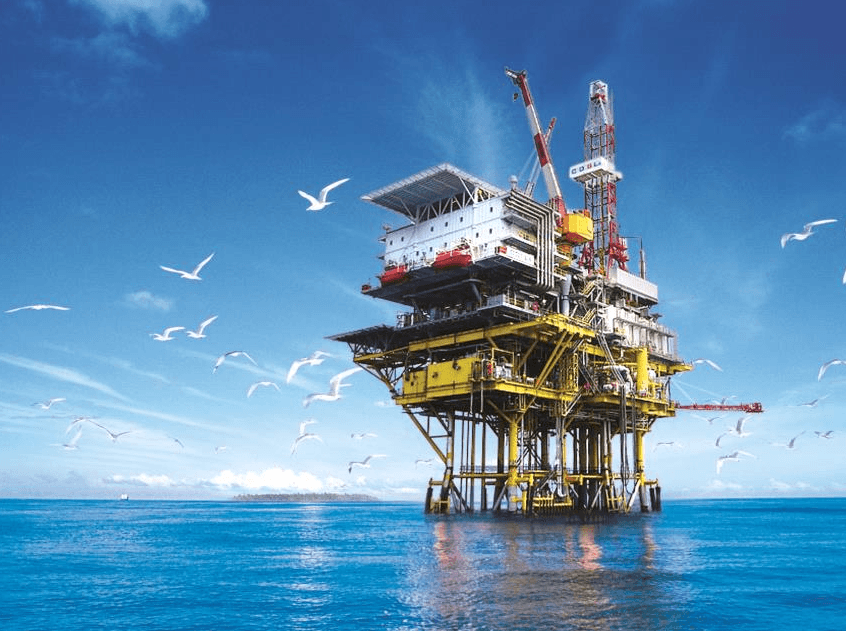

Oil prices declined Monday after government data showed another slowdown in China’s official growth rate, raising fresh fears about waning global demand.

China’s gross domestic product (GDP) expanded at the slowest pace in six years in the third quarter, the National Bureau of Statistics reported Monday, making it more likely Beijing will introduce additional stimulus measures in the coming months to stimulate growth.

The Chinese economy expanded 6.9% annually in the third quarter following an annual increase of 7% in the April to June period. A median estimate of economists had called for a gain of 6.8%.

Separately, China’s industrial production grew by a disappointing 5.7% in the 12 months through October, official data showed. That followed a gain of 6.1% in September.

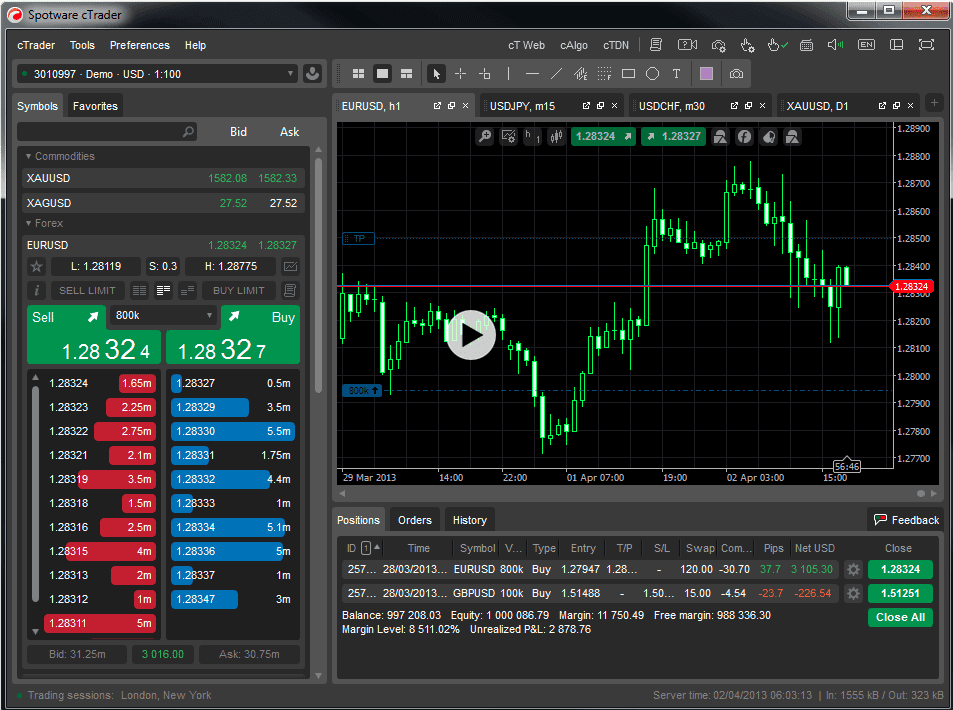

Oil prices declined sharply as a result, with international benchmark Brent crude slipping $1.06 or 2.1% to $49.40 a barrel on ICE Futures Europe. US benchmark West Texas Intermediate (WTI) for November delivery fell 83 cents or 1.8% to $46.43 a barrel on the New York Mercantile Exchange.

Oil prices declined last week after government data showed a bigger than expected rise in US commercial inventories. Crude stockpiles rose by 7.6 million barrels in the week ended October 9, the Energy Information Administration said last Thursday.

As the world’s biggest energy consumer, China plays a significant role in the direction of oil prices. Even the perception of waning demand in the world’s second-largest economy is often enough to weigh on investor sentiment.

Oil prices weren’t the only commodities affected Monday. The price of gold also fell to nearly one-week lows. Gold for December delivery bottomed out at $1,170.50 per troy ounce on the Comex division of the New York Mercantile Exchange. It would later settle around $1,176.30.

Asian stocks were mostly lower on Monday, with Tokyo’s Nikkei 225 Index closing down 160.57 points or 0.9% at 18,131.23.

In China, the benchmark Shanghai Composite Index closed down 0.1% at 3,386.70, only its second drop since mainland markets reopened on October 8.

The CSI 300 Index that tracks shares in Shanghai and Shenzhen was unchanged, as was the Hang Seng Index in Hong Kong.

European stocks wavered Monday before ending mostly lower. The major averages in London, Paris and Madrid were trading in the red. Frankfurt’s DAX Index was up 0.4%.

The pan-European STOXX 600 Index was up 0.1%.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading