’s structure as a strictly in-system currency, PPCoin, which can be traded for both fiat and digital currencies, and Ven, which has the backing of Thomson Reuters and was the first digital currency to be traded on the mainstream financial markets.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading