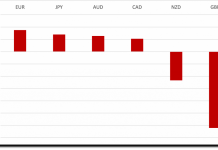

The euro dipped slightly this morning in the wake of continued uncertainty over Angela Merkel’s future coalition partners. Merkel’s CDU party scored a resounding victory in Sunday’s election, but fell short of the votes needed to form a majority government, and it is not yet clear which of the rival parties she will form a coalition with.

Source: FXstreet

“It will be tough to buy the euro strongly on the German elections as it will be some time before we know what kind of coalition we will get,” said Antje Praefcke, currency strategist at Commerzbank in Frankfurt, speaking to Reuters.

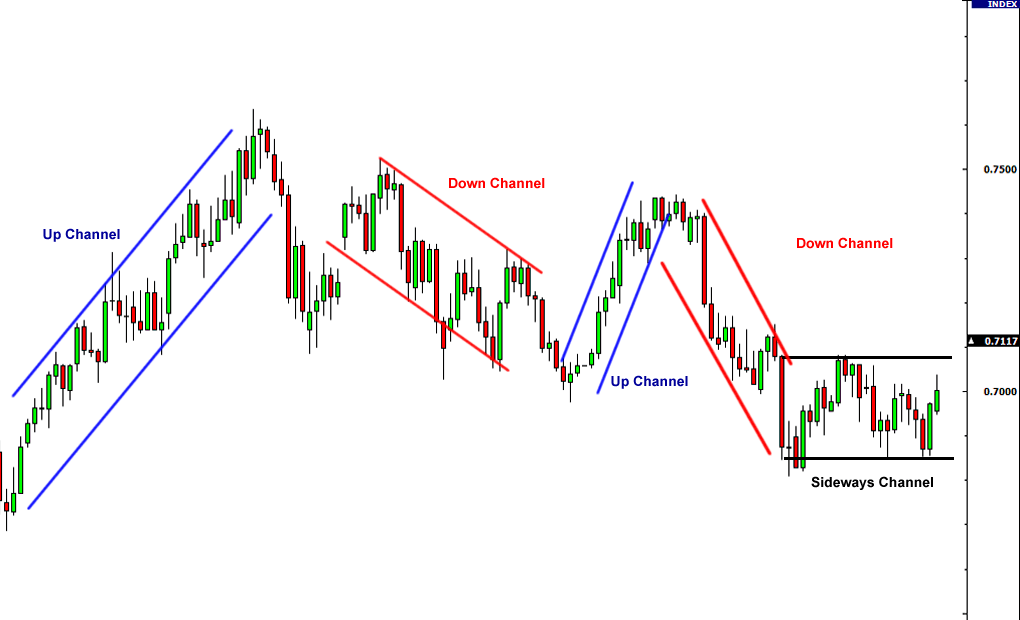

The euro had made significant gains against the dollar last week, although this was more to do with the Fed’s surprise decision not to begin scaling back its monetary stimulus programme than any inherent strength in the eurozone economy. While the euro had been boosted slightly by data that showed an above-forecast increase in private sector business activity, this was offset by a slowdown in German manufacturing activity growth.

The euro may struggle to build on the gains of last week unless forthcoming data points to an improving eurozone economy. The key news releases this week are the German Ifo sentiment data, and testimony from ECB President Mario Draghi later today.

Meanwhile, the dollar index has been holding stead at around the 80.409 mark, recovering from last week’s seven-month low. The increase was driven by comments from a top Fed official on Friday that suggested the tapering process may begin next month. Other Fed officials including Richard Fisher, William Dudley, and Dennis Lockhart are due to speak later today.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading