Top Trading and Investing Startups to Watch.

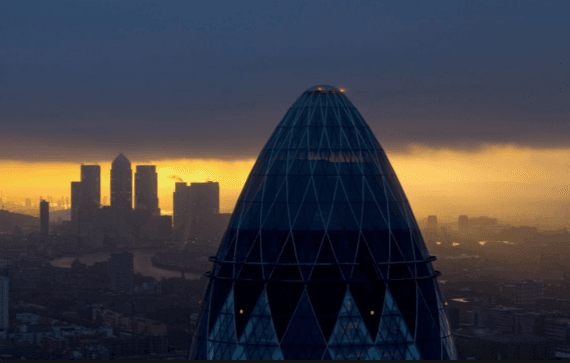

As Fintech continues disrupting the financial and investing / trading world there is a particular strong activity in the startup scene that is bringing a new stream of life to the way traders and investors are looking, managing and acting at the capital market world. From London Fintech capital where trading and investing Startups are emerging, but also in NY, San Francisco, Singapore, Switzerland, Hong Kong, Berlin, Brussels a lot of things are happening and traders and investors have fantastic ways to improve their trading as the industry evolves and innovates.

Traders and Investors are using new ways of trading and increasingly using algorithm platforms, data visualisation, and new dashboards, algorithm trading, social trading / copy trading functionalities and tools, and other fastest growing innovations in the trading / investing FinTech industry, taking the world of capital markets, indices, currencies and commodities by storm and somehow shifting the way trading is done.

Today’s brokerages and capital markets players are increasingly looking at self directed new retail platforms that assist traders and investors by working with blockchain, multi asset MAMs, hedge funds, portfolio managers, EAs, signals, cyber security, and in order to connect with each of these entities, a different method of integration is required, different APIs. Often, these integration are done manually, or in the case of hedge funds, they cannot be done at all.

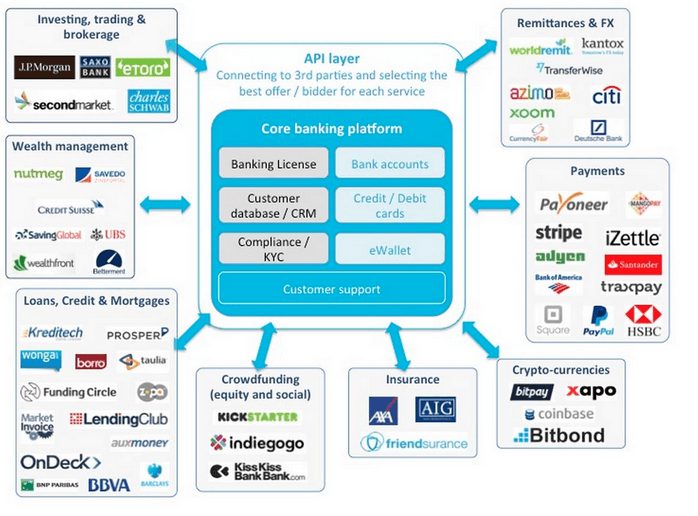

Fintech trading and investing, plus remittances and FX (Forex Exchange), Crypt Currencies, Crowdfunding, Payments, Loans, credit, mortgages and alternative finance new products, plus wealth management, peer to peer platforms, Social trading iare creating a new financial landscape and coming with an agenda to bring all these entities under one roof, with new innovative systems that make capital markets, data, financial process and information easily accessible.

Fintech new trading platforms are becoming the center of the engine for traders, investors and the industry entities supporting, in which traders and masters can both benefit through networking and sharing of ideas and skills but also improve and explore better ways of working. Just see the bellow graphic to see all the areas going in the Fintech technological API connecting 3d parties services and finance solutions providers.

Fintech Companies in Trading, Anti Fraud, Blockchain

Advanced APIs technologies integration, and algorithmic trading and investing is mainstream and most of the worldwide trading is processed by algorithms. With the advent of Algo trading and blackbox trading, blockchain technologies we will still see an encompass of new trading systems that are heavily reliant on new data dashboards, complex mathematical formulas and high-speed, computer programs to determine trading and investing strategies. Most startups offering solutions in these areas have an opportunity to be the next players. And big banks, wall street players, Silicon Valley, general investors and VC firms are conscious of that and investing heavily in this.

These new trading and investing startups are focused in exploring strategies that optimises the use electronic platforms to enter trading orders with better tools and algorithms which executes pre-programmed trading and investing instructions. These new innovations are accounting for a variety of variables such as timing, price, and volume.

Most of these new fintech innovations are now with API new integration, Algorithmic trading that widely used by trading brokers, robot advisers investing platforms, asset management, individual traders and investors, investment banks, pension funds, mutual funds, and other buy-side (investor-driven) institutional traders, to divide large trades into several smaller trades to manage market impact and risk. These startups have now a powerful opportunity and business market to showcase their products and services.

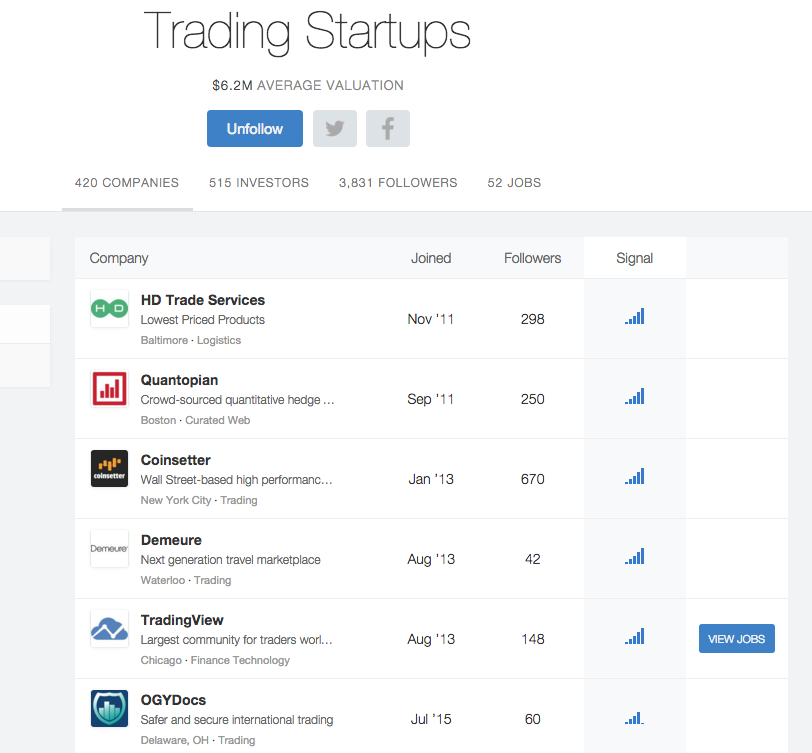

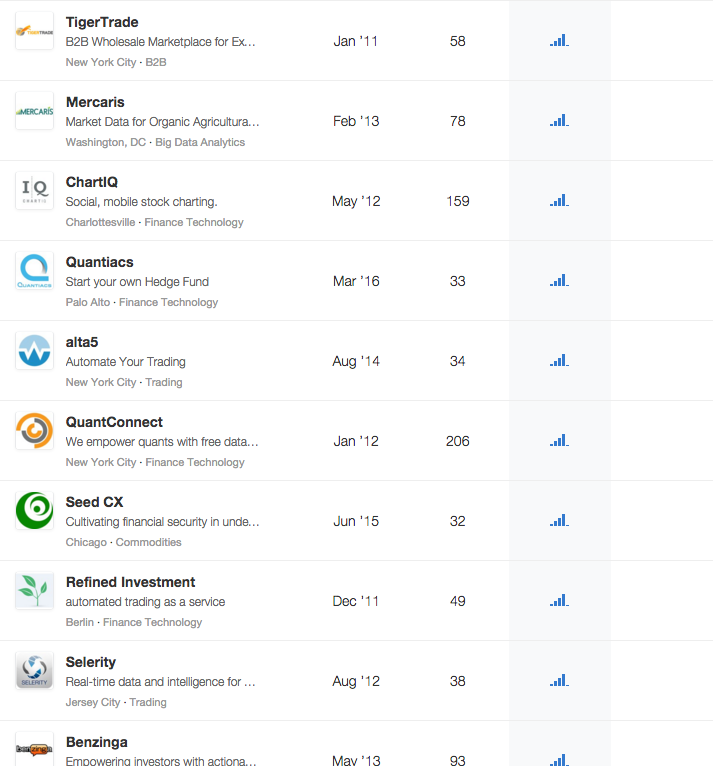

Some companies that we highlight are Quantopian, Coinsetter, TradingView, Quantics, Tradable, ChartIQ, Benzinga. Bellow some of the top companies highlighted by https://angel.co/trading

The investing platforms Angel.co highlights 420 trading startups / companies with 515 investors associated. Each of this startup has an average valuation of $6.2 M.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.