Last week continued the theme as Yields broke lower and Bond buying picked up pace. Dollar selling was the currency trade of the week.

The Dollar fell 0.2% despite some positive economic data. Core PCE was in line and despite GDP being revised higher this failed to lift the US Dollar at end the week positive.

The Euro lost after last week’s gains. The CPI printed below expectations at 2.4% YoY vs 2.7% and could hit the ECB target soon. Talk oil rate cuts is beginning to become louder and this only added to downward pressure on the single currency.

The GBP didn’t have any major economic data during the week but continued its recent good form. GBP closed above 1.27.

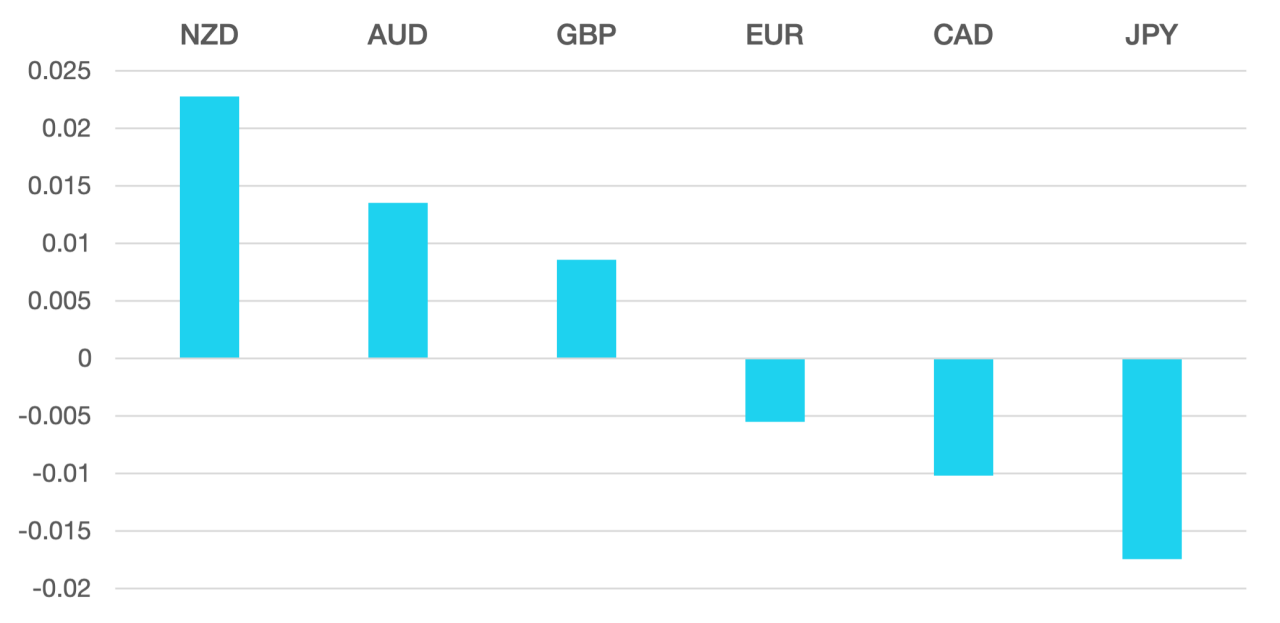

Commodity currencies are flying posting a third big week in a row. NOK and CAD both gained around 1%. AUD rallied 1.4% and NZD posted over 2% higher. US Yields continue to fall giving a significant boost to the commodities and general risk on.

The week ahead we have Yields firmly in the spotlight. Further retracement and bond buying could spur the USD to fall further and commodity currencies posting further gains.

Data for the week we have RBS Interest rates and BoC with both expecting no change. Friday, we have US Non-Farm Payrolls which could prove lively.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Yields Move Lower first appeared on trademakers.

The post Yields Move Lower first appeared on JP Fund Services.

The post Yields Move Lower appeared first on JP Fund Services.