The increased use of cryptocurrency can be ascribed to the rise in crypto wallet usage. The number of crypto wallet users worldwide reached 84.02 million in 2022, up from 76.32 million in 2021. The number of cryptocurrency purchasers is more than before.

Cryptocurrency wallets are essential tools for storing, managing, and transacting digital assets. As the adoption of cryptocurrencies grows globally, the number of crypto wallets has surged, reflecting increased interest in blockchain technology and decentralised finance (DeFi).

As of 2024, the number of cryptocurrency wallets worldwide has surpassed 500 million, according to industry estimates. This figure has grown exponentially from just a few million in the early 2010s. Key statistics include:

- Bitcoin wallets: Over 200 million (including addresses on major wallets like Blockchain.com and Electrum).

- Ethereum wallets: Exceeding 90 million (MetaMask alone reports over 30 million monthly active users).

- Exchange-based wallets: Centralised exchanges like Binance and Coinbase collectively host hundreds of millions of wallets, though many are custodial.

The market for crypto wallets has expanded rapidly alongside the rising popularity of cryptocurrencies like Bitcoin and Ethereum. In 2021, the global crypto wallet market was valued at approximately USD 6.97 billion and is projected to grow at a compound annual growth rate (CAGR) of 24.31% from 2022 to 2030. By 2030, the market revenue is forecasted to reach around USD 48.42 billion.

Tracking the exact number of crypto wallets globally can be complex because individuals may own multiple wallets, and wallets can be dormant or active. However, estimates of active wallet users provide useful insight into the adoption rate.

- In 2021, the number of crypto wallet users worldwide was around 76.32 million.

- By 2022, this number had increased to approximately 84.02 million, reflecting a growth driven by broader crypto adoption and more accessible wallet solutions.

What is a crypto wallet?

To understand the significance of the number of crypto wallets worldwide, it is important first to clarify what a crypto wallet actually is. Contrary to what the name might suggest, a cryptocurrency wallet does not physically store cryptocurrencies. Instead, it securely holds the cryptographic keys, primarily the private key and the public key, that provide access to the digital assets on a blockchain.

When a user sends or receives cryptocurrency, what actually changes is the record on the blockchain ledger, reflecting the transfer of ownership from one wallet address to another. The wallet provides the interface and security for managing these keys, making it a gateway to interacting with cryptocurrencies.

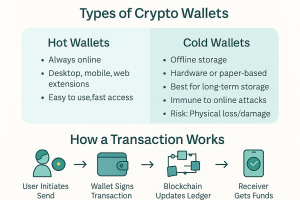

Crypto wallets are generally divided into two broad categories based on their connectivity to the internet:

1. Hot Wallets

Hot wallets are continuously connected to the internet. They can be software applications on desktops, mobile phones, or web-based browser extensions. Their main advantage lies in convenience and accessibility, allowing users to trade, send, and receive cryptocurrencies quickly.

Hot wallets often support features such as direct swapping of tokens within the app, integration with decentralized finance (DeFi) platforms, and Web3 applications. However, their constant online status exposes them to greater risk of hacking or malware attacks, making security a vital consideration.

2. Cold Wallets

Cold wallets, in contrast, are kept offline and provide enhanced security by isolating the cryptographic keys from internet access. These include hardware wallets, physical devices like USB drives, and paper wallets, which are physical printouts or engravings of private keys or QR codes.

Cold wallets are favored by long-term investors like Karen Florek who prioritize security over speed of access. They are less convenient for frequent trading but offer robust protection against remote hacking attempts. However, the risk of physical loss or damage to the wallet means proper backup and safekeeping are essential.

Regional insights and trends

North America: North America, particularly the United States, accounts for a significant share of the crypto wallet market. Approximately 22 million users are in the region, with 30 to 40% residing in the U.S. alone. The U.S. market is expected to represent more than 70% of North America’s crypto wallet market share by 2030. The presence of leading cryptocurrency companies and ongoing innovations contribute to this strong market position.

Europe: Europe is the fastest-growing market for crypto wallets, aided by increasing governmental support and regulatory clarity. The European Union’s initiative to develop a digital wallet for its citizens aims to facilitate seamless payments and secure digital identities across member states.

Asia Pacific: The Asia Pacific region has seen robust growth in cryptocurrency adoption, driven by markets such as China, India, Japan, and South Korea. Smartphone penetration and rising internet accessibility support wallet usage, although regulatory environments vary significantly across countries.

Top crypto wallets of 2025

Following thorough research and evaluation of security, functionality, and user experience, here are the leading crypto wallets in 2025:

1. Exodus

Platforms: Android, iOS, Linux, Mac, Windows, Chrome, Brave

Exodus offers broad support for over 50 blockchain networks and integrates natively with Trezor hardware wallets. Its built-in crypto swapping allows seamless exchange of assets without leaving the app. Exodus scores highly in security, with consistent marks across independent ratings. Exodus is a reliable choice for investors managing diversified portfolios seeking a balance between security and usability.

Pros:

- Extensive asset support

- Easy cross-platform use

- In-app swapping feature

Cons:

- Users cannot set exact transaction fees

- Lacks some third-party security audits

2. ZenGo

Platforms: Android, iOS, Linux, Mac, Windows

ZenGo employs Multi-Party Computation (MPC) cryptography, eliminating the need for seed phrases or private keys. Its user-friendly design and 24/7 live support simplify onboarding new users. ZenGo suits those new to crypto who desire strong security without managing complex private keys.

Pros:

- Keyless security model

- Straightforward setup

- Round-the-clock support

Cons:

- Limited supported cryptocurrencies

- Higher in-app exchange fees

3. Sparrow

Platforms: Linux, Mac, Windows

Sparrow is a lightweight desktop wallet dedicated to Bitcoin. It offers comprehensive control over transaction fees and multiple server connection options, including public, private, or Bitcoin Core servers. It supports the Lightning Network for faster, cheaper transactions.

Pros:

- Detailed transaction editor

- Supports all common hardware wallets

- Lightning Network compatibility

Cons:

- Requires Bitcoin knowledge to use effectively

- No built-in token swaps or fiat onramps

4. BlueWallet

Platforms: Android, iOS, Mac

BlueWallet combines a modern interface with advanced features such as Lightning Network wallets, multi-signature support, and push notifications for wallet activity. BlueWallet is well-suited for users looking for a feature-rich Bitcoin wallet on the go.

Pros:

- User-friendly on mobile devices

- Multiple Bitcoin wallet types supported

- Notifications to stay updated on transactions

Cons:

- Lacks educational resources for beginners

- Technical features may overwhelm casual users

5. Trust Wallet

Platforms: Android, iOS, Brave, Chrome, Edge, Opera

Trust Wallet supports an extensive range of coins and tokens, including Ethereum and Binance Smart Chain NFTs. It features in-app token swapping and a clean, straightforward interface. This wallet is a solid generalist option for mobile users engaging in various crypto activities.

Pros:

- Native NFT viewing support

- Largest coin support on mobile

- High security ratings

Cons:

- Limited ability to customise gas fees

- No live customer support

Challenges in measuring crypto wallet numbers

While wallet counts provide insight into adoption, several challenges affect accuracy:

- Multiple wallets per user: Many individuals create multiple wallets for security or different use cases.

- Inactive wallets: A significant portion of wallets may no longer be in use.

- Exchange custodial wallets: Centralised exchanges hold assets on behalf of users, meaning one exchange wallet may represent thousands of customers.

- Lost or forgotten wallets: Millions of Bitcoin wallets are estimated to be inaccessible due to lost private keys.

Future projections

Estimates suggest that by 2030, the number of crypto wallets could exceed 1 billion, particularly if blockchain technology becomes a standard part of global finance.

The number of crypto wallets is expected to continue growing, driven by:

- Mainstream financial integration: Banks and payment providers incorporating crypto services.

- Web3 and metaverse expansion: Increased need for wallets in virtual economies.

- CBDCs and stablecoins: Central bank digital currencies may interact with existing wallet infrastructures.

- Improved security: Advances in biometric and multi-signature wallets could attract more users.

Final thoughts

The number of cryptocurrency wallets worldwide has grown significantly, reflecting broader adoption of digital assets. While exact figures vary due to duplicates and inactive wallets, the trend is clear: more individuals and institutions are engaging with blockchain technology. Regional differences highlight varying levels of adoption, influenced by economic conditions, regulations, and technological access. As the crypto ecosystem evolves, wallet usage will likely expand further, playing a central role in the future of finance.

Understanding these trends helps stakeholders—investors, developers, and policymakers—navigate the rapidly changing landscape of digital assets. While challenges remain, the continued growth of crypto wallets signals a shift towards a more decentralised and inclusive financial system.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.