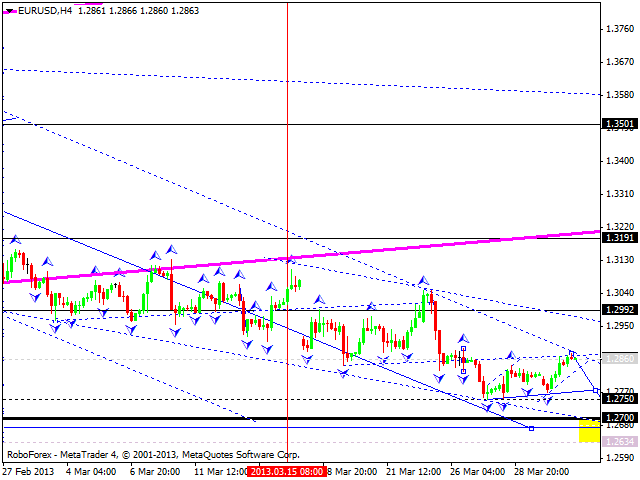

EUR/USD

The EUR/USD currency pair completed a correction. We think today the price may break an ascending channel and fall down to reach a new minimum and reach the level of 1.2700. Later, in our opinion, the pair may start forming a reversal structure for a new correction.

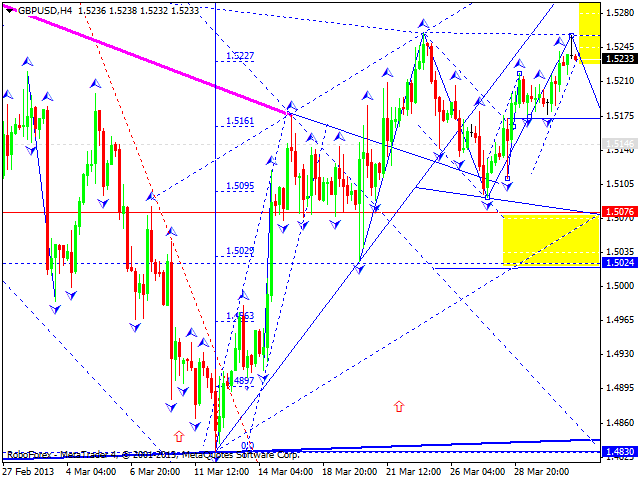

GBP/USD

The GBP/USD currency pair is moving near its maximums; a correction of the previous wave was quite short.We think today the price may form another descending structure to reach the level of 1.5080 and then start a new ascending movement towards the target at 1.5400.

USD/CHF

The USD/CHF currency pair reached the target level of the first descending movement. We think today the price may leave this descending channel and move upwards to return to the level of 0.9500. After that the market may define future scenarios. The main scenario implies that the pair may continue falling down towards the target at 0.9300; an alternative one – another ascending structure to reach the level of 0.9600.

USD/JPY

The USD/JPY currency pair is still moving inside a descending channel; the price completed a correction. We think today the price may start forming a reversal pattern for a new ascending movement. Later, in our opinion, the pair may test its maximums once again. The target is at the level of 99.90.

AUD/USD

Australian Dollar is falling down; this movement may be considered as the first wave. The price corrected this wave and tested the broken channel from below. Later, in our opinion, the pair may start another descending structure to reach the level of 0.9300.

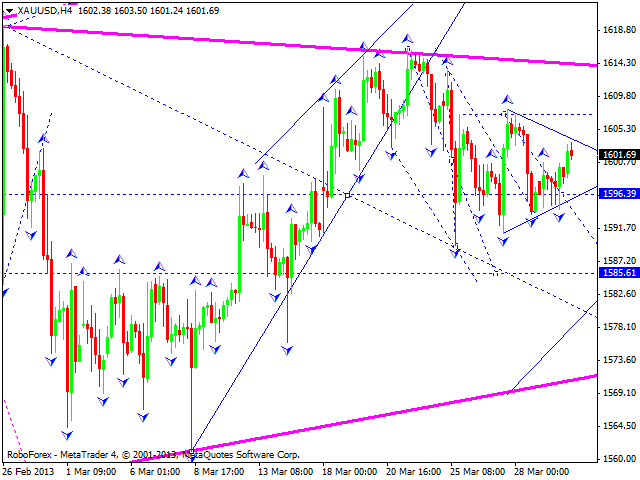

GOLD

Gold is still moving inside a narrow consolidation channel. We think today the price may move upwards to reach the level of 1640. However, an alternative scenario implies that the instrument may fall down towards the level of 1585 and then start a new ascending movement to reach the target at 1640.

This Market Analysis is reproduced here with permission from RoboForex’s Analytical Department. Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading