Before we review our Breakout EURUSD, let’s start here on the US Dollar versus the Swiss Franc [USDCHF]. We’ve been looking for opportunities to go long in the direction of our current momentum, which has been clearly bullish along the blue trend line. So, yesterday we saw the market push above. After the market opened, push above the 0.9750-level. As it dipped back down to that 0.9750-level, as it came back down into that support, looking for a buy and targeting the top of our long-term daily channel that we’ve been studying into the 0.9800-level.

You could see the trade going down here at the very bottom of the chart. There it is right there. 0.9757 was the entry. Currently sitting 28 pips of profit on the trade. Of course, the trade manager is in play, taking advantage of the trade manager, locking in the stop loss into profit as it continues to move in our direction. Again, we’re targeting 0.9800 on the USDCHF.

Next, moving over to the US Dollar versus the Canadian Dollar [USDCAD]. You could see that going down here. 1.2880 was the buy. We saw it dipping down here, again, into the support zone, the orange-shaded area. So, a buy into 1.2880. A little bit more aggressive maybe than normal, but because oil prices have been on the rise, but have an opportunity now. We’re sitting with 45 pips of profit from the orange-shaded area. Now looking for it to continue to pressure higher towards the 1.3000-level.

Of course, US data today could change all of that, but looking for the 1.3000-level as our target. If it can break above there, much more profit could be seen. If oil takes a significant rise again, we’ll probably look for this to turn back down. Of course, we’re using the trade manager to manage the profit and the trade, so we’re at break even or better than break even at the current moment. So, we’re locked into profit. Can’t lose on the trade. But watching oil prices and the news coming up in about 25 minutes of the recording of this video.

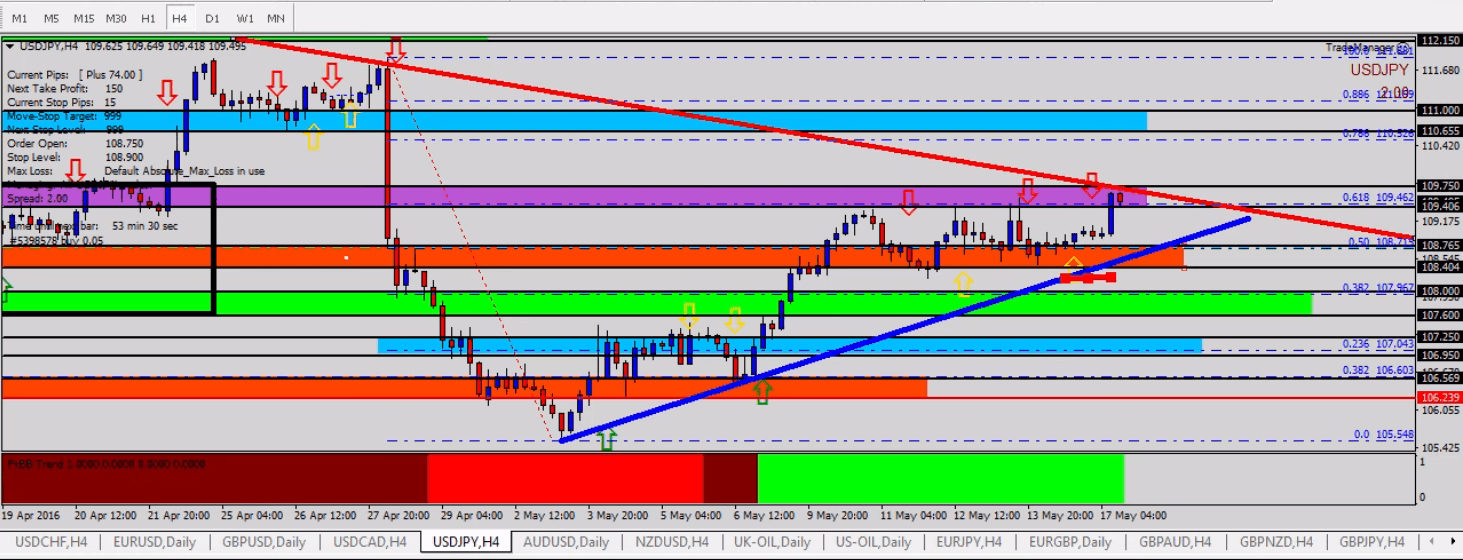

Next, let’s head on over to the USDJPY. It was sitting on top of this orange-shaded area. Of course, we’ve seen bullish momentum over the past couple of days. Actually since the beginning of May we’ve seen more bullish than bearish momentum, so looking for a rise into the resistance zone, into the mid-109s. So, the market was sitting on top of 108.75. There’s the trade going down right here at 108.75. Sitting 74, 75 pips of profit at the current moment. I saw a little bit more just a short while ago, but looking for the breakout above 109.75 and the continuation towards 110. We’ll watch the US data. Could send this back down again for the USDJPY.

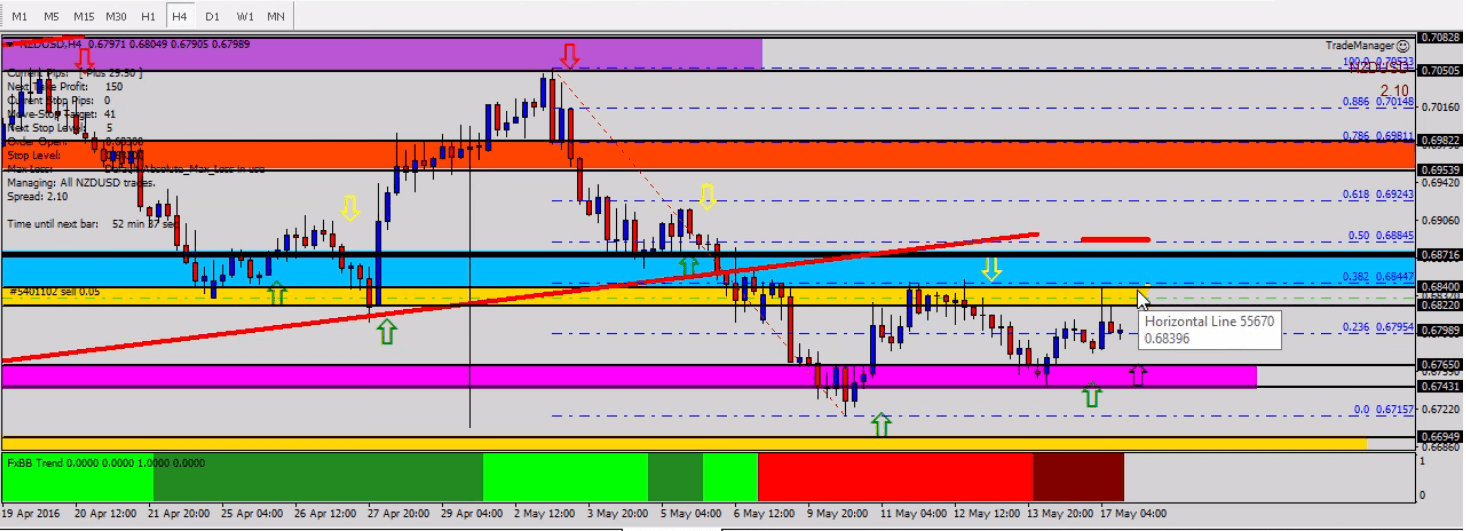

And lastly, NZDUSD. We saw the market rising. We talked about this yellow and the blue-shaded areas yesterday and the opportunities that would arise if it came back up into 0.6820 to 0.6840. I placed a sell right in the middle of the yellow-shaded area at 0.6830. The market took me in. Sitting about 30 pips of profit on the trade right now, looking to target the pink-shaded area on down here towards the 0.6765, 0.6750-level on the way down. If it turns around and goes back up, that’s okay. Of course, we’re using the trade manager to manage the profit on that trade.

So, all four of those working out quite nicely in our favor. Of course, we discussed yesterday the potential impact of news on the AUDUSD, and that of course caused the market to spike higher and then rapidly pull back at the current moment. Take it down to the four-hour timeframe. There’s the spike higher. So, that was the risk on the news. As I mentioned yesterday, if the market hadn’t taken me into the trade before the news, it would be a good idea maybe to remove that pending order before the report. And at least at this point, that looks like it was a good idea because it had made that spike higher.

I think if we can get some bearish momentum back into this and it gets back underneath 0.7300, we’ll look for the resumption of the downtrend. Any bullish momentum and maybe weak data out of the US coming up here in a few minutes, we could look for this to go back up again.

Same thing over here on the GBPUSD. We had a trade going right around the 1.4400. Maybe just a little bit shy of the 1.4400-level. The market just continued to pressure higher back into the 1.4500-level. That one was a stop loss for us because we were in the trade. That one was a stop loss, so hopefully you were using appropriate risk strategies. In that case, all these other four trades have clearly made up for that stop loss without any problem there.

I think, at least for the day today, that data was not perfect. I mean we did have a poor little data out of the UK, so I would suspect we’re still going to look for resistance here at 1.4500. And the only reason to start buying this pair is if it gets back above 1.4550 or so, above the orange zone. That way, I think we’re looking for a buy scenario. Otherwise, underneath 1.4500, I believe it remains a sell situation here for the GBPUSD. Something to watch for as we go through our day.

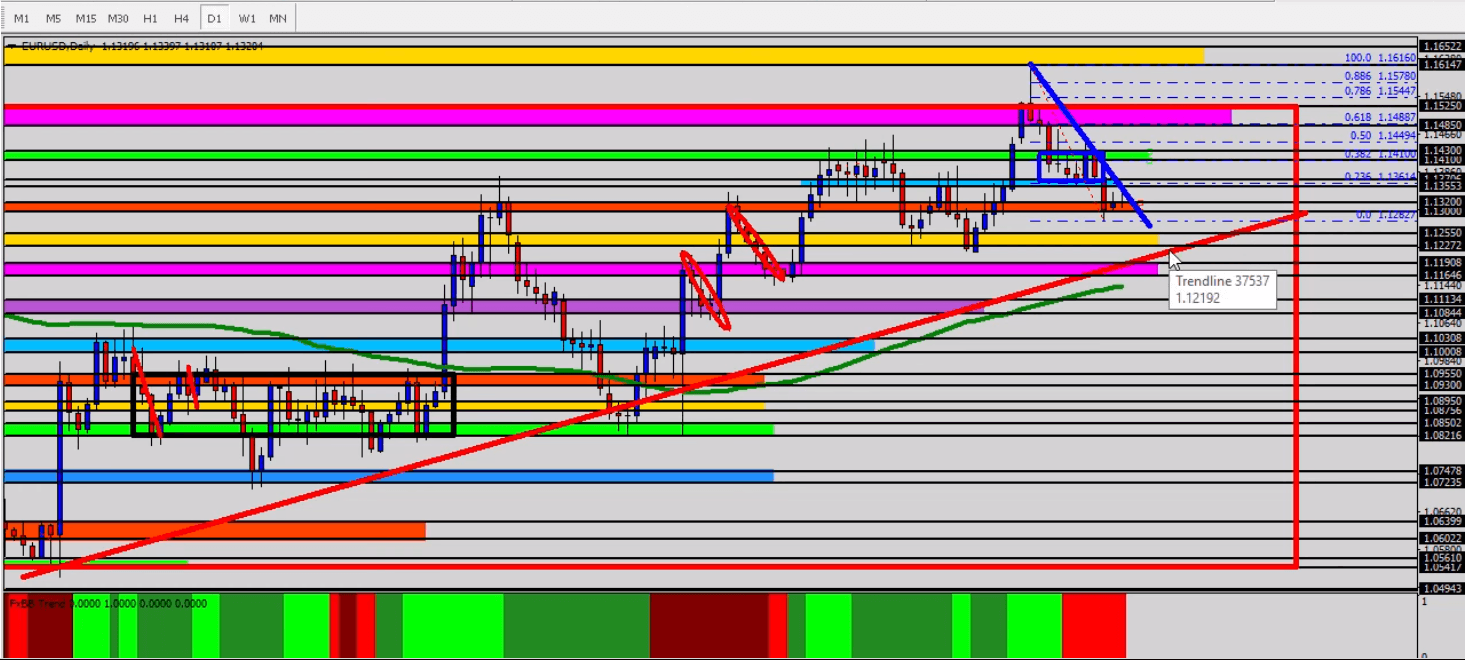

Take it over here to the EURUSD. Of course long-term weekly timeframe. Real quick. We have been studying the long range since January 2015, the red box that you see here on the weekly timeframe, so that’s something to consider. You take it down here to the daily chart. There it is right there. There’s the red box. We’ve been up there at the top and reversed off of the top of that range and the red box. So, we have some bearish momentum starting here. Of course, US data today could change all of this, but something to watch for is that bearish momentum.

Zoom it back in here a couple of times here on the daily. Take a look at our orange-shaded area holding as support. Two and now the third day sitting into 1.1300, 1.1320, so right now the orange zone support. If it finds support, we get weak data out of the US today; we could look for this to take another rise higher. Maybe back to the blue-shaded area here or possibly as high as the green-shaded area today. That would be interesting, and we’ll look at that later in the Trade Room as a potential head and shoulders pattern developing here for the EURUSD.

Now, if we get good news out of the US today, a breakdown of the orange zone, a push underneath 1.1300, we’re back down into the mid to low-1.1200s, and that’s the yellow-shaded area down here. So, what I’m looking for today is either bad news out of the US, causes this to go up, giving us a selling opportunity into resistance similar to what you might have looked for here at the green zone. Sell opportunity into resistance for the EURUSD will be our next move. Otherwise, if it’s good news, we look at the breakdown of 1.1300 and selling opportunities targeting into the mid to low-1.1200s for the EURUSD today.

Source: Forex Traders Daily

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.