Gold or Bitcoin – Where is the Future in a Digital Blockchain new Economy?

Introduction – In an increasingly digitised world economy where do you position bitcoin and gold?

The world economy is only in its early days of digitalisation. At the moment there is a process of understanding the paralel between commoditisation and digitalisation of the economy and special finance and trading will be critical in this new world. What is critical is how to leverage real economy and digital economy and this is paramount as there is a dysfunctional unbalance between all present commodities values and all digital assets, such as tech stocks and bitcoin valuations and old solid commodities value such as Gold, silver in one hand and bitcoin and digital currencies or tech platforms worth more than most of the countries.

The global increasing use of digital technologies can add over $1.36 trillion to total global economic output in 2020, (data from 2015) according to a study by Accenture and Oxford EconomicsSource. This may be only a fraction of the total global gross world product (that has various valuations according to different sources, but generally sized between $70 and $87 trillion source Bloomberg / WEF), but there is still a substantial space for contribution to growth. The challenge is how to manage a valuation between real economy and commodities such as gold and the emergence of digital crypto currencies among others Bitcoin.

The entire new global economy is digital, and is one that specifically is designed for the digital realm but lacks still full capacity to be properly managed in an efficient digitalised way. With the world in financial disruption and in some cases disarray, as national currencies are failing and economies in flux, the introduction of a global currency can solve many of these issues.

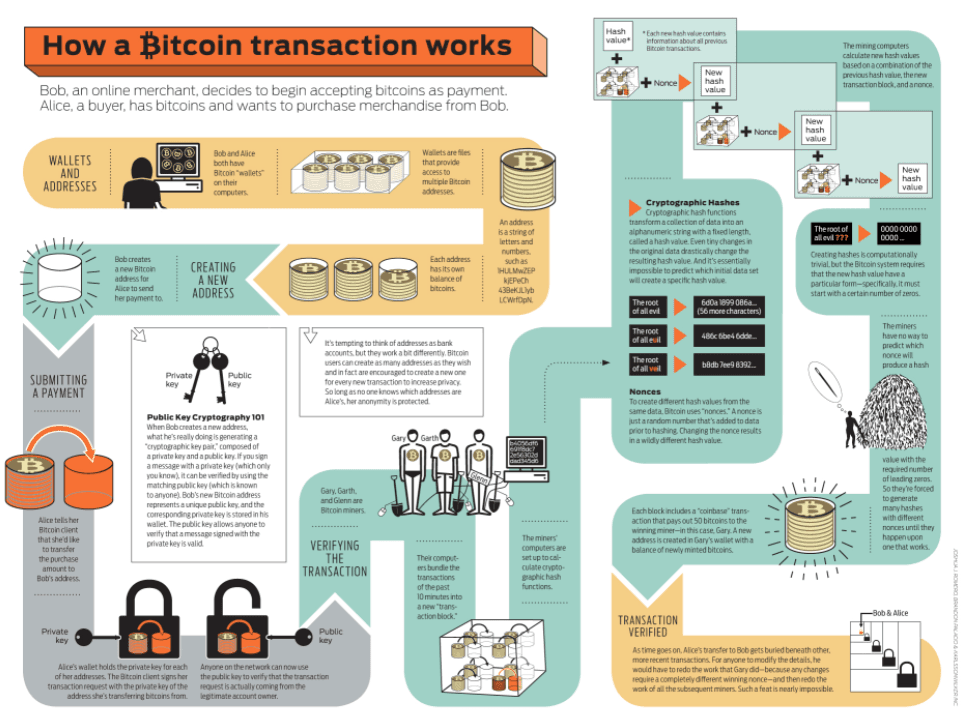

Bitcoin, is a decentralised digital electronic currency, or so called ‘cryptocurrency’, that uses powerful peer-to-peer networking, both of people and computers through distributed blockchain ledgers, digital signatures and complex algorithms to generate currency without having to operate through middle men or central authority, such as a banks, regulators and so many other organisations.

This digital growth and density is increasing as the share of the internet economy grows and special trading and investing become almost fully managed by algorithms and tech platforms and by the full shift or emphasis in multiple indicators across set broad activity areas of a business or economy, which include:

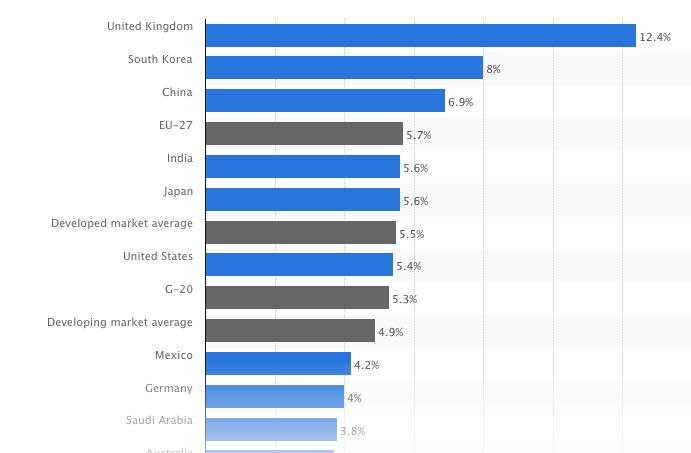

- The increasing digitalisation of present existing economy is only at its inception. Industry experts estimate that the share of the internet economy in the GDP of the United States to reach 5.4 percent in 2017. The data shows that in developed market average is projected to be 5.5 percent, the rest of the world even less.

- As this value augments will make the digital become the default setting of global economy, special bearing in mind all the fintech revolution going on and the size of capital markets (both real money trading and leveraging of money) and the fast growing creation of new digital models and capital markets;

- Variation between reality and virtual reality of teh economy and digital goods economy.

- The increase usage of businesses’ of digital technologies and activities to execute their key business functions and the value that it creates, special in tech stocks and companies valuation;

- The use of digital technologies to source and/or use factors of production or create alternative crypto currencies, such as land, capital, bitcoin type of currencies, talent, plant, and property;

- Changes in institutional and socio-economic fast disruptive environments to facilitate the process of full digitalisation.

- Leveraging the realism in the economy and trading and the various leveraging of trading and related assets and how that is processed in debt creation.

To put it in perspective, as the global economy and capital markets moves forward the full-force with digital and all new foundation technologies – blockchain, AI, IOT it would add an economy the size of South Korea to the global market (current GDP at $1.3 trillion). This is in my view a conservative estimative. At the moment the biggest corporations in the world economy are digital players that based their business and capital markets in trust and in virtual systems.

This is where the Gold versus Bitcoin DNA poses a strong metaphor and paradigm for looking at the evolution of the world economy, special the future of money and capital markets as we push algorithm processing operation with AI and machines for everything we do.

Gold in a Time of The Algorithm Economy and The Bitcoin Paradigm

As it stands presently “the gold supply is 180,000 tonnes of ‘above ground’ gold” stated Fran Strajnar, co-founder and CEO of data and research company Brave New Coin in CNBC in 2017, and this precious metal, the highest profile commodity is valued at $7 trillion. The bitcoin market value is around $20 billion in 2017, and some market analysts still find it somehow a bubble. The question to ask is gold vs bitcoin more symbolic or psychological than anything?

We are living in a full speed Algorithm Economy. The algorithm economy is based in general AI and is powered increasingly with advanced disrupting technologies and the leveraging of search engines, mobile devices, smart identity, social media and IOT and increasingly blockchain new distributed ledger solutions. Bitcoin is a child of all of this algorithm economy and blockchain was its inception technology.

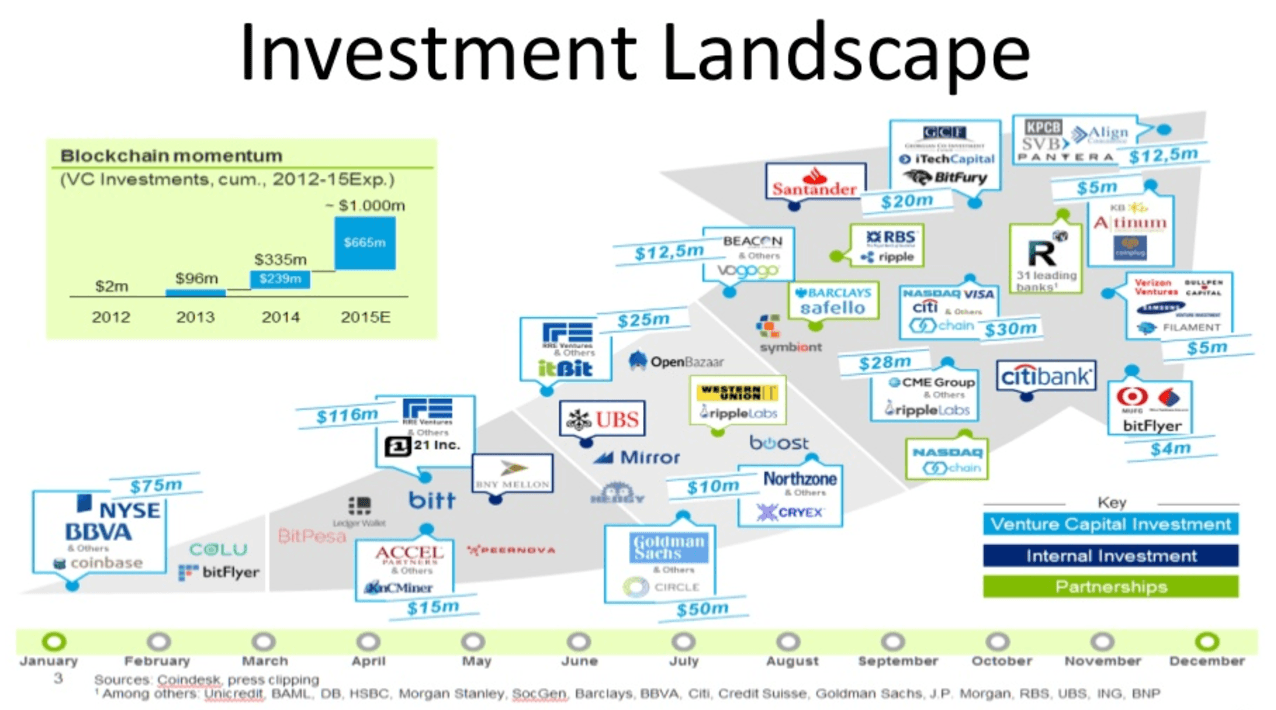

Reflecting that the value of the Bitcoin price and that its economy is around 20 billion USD as of March 2017 we still have questions marks. Of course this value is symbolic but all money is symbolic. There are different ways to measure this. We can more than double this if we consider all the landscape ecosystem associated, special now that blockchain is emerging as the foundational tech for banks and general businesses.

So if Bitcoin price continue its trajectory as in the last months where it managed to exceeded the price of gold briefly for the first time there are a lot of new things to consider. The first one is that this comparison is something that needs to be rethinked in the light of the new global tech, algorithm blockchain powered economy, financial capital markets that will be more and more lead by fintech collaborations and also in any time just to remind for now this is still arbitrary and volatile. Second there is no real compliance or global legal frame for bitcoin as a whole.

We know that Gold has been there for thousand of years and is measured in real forms by weight and its preciousness is wide known. So, while Bitcoin, much like any currency, is an abstract form of money and can only be measured in units of itself it has still a big way to go as a FIAT asset or measure of solid sustained value. Even if presently one Bitcoin can be worth a lot more than 1 gram of gold, it is also a lot less than 1 tonne. Despite Bitcoin’s stellar performance in 2016 and 2017 there have been very big volatile things that we need to consider very seriously. Thirdly the reality check is that the size and depth of the cryptocurrency market, and not just Bitcoin is dwarfed by the $7 trillion gold market.

There is no doubt that Bitcoin – the top cryptocurrency for now followed by Ether – is the most exciting financial and monetary experiment, (well, now a reality), in modern times. It disrupted a lot of the ways money has been produced and mirrors the digital economy and our reality of search algorithm, in its all complex borders. However, Bitcoin is still a small part of the trading universe and its value is very small if we compare with al buzz and media outreach.

Unlike conventional fiat currency, there are evolutionary stages in any emergent new form of money. Bitcoin can’t just be printed, it is driven in digital forms and is based in algorithm processing, and it somehow mimics in a lot of ways the scarcity properties of the commodity gold in that it requires an enormous amount of efforts, and energy to create one coin. The scarcity and special energy-proof of value is what defines and somehow links gold to the primary industries and has been allowing it to maintain its purchasing power over incredibly long periods of time in history of money.

Scarcity and special symbolic value attribution in a given organised society makes money become FIAT. Without these attributes, there is no value creation or representation. As history has shown us over and over again any form of fiat money representation has pics and downs and has to represent the society intrinsic value. Otherwise will inevitably be corrupted over time and decay as a measure of value creation or even vanish like what happened in previous old civilisations.

Money representation has various times in history changed, and special with global national currencies things have a lot of ups and downs. Crypto currencies such as Bitcoin have some of the same energy-proof of value that makes gold historical far superior to fiat currency, which can be created with the stroke of a key. Bitcoin, also like gold, is a global currency that may be universally accepted in the future due to its digital DNA inception. Even major global currencies such as USD, GBP or EUR can’t make that claim and has we have been seen so much stability recently.

Independent of all its flaws and reputation Bitcoin has some important new digital age qualities that are not shared by any other form of FIAT money, most notably the global digital outreach, the algorithm driven mining identity, the potential total anonymity in electronic transactions; however, some might feel that some of these aspects that may be a catch 22 and can make prevent the universal adoption of Bitcoin as effective universally accepted money.

Bitcoin has been from time to time in the limelight because of its innovative radical concept, its high profile investors, all the good and bad media attention and ultimately because in 2017 for a while it indeed exceeded the price of gold for the first time on some global exchanges. There is however another major thing to consider and a serious obvious obstacle when comparing Bitcoin with gold: lack of regulation and certification and all Volatility it has been going through.

Ease of Tracking: Gold is Easy to Track – Bitcoin is More Complicated and Risky

Gold and elements can be measured by weight (oz, g, kg, t). Mass and weight are the measuring units endowed by nature. Fiat currencies, or any other abstract commodity or money (including Bitcoin), cannot be measured that way. An abstraction can only be measured in units of itself. Gold and silver are therefore the only form of money today that are traded in weight. Fiat currency on the other hand cannot be measured by anything other than other currency, at least since Nixon ended the convertibility to gold in 1971. In that respect, Bitcoin falls into the same category.

Gold is easy to track because it has a global tracking system. This helps to preserve the value of the investment option because it makes it harder to fake, steal or misroute. Sadly, the same cannot be said about Bitcoins. In fact, one of the biggest Bitcoin exchanges MT.GOX based in Tokyo, Japan crashed recently because of a flaw in their software that allowed hackers to steal millions of dollars worth of Bitcoin.

Moreover, tracing Bitcoins is impossible because it is originally designed to evade government entities. Whether you are going to avoid paying taxes or try to fund activities that should not be funded, Bitcoin is there. It is untrackable and highly-encrypted. No wonder, it was the preferred digital currency of choice for online drug dealers and people looking to get other people assassinated and other cyber criminals. Keep this in mind because this can be a serious limitation on Bitcoin should global governments decide to regulate these cybercurrencies.

Bitcoin Explained from Duncan Elms on Vimeo.

There are no doubts that Gold is Rare, but as we move to a digital economy Bitcoins are even Rarer although they open a lot of questions still not answeres

One key factor where Bitcoin truly shines is its digital algorithm based rarity in a world, economy and money trading infrastruture that increasingly is digitalised. While gold is the top commodity that is historical the top leading and of course rare, Bitcoin is in some ways a continuation of a digital gold that is in some way much more rare because of its DNA blockchain technology and special also because there is a limited amount of it that can come into existence.

The Bitcoin foundational software stops producing beyond that limit and it has some advanced. This is crucial to understand because whenever supply is restricted, and demand is high, price goes up. This is economics 101. The higher the demand and the lower the supply, the higher the price will become. Gold, on the other hand, goes to supply-and-demand cycles where high demand for gold pushes miners to look for newer sources of gold. Moreover, when gold is expensive enough, people all over the world would cash in their gold jewelry and coins. Then a lot of these materials are melted to create pure physical gold.

Gold has a Sustained Global Network of Exchanges While Bitcoin Exchanges are Still in its Infancy and in Fragile Transition

Bitcoin has been going through some serious disruptions moments and a rollercoaster like previous moments, when it crashed such as what happened with exchange MT.GOX or other recent issues such as the Silk Road website and trust incidents. These incidents created a lot of negative press for Bitcoin but created as well big visibility for it. Something such as an exchanges crash it takes with it serious consequences. These produces a lot of uncertainty regarding the investment instruments being traded by those exchanges. On the other hand, gold has a historical track record also with its ups and downs but much more sustainable. Gold doesn’t have such a problem with exchanges although has faced also volatility.

Gold’s global network of exchanges is historical fairly transparent because the pricing signals are clear and established. On the other hand, Bitcoin isn’t so clear once it is a new currency, decentralised, non regulated and based in digital technology. When it comes to bitcoin there are only a few exchanges, networks that are different from each other. However as the global economy increasingly digitilises open new doors and possibilities as new global organisations and investors look for new solutions. So for now if enough of the main Bitcoin exchanges experience issues down the road, or news of bad use of the technology can cause a crisis in confidence that may affect Bitcoin value and impact.

There is no doubt that gold as a mainstream traded commodity has a solid baseline value and in the other hand for now bitcoin is still partly purely speculative but it represents and open new possibilities for the complexities of the digital economy.

The great thing about investing in a classical commodity gold is that there will always be a big, historical and in same cases industrial demand for it in terms of basic simples such as its historical value in areas such jewelry, art pieces. In other words, there is baseline value for it. Its price cannot crash below a certain line otherwise it would hit this base demand.

Pair that with the fact that gold has historically been viewed as a traditional store of value because it can be tapped during uncertain economic times and is physical However, the same cannot be said about Bitcoin because it is purely speculative, digital as there is no industrial use for it is only an algorithm based digital symbolic code creation. It only exists in the internet, as code and hard drive storage and servers.

This is why it’s very important to pay attention to all the different areas of Bitcoin’s nature. It does not exist yet, with exception of a code based asset and people make bets on it based in symbolic value and that is probably the biggest challenge. But also its strenghts in an increasingly software, code driven economy. Just like with anything purely speculative or symbolic – the Dutch Tulip Mania of the 1600s, once enough people stopped believing, the value of the investment crashed to the floor – or sky rocks in case of alternative investments such as property or other symbolic values such as health or education, depending of how value is perceived and created.

Gold is a Classic Investment and Easier to Convert Into Cash but Bitcoin Represents the new Present Future Digital Paradigm

Gold has universal value all over the world that is what makes it so special as a commodity. This is a critical factor to keep in mind when making a comparition Bitcoin to gold. This is due to the fact the people all over the world want gold. However, the same cannot be said about Bitcoin. Only a select number of investors or traders are so far interested in it. This is a crucial point in analysing the main areas of Bitcoin vs. gold.

It may seem crazy comparing Bitcoin to gold but in the end is all about symbolic and official representational approved social value. After all, gold is a metal you find in nature, and some say in meteorits in the space. Gold has historical store of value and is recognized all over the world.

However, considering the evolution of mankind and its changes throughout history makes sense to think in evolution in money and financial value. The present attention and huge appreciation of Bitcoin display the evolutionary side of money representation. And an analysis of these two is more than warranted and critical to understand new social and financial investment and trading paradigms.

A lot of investors may be afraid or tempted to invest in Bitcoin. Like in any currency there are ups and downs. The factors and ideas stated above should be kept firmly in mind and in the end of the day investment and trading comprehend all risk, and a lot of legal disclaimers. While Bitcoin is an emergent currency and based in algorithm technology it does have a lot of no doubt innovative impressive things going, there are still a lot of questions, concerns regarding this particular investment vehicle and of course risks. Lined up with an analysis versus gold as an investment, any trader or investor needs to be careful not to engage in wishful thinking or get things out of context. So investors or traders have to continue doing their homework and manage on overlooking their focus on the facts and risks. This is the proper way to do a Bitcoin vs. gold analysis or any other consideration.

There is no doubt that for now, gold remains the only global metal meta-commodity sort of top financial currency in which individuals and corporations can transact with no time delay, with price volatility comparable to that of major country currencies yet without too much high counter-party risk. Gold is also a commodity and a financial asset that has been proven as a store of value for thousands of years, in different societies and civilisations, even with its ups and downs in evaluation.

Conclusion – Gold Versus Bitcoin The New Digital Blockchain Economy?

The differences between Gold Versus Bitcoin are many and we are only in the inception, but in the New Digital Blockchain Economy will highlight it and show the strengths and weaknesses of each other. There is a massive fintech revolution going on in the world of finance and investment and as money becomes totally digital. Crypto currencies like Bitcoin and the other major ones such as Ether will become FIAT. It is a question of time, and part of its evolution will be the capacity of these crypto currency to represent, create solid value and be seen as a paramount official representation of Fiat society.

The world works in evolving changing moments managed by a balance between ideas, technology, finance engineering society shifts, and there are moments of high disruption and innovation. The last 100 years were the fast changing years in the history of mankind and special the evolution of money has been radical and full of crashs and volatility in paralel with financial innovation. The last 10 years and the next 10 are going to be increasingly much more disruptive and radical.

The fintech revolution has created a scope for a more ‘frictionless’ investment and trade lifecycle that is definitely out there and fast growing. As very little innovation has taken place in the post trade clearing/settlement environment and even less when it comes to trading between counterparties there is a big space for change and disruption. The new emerging FIX protocol has helped usher in the world of high frequency/algorithmic trading of most of the professional trading institutional industry around the globe, however this new form of trading execution was so far limited to only trade execution.

Blockchain technologies and all ist decentralised and distributed ledger possibilities in paralel with critical number of technological innovations such as machine learning/AI, multi-tenant cloud architectures, robot advisers, and Big Database platforms, that have the potential to innovate and liberate capital markets from some vicious old fashioned and incumbent players and start the process of real – not ghost – liquidity generation away from market makers and investment banks and toward the infrastructure of the market itself building a better sustainable economy and trading ecosystem. This is where bitcoin comes as a leading ambassador and first driver or this revolution. A lot has to be done both on technology development, regulation and global versus local, national paradigms and issues, still to solve.

According to all research and a recent Mckinsey report, called “Blockchain Technology in the Insurance Sector” Blockchain the technology that was behind Bitcoin has the potential to remove $80-$110 billion in costs for the global financial services industry over the next few years. Technologies such as blockchain, AI and IOT will change everything we know about the DNA of the financial industry and value creation.

We live in a digital world and as we digitalise everything in society and economy we need to have digital money and trading operations but we have also to have traditional serious commodities and sustained value creation trust when it comes to money and all its representations. Gold and Bitcoin are to evolutionary systems in the history of money and finance. Gold has a historical powerful track record and is much more than just a commodity. It is a powerful metal used in multiple things from jewellery to art and many other applications such as investments, decoration and so forth. Bitcoin in the other hand is a digital emerging crypto currency with just some years of life. So it has its challenges when it comes to value paradigm and solid sustainable commodity or money value paradigm.

As the wold evolves towards a total digital AI and blockchain driven economy and financial digital technology systems we will have more the need for new solutions such as crypto currencies such as Bitcoin and other emerging ones such as Ether.

For now a large and widespread financial ecosystem and economy have evolved around Bitcoin, special in the last couple of years, with tens of millions worth of Bitcoins changing hands every day in electronic transactions, spent on anything from electronics, to web-hosting, charities, funds to herbal goods and natural products. Money wise is small size to the rest of the world trading assets and economy. Symbolic is much bigger.

This is only the beginning we will have much more transformation as society and finance become fully digital. The challenge is now how to use this new crypto currency to create sustained value and stable assets such as gold as a commodity and financial trust paradigm has been able to do it in the last thousand of years.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.