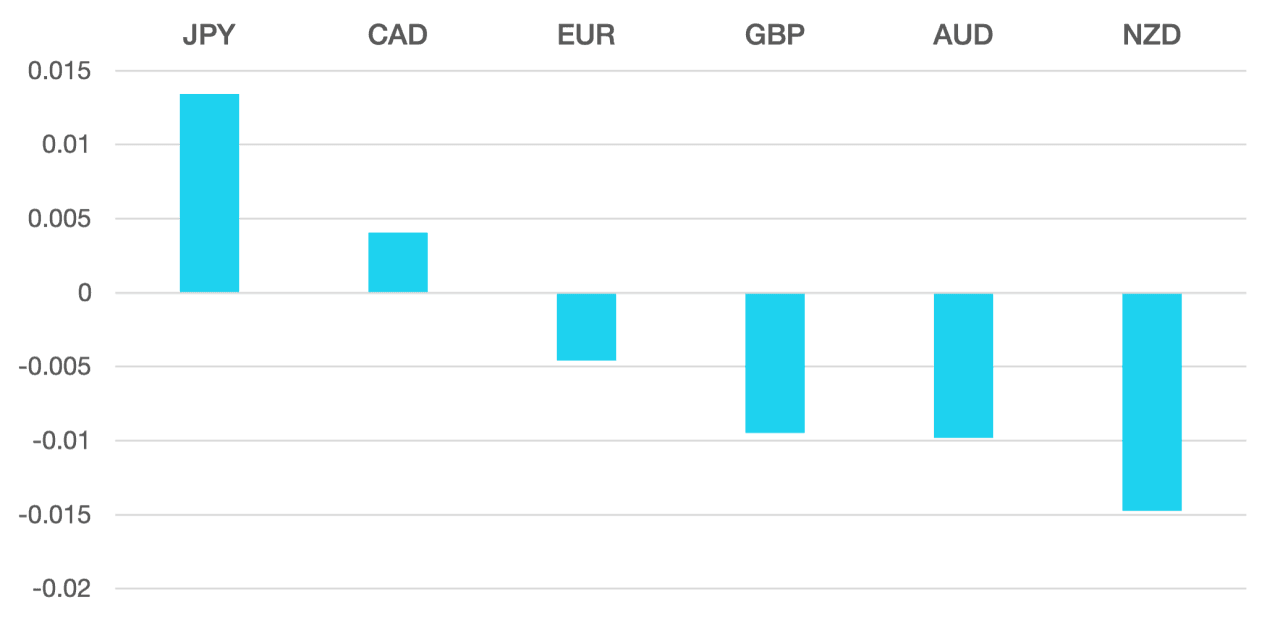

Last week the dollar ended the week the strongest. This was in contrast to the previous week where we felt the trend had reached a turning point.

Despite the reversal the Dollar remains well within the range pointing to the market waiting for Fed confirmation before the market makes its next move.

The Yen was the main loser along with the Kiwi. Yen is still dividing opinion as to if the BoJ will act or push their decision into April.

Kiwi lost ground as the Finance Minister gave a poor picture of economic outlook which could lead the RBNZ to cut rates earlier.

Euro and GBP had a quieter week falling slightly against a resurgent dollar. the Euro gained against the GBP on the week. ECB policy is clearer with a weakening economy, but inflation is more controlled. The ECB is looking to cut rates through spring.

Commodity currencies struggled with AUD and NZF falling the most. As said a weakening economy and poor outlook in New Zealand took its toll on the currency.

CAD lost ground despite good gains in Oil. WTI broke above $80 again to close 4.1% higher.

The week ahead is a busy one as more central bank decisions come into focus.

We have BoJ on Tuesday along with the Fed, BoE and RBA. This could lead to setting the trajectory for the coming sessions as guidance or decisions are confirmed.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post USD Reverse first appeared on trademakers.

The post USD Reverse first appeared on JP Fund Services.

The post USD Reverse appeared first on JP Fund Services.