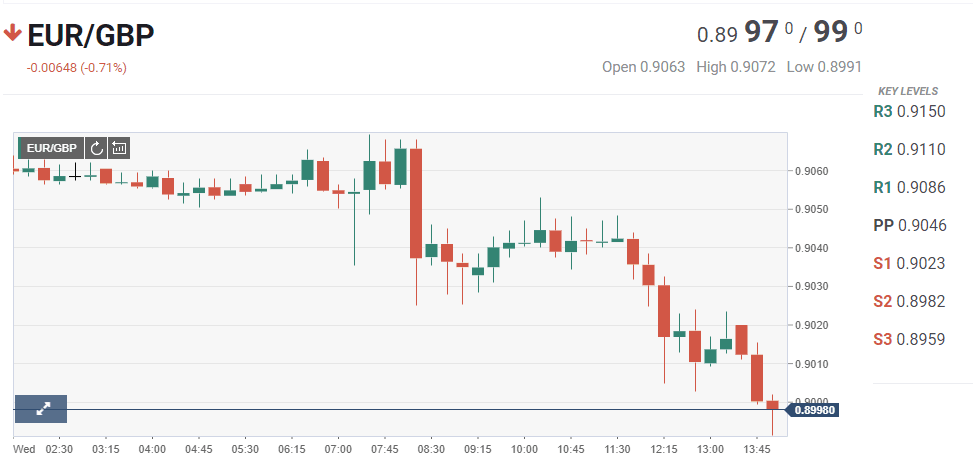

After the recently announced vote of no confidence that PM Theresa May has to face within her own Tory party, markets have reacted as expected and the Pound Sterling has gone down again against its major competitors. As of today, The EUR/GBP cross trades around 0.9010 at the time being, its highest in over a month, up for the day amid Pound’s weakness.

Regarding the news that the pound sinks even lower after Brexit deal vote was postponed and no confidence vote was risen, Mihir Kapadia – CEO and Founder of Sun Global Investments, has said:

“Pound Sinks Even Lower After Brexit Deal Vote Is Postponed “With the Parliamentary vote over the Brexit deal postponed, the pound has continued its decline as Prime Minister May frantically looks to save her Brexit deal. Although European stock markets have been lifted today by the turnaround and recovery overnight in US stocks and some positive sentiment over the US-China trade dispute, Brexit continues to weigh on sentiment, and is likely to influence trading between now and March 2019 when the UK leaves the EU.

Concerns over the prospect of a no-deal Brexit have increased as the EU continues to insist the Brexit Withdrawal Agreement will not be re-opened. As a result, this is only likely to add to more pressure on the Pound.”

As such, the firsts to suffer this pound sink are Business, which are left once again aside from Brexit consequences and must hold all of this political turmoil. “The latest developments in the Brexit process have served to highlight the current chaos that has surrounded it since the results of the referendum in 2016. With the pound reaching new lows and growing uncertainty around Theresa May’s withdrawal agreement, the likelihood of MPs triggering a no confidence vote against the Prime Minister remains high,” continued Mr Kapadia.

This has been a possibility since Jacob Rees-Mogg issued a vote of no confidence last month following the draft agreement and has raised enough popularity to trigger a no confidence vote amongst Brexiteer MPs within her party when voting over the deal recommences. A no-confidence motion against May will only delay the Brexit proceedings further and increase the likelihood of a no-deal Brexit.

With just four months to go to the scheduled date for the UK departure, stability and confidence are essential for investor and business confidence in what is expected to be a difficult time and development.”

The EUR/GBP cross rates has been struggling with its 200 DMA throughout the past week, with the shorter ones below the larger. Now the daily chart shows that it´s firmly advancing above all of its moving averages while technical indicators gain upward momentum within the positive ground, supporting additional gains ahead. October 12 daily high at 0.9032 comes as immediate resistance, followed by the 0.9050/60 price zone. Supports come at 0.9000, followed by the daily low, at 0.8957.

Sun Global Investments Ltd. is an international financial services firm based in London, providing a full scope of services to institutional investors, corporate companies, family offices and high net worth individuals. Established in 2008, in the midst of turmoil in the financial services industry, Sun Global identified lucrative investment opportunities in emerging market corridors and has since established itself as a trusted boutique firm for investors looking to take advantage of these versatile markets.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.