In spite of all the attention still being directed towards the Brexit vote, a new crisis that threatens to further loosen the threads of Europe is resurfacing in Italy. After the last sovereign debt crisis and banking sector woes, years of foot dragging is finally catching up with the beleaguered Italian banking sector. The resurgent issue of nonperforming loans on bank balance sheets has created a new problem for the embattled administration of Prime Minister Matteo Renzi while catching Europe off-guard at a moment when it is especially vulnerable. The tremendous slide in Italian banking shares has brought about new concerns that the entire sector needs to be recapitalized in a move that could further destroy confidence in the nation’s outlook. With these factors in play, the accommodative monetary policy backdrop is unlikely enough to prop up the benchmark Italian MIB as the financial sector sinks the index.

Looming Crisis

For years the Italian banking sheet has been under fire for its souring stockpile of nonperforming loans. Three years of recessionary-like conditions following the implementation of austerity to get the budget back on track have severely hobbled the economy which has been unable to mount a serious recovery. Unemployment, while improving, currently stands at 11.50% just as deflation remains an ever present risk with the latest headline annualized consumer prices reading marking 5-straight months of declines.Although the country boasts one of the best trade surpluses in all of Europe, falling prices do not bode well for the economic outlook. However, aside from the nation’s economic woes, are the problems created by the European Central Bank’s monetary policies and how it is impacting the banking system.

Interest income is a critical component of a healthy banking sector because as interest rates rise, banks are able to capitalize on these gains when lending money. However, with interest rates in negative territory thanks to the extreme policy measures of the ECB, the traditional banking model has been broken. Add to the fire the ongoing nonperforming loan debacle and the perfect storm appears for the entire sector. According to reports released last week, the idea initially was to recapitalize the local banking sector with EUR 40 billion of government funds which was quickly rejected. Then late in June the European Commission approved government guarantees to the tune of EUR 150 billion in order to provide liquidity to banks that were solvent. Nevertheless, Prime Minister Matteo Renzi seems prepared to go it alone if his calls for help are rebuffed by his European Union partners.

Italy Holds The Trump Card

In lieu of the Brexit referendum, voters and opposition parties across the European Union are calling on governments to hold similar referendums in an effort to give Europeans a chance to determine their own destiny. For Italy, this could be used as opportunity to force concessions from Europe in light of the UK’s decision to leave. After flatly rejecting Renzi’s plan to directly recapitalize the banking system that would go in defiance of recently written banking sector rules, the Euro Area could find itself trying to prevent the third largest member economy from making exit plans of its own. If Italy leaves, it could cause a cascade of exoduses from both the political and economic blocs, further crushing the European superstate dream.

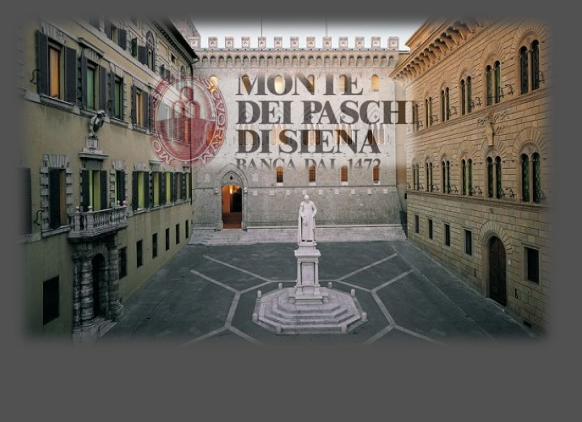

Now that the curtain has been pulled back on how stark the reality is for the entire banking sector, investors are running for cover. With the system on the verge of collapse, it seems that Europe is facing another panic that this time may emanate from one of the core European Union members and a crucial component of the Euro Area. The true extent of the nonperforming loan problem facing Italian banks is unknown, with figures ranging from $400 billion to as high as $540 billion according to certain estimates. As a result, banks in the nation are taking a deep dive, especially after it emerged earlier that Banca Monte dei Paschi di Siena (BMPS), the third largest Italian bank, was told by the ECB to reduce the amount of nonperforming loans outstanding by €14 billion, sending stocks into a tailspin.

Bank Run In The Wings?

The Italian MIB is comprised of 40 components, of which 9, or 22.50% are banking stocks. With the sector currently in ruins after Monte Paschi tumbled -13.99% alone during Monday’s trading session, the outlook for the entire index remains depressed. On the whole, MIB performance over the last 52-weeks has been extraordinarily disappointing, returning a miserable -28.81% for holders. During that time, only FinecoBank has outperformed the sector, falling -16.27% during the same time frame. With no clear end in sight for the system and a bailout not on the horizon, a creditor bail-in is possible, potentially sending depositors may to the exits. Despite trying to avoid this exact situation, Matteo Renzi might be forced to act in defiance of the Europe Commission to prevent a bank run, a move that might buoy the FTSE MIB and help performance, but destroy confidence in the European Union’s ability to manage crises.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading