Raised expectations that the US government will reach a deal to avoid defaulting on debts has seen risk return to the markets, with the Australian dollar being one of the biggest beneficiaries.

Markets have been jittery over the past few weeks about the prospect of a historic US default, with politicians involved in a bitter stand-off over debt levels and funding for President Obama’s healthcare reforms.

However, comments yesterday from the Democrat US Senate Majority Leader Harry Reid revealing that “tremendous progress” had been made in talks on Monday with his Republican counterpart have been taken as a sign that the crisis could soon be at an end. Expectations are growing that a deal could be reached later today, ahead of the debt ceiling deadline this Thursday.

Optimism surrounding a potential deal has seen investors return to riskier assets such as the Australian dollar, which hit a four-month high against the US dollar this morning. It was also bolstered by the publication of central bank meeting minutes indicating that Australian policymakers are in no hurry to cut interest rates.

The Aussie was up 0.6% to $0.9547 this morning, its highest point since June, and the minutes seem to have been the main driver of this rise. Moves in other major currency pairs were less dramatic, with the euro trading within its recent $1.35 to $1.36 range, and the dollar dropping 0.2% against the yen having hit a two-week high of 98.71 earlier on.

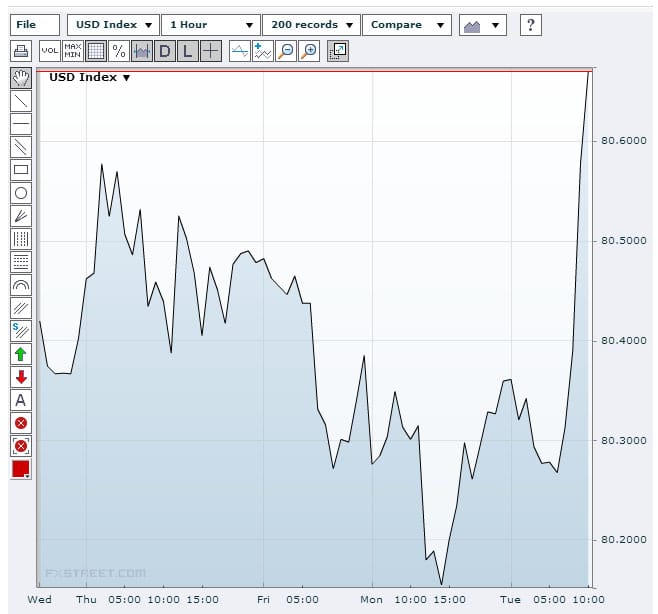

The dollar index rallied strongly this morning as US markets opened, rising quickly from a low of 80.2697 to above the 80.7000 mark.

Source: FXstreet

While markets are optimistic about the talks, the plan under discussion will only raise the debt ceiling until mid-February 2014 and fund the government until January, which means that there could be another standoff within months.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading