Last week we saw the US inflation report come in higher than expected. YoY dropped to 3.1% but it fell less than markets expected. The led the DXY Index to new 3-month highs and push lower yielding currencies like Yen to new lows.

Any hopes of a March rate cut are now firmly off the table after the Fed Chair pushed back on expectations earlier this month and the higher-than-expected inflation report.

The Pound initially sought support after a better-than-expected result after the Unemployment announcement and stronger wage growth. However, any expectation of the Pound rising was dashed later in the week as the UK economy confirmed it was in recession in the second half of 2023.

Euro as ever continues to languish. The Eurozone managed to avoid recession but only just with GDP flat in December. We are seeing some shoots of hope as leading Euro Economy indicators are showing signs of improvement especially the German ZEW survey which was the highest in almost 12 months.

Commodity currencies were quiet apart from the lower yielding JPY which suffered vs a strong Dollar. This was coupled with a drop in December GDP which will make any potential change in policy for the BoJ less likely.

The week ahead we have more central bank announcements. We also have key manufacturing and PMI from the US, UK, and EU.

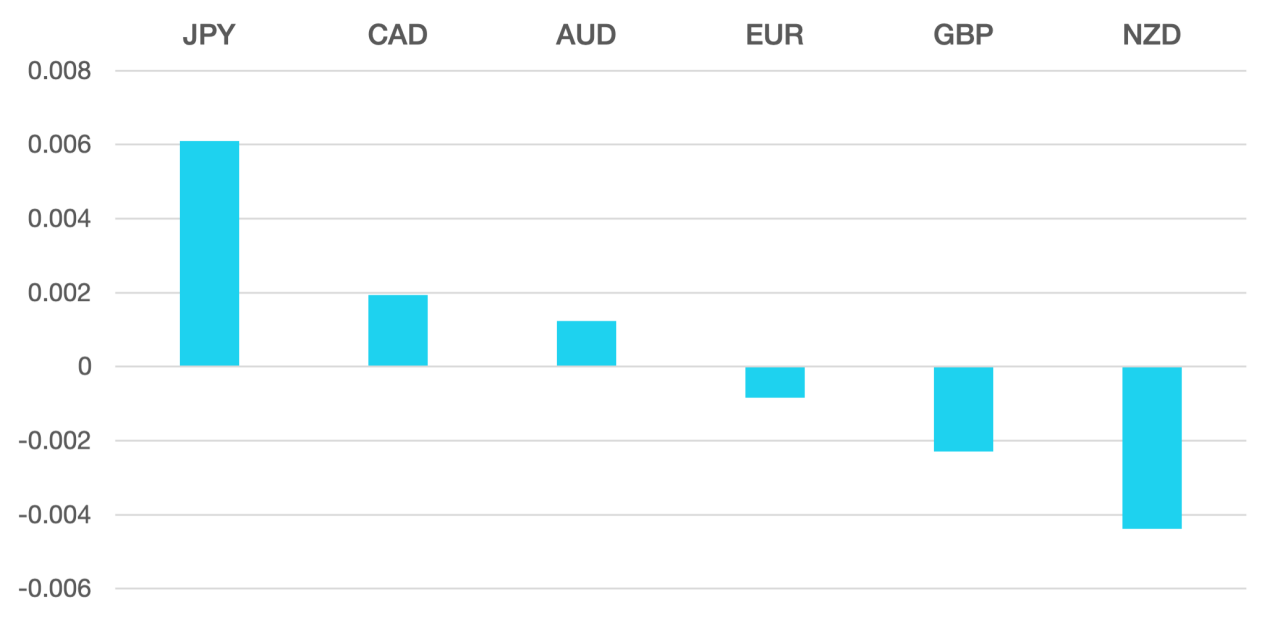

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Inflation Continues to Quell Fed Cuts first appeared on trademakers.

The post Inflation Continues to Quell Fed Cuts first appeared on JP Fund Services.

The post Inflation Continues to Quell Fed Cuts appeared first on JP Fund Services.