The Greek government will not renege on its campaign promises to voters in its negotiations with creditors, a government spokesperson said on Thursday, raising the likelihood of a cash crunch just days before a crucial IMF payment.

“We won’t go beyond the limits of our red lines,” Gabriel Sakellaridis said in a press conference in Athens, referring to labour and pension issues.

Sakellaridis added that the Greek people should not expect that the government “will back down on everything.”

The Syriza party spokesman reiterated that his government was prepared to repay its financial obligations, but was looking to the European Central Bank to ease its liquidity restrictions. Sources close to the negotiations suggest the ECB is highly unlikely to give Athens such leeway unless Eurozone ministers agree to lift the current bailout impasse.

Greece’s troika of creditors – the European Union, International Monetary Fund and European Central Bank – are demanding widespread economic reforms ranging from public service cuts to privatization in exchange for unlocking bailout funds. Both sides have been locked in a months-long battle to secure Greece’s financial future in the Eurozone.

The cash-strapped Greek government is on the hook for another €763 million payment to the IMF on Tuesday. Greece’s controversial finance minister Yanis Varoufakis insists that Athens will meet the deadline. On Thursday he said a deal between Greece and its creditors was getting close.

Negotiations are expected to continue over the weekend, as both sides look to establish a common framework in time for next week’s Eurogroup meetings. The ministerial meetings kick off on Monday in Brussels.

Next week’s agenda states that EU finance ministers will be “briefed on the state of play in the ongoing discussions between the Greek authorities and the [troika] … on the list of reforms that the Greek government is expected to complete under the current agreement.”

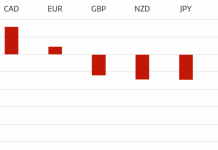

A failure to solidify an agreement this month threatens to push Greece out of the Eurozone. The “Grexit” or “Grexident” scenarios could lead to a dangerous aftermath for the shaky currency union, whose very legitimacy would be threatened by such developments.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading